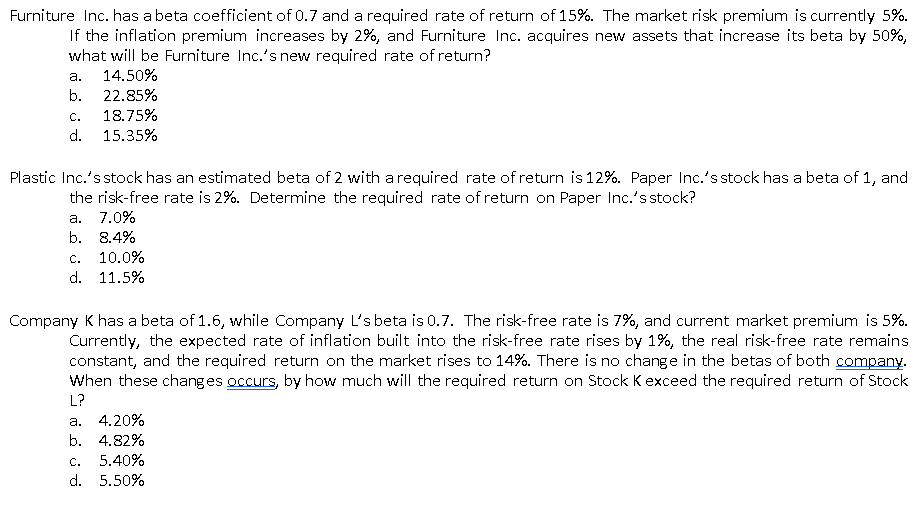

Furniture Inc. has a beta coefficient of 0.7 and a required rate of return of 15%. The market risk premium is currently 5%. If the inflation premium increases by 2%, and Furniture Inc. acquires new assets that increase its beta by 50%, what will be Furniture Inc.'s new required rate of return? a. 14.50% b. 22.85% C. 18.75% d. 15.35%

Furniture Inc. has a beta coefficient of 0.7 and a required rate of return of 15%. The market risk premium is currently 5%. If the inflation premium increases by 2%, and Furniture Inc. acquires new assets that increase its beta by 50%, what will be Furniture Inc.'s new required rate of return? a. 14.50% b. 22.85% C. 18.75% d. 15.35%

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 26P

Related questions

Question

Transcribed Image Text:Furniture Inc. has a beta coefficient of 0.7 and a required rate of return of 15%. The market risk premium is currently 5%.

If the inflation premium increases by 2%, and Furniture Inc. acquires new assets that increase its beta by 50%,

what will be Furniture Inc.'s new required rate of return?

14.50%

а.

b.

22.85%

С.

18.75%

d.

15.35%

Plastic Inc.'sstock has an estimated beta of 2 with arequired rate of return is 12%. Paper Inc.'s stock has a beta of 1, and

the risk-free rate is 2%. Determine the required rate of return on Paper Inc.'s stock?

7.0%

а.

b. 8.4%

c. 10.0%

d. 11.5%

Company K has a beta of 1.6, while Company L's beta is 0.7. The risk-free rate is 7%, and current market premium is 5%.

Currently, the expected rate of inflation built into the risk-free rate rises by 1%, the real risk-free rate remains

constant, and the required return on the market rises to 14%. There is no change in the betas of both company.

When these changes occurs, by how much will the required return on Stock K exceed the required return of Stock

L?

а. 4.20%

b. 4.82%

С.

5.40%

d. 5.50%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT