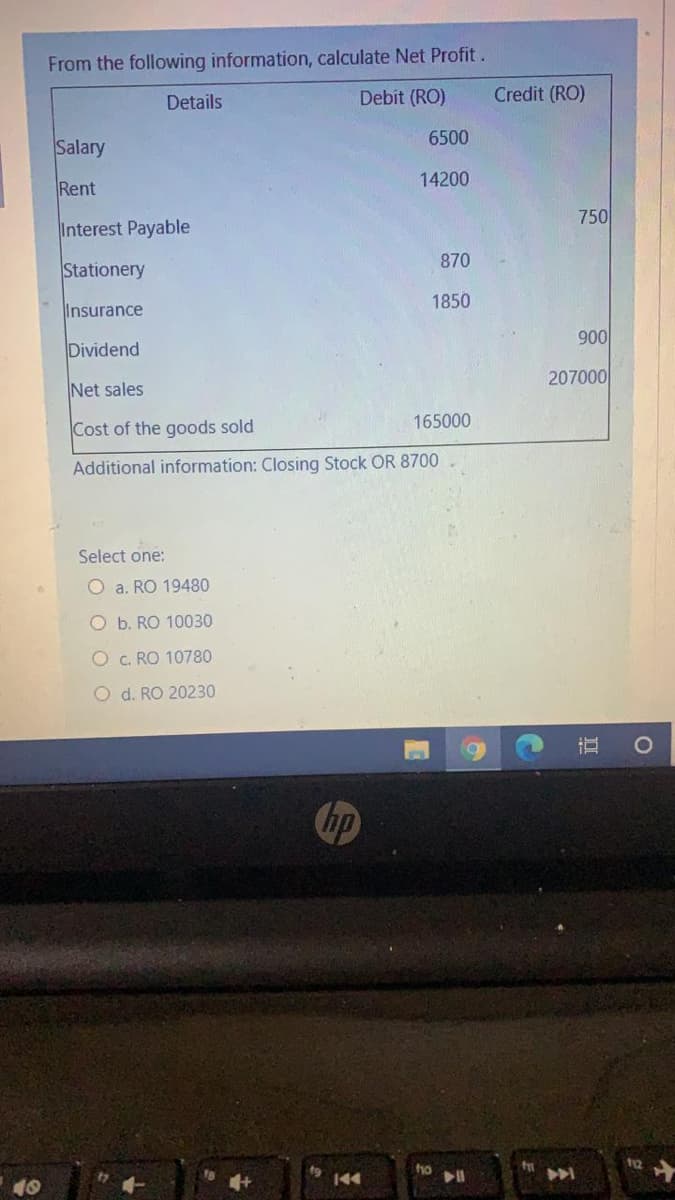

From the following information, calculate Net Profit. Details Debit (RO) Credit (RO) 6500 Salary 14200 Rent 750 Interest Payable 870 Stationery 1850 Insurance 900 Dividend 207000 Net sales Cost of the goods sold 165000 Additional information: Closing Stock OR 8700 Select one: a. RO 19480 O b. RO 10030 O . RO 10780 O d. RO 20230

From the following information, calculate Net Profit. Details Debit (RO) Credit (RO) 6500 Salary 14200 Rent 750 Interest Payable 870 Stationery 1850 Insurance 900 Dividend 207000 Net sales Cost of the goods sold 165000 Additional information: Closing Stock OR 8700 Select one: a. RO 19480 O b. RO 10030 O . RO 10780 O d. RO 20230

Chapter6: Merchandising Transactions

Section: Chapter Questions

Problem 17Q: A seller sells $800 worth of goods on credit to a customer, with a cost to the seller of $300....

Related questions

Question

100%

Transcribed Image Text:From the following information, calculate Net Profit.

Details

Debit (RO)

Credit (RO)

6500

Salary

14200

Rent

750

Interest Payable

870

Stationery

1850

Insurance

900

Dividend

207000

Net sales

Cost of the goods sold

165000

Additional information: Closing Stock OR 8700

Select one:

O a. RO 19480

O b. RO 10030

O c. RO 10780

O d. RO 20230

Chp

144

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning