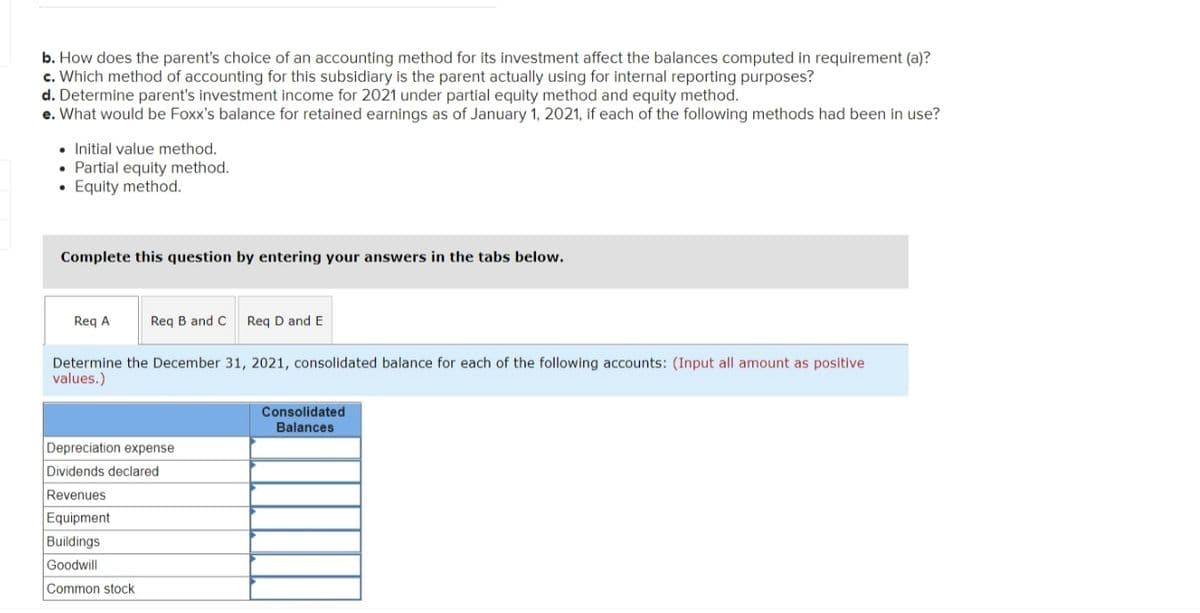

Foxx Corporation acquired all of Greenburg Company's outstanding stock on January 1, 2019, for $743,000 cash. Greenburg's accounting records showed net assets on that date of $609,000, although equipment with a 10-year remaining life was undervalued on the records by $59,500. Any recognized goodwill is considered to have an indefinite life. Greenburg reports net income in 2019 of $125,000 and $127,500 in 2020. The subsidiary declared dividends of $20,000 in each of these two years. Account balances for the year ending December 31, 2021, follow. Credit balances are indicated by parentheses. Greenburg $ (920,000) 230,000 425,000 Foxx $(1,184,000) 148,000 392,000 (20,000) $ (664,000) $(1,140,000) (664,000) 120,000 Revenues Cost of goods sold Depreciation expense Investment income Net income $ (265,000) Retained earnings, 1/1/21 24 (521,500) (265,000) 20,000 Net income Dividends declared Retained earnings, 12/31/21 $(1,684,000) $ (766, 500) 24 328,000 743,000 1,022,000 844,000 652,000 Current assets 152,000 Investment in subsidiary Equipment (net) Buildings (net) Land 798,000 418,000 161,000 $ 3,589,000 $(1,005,000) (900,000) |(1,684,000) $(3,589,000) $ 1,529,000 $ (462,500) ( 300,000) (766, 500) $(1,529,000) Total assets Liabilities Common stock Retained earnings Total liabilities and equity a. Determine the December 31, 2021, consolidated balance for each of the following accounts:

Solution:

Since As per Chegg's guidelines each question is answered to a maximum of four sub parts. Please resubmit remanining, if any.

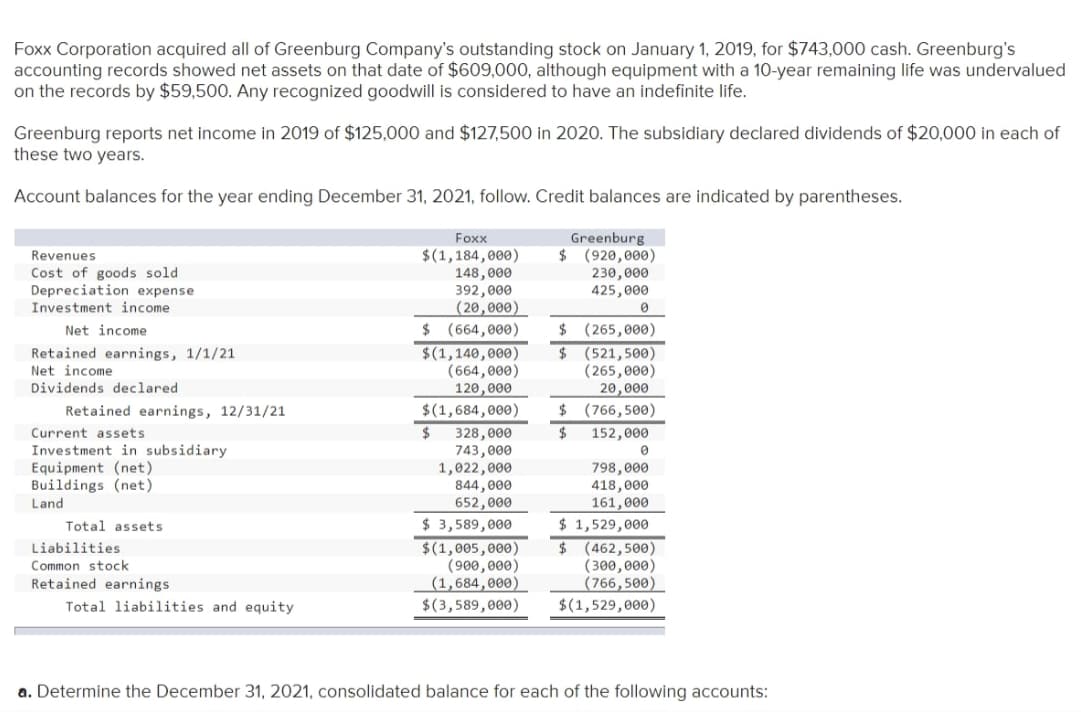

a)

|

Purchase price, $ |

743,000 |

||

|

Book value (given), $ |

(609,000) |

||

|

Price in excess of book value |

134,000 |

||

|

Life |

Annual Excess amortizations |

||

|

Allocation to equipment based on difference in market value and book value |

59,500 |

10 |

5,950 |

|

Goodwill |

74,500 |

indefinite |

|

|

Total |

$134,000 |

$5,950 |

|

|

Consolidated balances, $ |

|

|

Depreciation expense ($392,000+$425,000+$5,950) |

$6,767,000 |

|

Dividends declared |

120000 |

|

Revenues |

2,104,000 |

|

Equipment |

1,913,650 |

|

Buildings |

1,262,000 |

|

Goodwill |

74,500 |

|

Common stock |

900000 |

Depreciation expense = book value of Foxx + book value of Greenburg+amortization expense = 392,000+425,000+5,950=$6,767,000

Dividends declared = book value of Foxx = 120000

Revenues = book value of Foxx + book value of Greenburg = 1,184,000+920,000=$2,104,000

Equipment= book value of Foxx+ book value of Greenburg + excess allocation+ amortization expense(3 years) = 1,074,000+798,000+59,500-(5,950*3) = 1,913,650.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps