Francisco is planning to invest up to $27,000 in corporate and municipal bonds. The least he is allowed to invest in corporate bonds is $5000, and he does not want to invest more than $19,000 in corporate bonds. He also does not want to invest more than $19,000 in municipal bonds. The interest is 5% on corporate bonds and 3% on municipal bonds. This is simple interest for one year. How much should he invest in each type of bond in order to maximize his income? What is the maximum income? Francisco should invest in corporate bonds and in municipal bonds in order to maximize his income.

Francisco is planning to invest up to $27,000 in corporate and municipal bonds. The least he is allowed to invest in corporate bonds is $5000, and he does not want to invest more than $19,000 in corporate bonds. He also does not want to invest more than $19,000 in municipal bonds. The interest is 5% on corporate bonds and 3% on municipal bonds. This is simple interest for one year. How much should he invest in each type of bond in order to maximize his income? What is the maximum income? Francisco should invest in corporate bonds and in municipal bonds in order to maximize his income.

Chapter13: Comparative Forms Of Doing Business

Section: Chapter Questions

Problem 13DQ

Related questions

Question

L 25

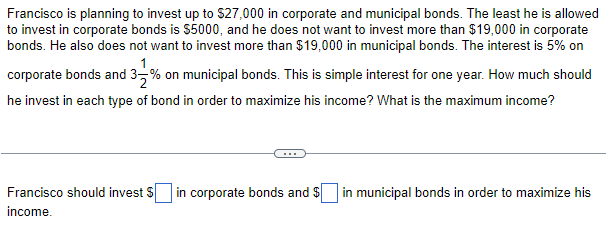

Transcribed Image Text:Francisco is planning to invest up to $27,000 in corporate and municipal bonds. The least he is allowed

to invest in corporate bonds is $5000, and he does not want to invest more than $19,000 in corporate

bonds. He also does not want to invest more than $19,000 in municipal bonds. The interest is 5% on

corporate bonds and 3% on municipal bonds. This is simple interest for one year. How much should

he invest in each type of bond in order to maximize his income? What is the maximum income?

Francisco should invest $ in corporate bonds and $ in municipal bonds in order to maximize his

income.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning