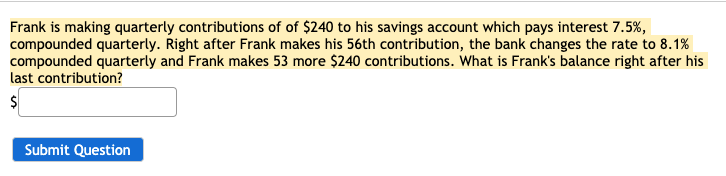

Frank is making quarterly contributions of $240 to his savings account which pays interest 7.5%, compounded quarterly. Frank makes his 56th contribution, the bank changes the rate to 8.1% compounded quarterly and Frank makes 53 more $240 contributions. What is Frank's balance right after his last contribution?

Frank is making quarterly contributions of $240 to his savings account which pays interest 7.5%, compounded quarterly. Frank makes his 56th contribution, the bank changes the rate to 8.1% compounded quarterly and Frank makes 53 more $240 contributions. What is Frank's balance right after his last contribution?

Chapter6: Deductions And Losses: In General

Section: Chapter Questions

Problem 25DQ

Related questions

Question

Frank is making quarterly contributions of $240 to his savings account which pays interest 7.5%, compounded quarterly. Frank makes his 56th contribution, the bank changes the rate to 8.1% compounded quarterly and Frank makes 53 more $240 contributions. What is Frank's balance right after his last contribution?

Transcribed Image Text:Frank is making quarterly contributions of of $240 to his savings account which pays interest 7.5%,

compounded quarterly. Right after Frank makes his 56th contribution, the bank changes the rate to 8.1%

compounded quarterly and Frank makes 53 more $240 contributions. What is Frank's balance right after his

last contribution?

Submit Question

Expert Solution

Step 1

The time value of money is used to calculate the present values and future values of any stream of cash outflows and inflows or the present and future values of the amounts contributed to various accounts. The concept of the time value of money is a finance concept and states that the money earned sooner is worth more than the money earned later and money earns interest.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT