Franklin & Associates declined the offer. Given the circumstances, what is the probable outcome of a lawsuit between Black and Franklin & Associates?

Franklin & Associates declined the offer. Given the circumstances, what is the probable outcome of a lawsuit between Black and Franklin & Associates?

Chapter25: Taxation Of International Transactions

Section: Chapter Questions

Problem 26P

Related questions

Question

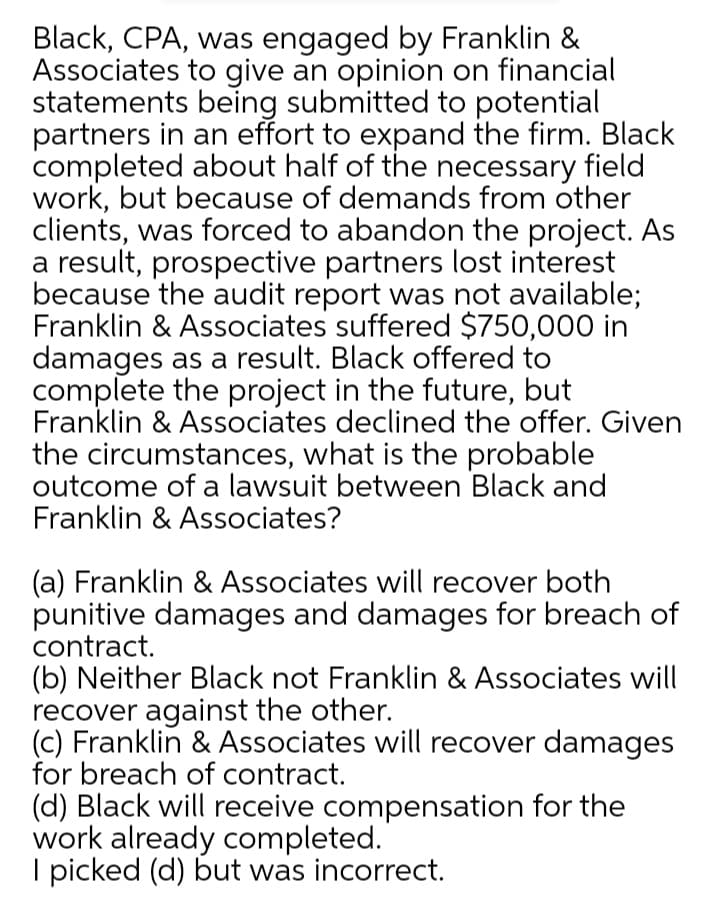

Transcribed Image Text:Black, CPA, was engaged by Franklin &

Associates to give an opinion on financial

statements being submitted to potential

partners in an effort to expand the firm. Black

completed about half of the necessary field

work, but because of demands from other

clients, was forced to abandon the project. As

a result, prospective partners lost interest

because the audit report was not available;

Franklin & Associates suffered $750,000 in

damages as a result. Black offered to

complete the project in the future, but

Franklin & Associates declined the offer. Given

the circumstances, what is the probable

outcome of a lawsuit between Black and

Franklin & Associates?

(a) Franklin & Associates will recover both

punitive damages and damages for breach of

contract.

(b) Neither Black not Franklin & Associates will

recover against the other.

(c) Franklin & Associates will recover damages

for breach of contract.

(d) Black will receive compensation for the

work already completed.

I picked (d) but was incorrect.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning