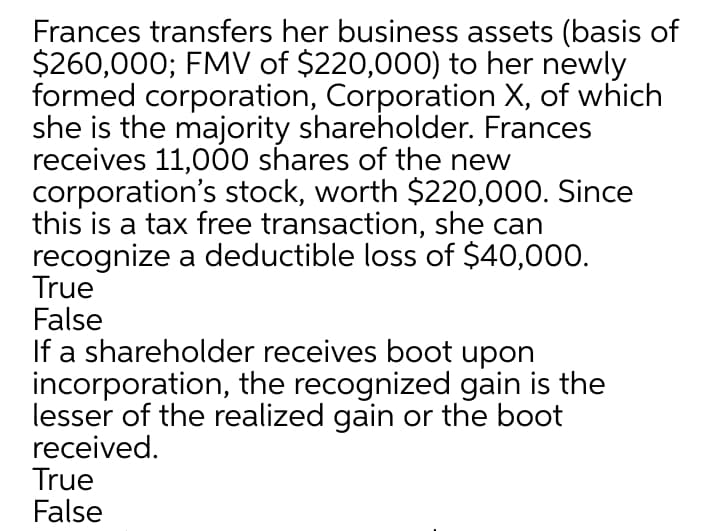

Frances transfers her business assets (basis of $260,000; FMV of $220,000) to her newly formed corporation, Corporation X, of which she is the majority shareholder. Frances receives 11,000 shares of the new corporation's stock, worth $220,000. Since this is a tax free transaction, she can recognize a deductible loss of $40,000.

Frances transfers her business assets (basis of $260,000; FMV of $220,000) to her newly formed corporation, Corporation X, of which she is the majority shareholder. Frances receives 11,000 shares of the new corporation's stock, worth $220,000. Since this is a tax free transaction, she can recognize a deductible loss of $40,000.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter15: S Corporations

Section: Chapter Questions

Problem 28P

Related questions

Question

Transcribed Image Text:Frances transfers her business assets (basis of

$260,000; FMV of $220,000) to her newly

formed corporation, Corporation X, of which

she is the majority shareholder. Frances

receives 11,000 shares of the new

corporation's stock, worth $220,000. Since

this is a tax free transaction, she can

recognize a deductible loss of $40,000.

True

False

If a shareholder receives boot upon

incorporation, the recognized gain is the

lesser of the realized gain or the boot

received.

True

False

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you