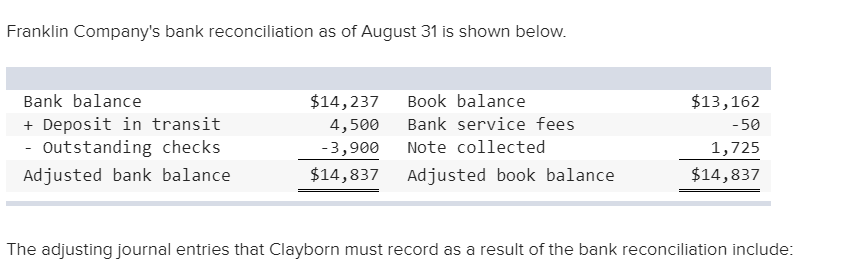

Franklin Company's bank reconciliation as of August 31 is shown below. Bank balance $14,237 Book balance $13,162 Deposit in transit - Outstanding checks Bank service fees 4,500 -50 Note collected -3,900 1,725 $14,837 $14,837 Adjusted bank balance Adjusted book balance The adjusting journal entries that Clayborn must record as a result of the bank reconciliation include:

Franklin Company's bank reconciliation as of August 31 is shown below. Bank balance $14,237 Book balance $13,162 Deposit in transit - Outstanding checks Bank service fees 4,500 -50 Note collected -3,900 1,725 $14,837 $14,837 Adjusted bank balance Adjusted book balance The adjusting journal entries that Clayborn must record as a result of the bank reconciliation include:

Chapter8: Fraud, Internal Controls, And Cash

Section: Chapter Questions

Problem 11EB: Using the following information, prepare a bank reconciliation. Bank balance: $12,565. Book...

Related questions

Question

Transcribed Image Text:Franklin Company's bank reconciliation as of August 31 is shown below.

Bank balance

$14,237

Book balance

$13,162

Deposit in transit

- Outstanding checks

Bank service fees

4,500

-50

Note collected

-3,900

1,725

$14,837

$14,837

Adjusted bank balance

Adjusted book balance

The adjusting journal entries that Clayborn must record as a result of the bank reconciliation include:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage