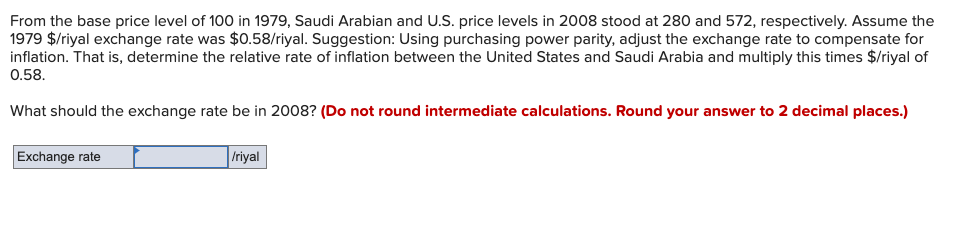

From the base price level of 100 in 1979, Saudi Arabian and U.S. price levels in 2008 stood at 280 and 572, respectively. Assume the 1979 $/riyal exchange rate was $0.58/riyal. Suggestion: Using purchasing power parity, adjust the exchange rate to compensate for inflation. That is, determine the relative rate of inflation between the United States and Saudi Arabia and multiply this times $/riyal of 0.58. What should the exchange rate be in 2008? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Exchange rate Iriyal

From the base price level of 100 in 1979, Saudi Arabian and U.S. price levels in 2008 stood at 280 and 572, respectively. Assume the 1979 $/riyal exchange rate was $0.58/riyal. Suggestion: Using purchasing power parity, adjust the exchange rate to compensate for inflation. That is, determine the relative rate of inflation between the United States and Saudi Arabia and multiply this times $/riyal of 0.58. What should the exchange rate be in 2008? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Exchange rate Iriyal

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter27: Multinational Financial Management

Section: Chapter Questions

Problem 10P

Related questions

Question

Transcribed Image Text:From the base price level of 100 in 1979, Saudi Arabian and U.S. price levels in 2008 stood at 280 and 572, respectively. Assume the

1979 $/riyal exchange rate was $0.58/riyal. Suggestion: Using purchasing power parity, adjust the exchange rate to compensate for

inflation. That is, determine the relative rate of inflation between the United States and Saudi Arabia and multiply this times $/riyal of

0.58.

What should the exchange rate be in 2008? (Do not round intermediate calculations. Round your answer to 2 decimal places.)

Exchange rate

Iriyal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning