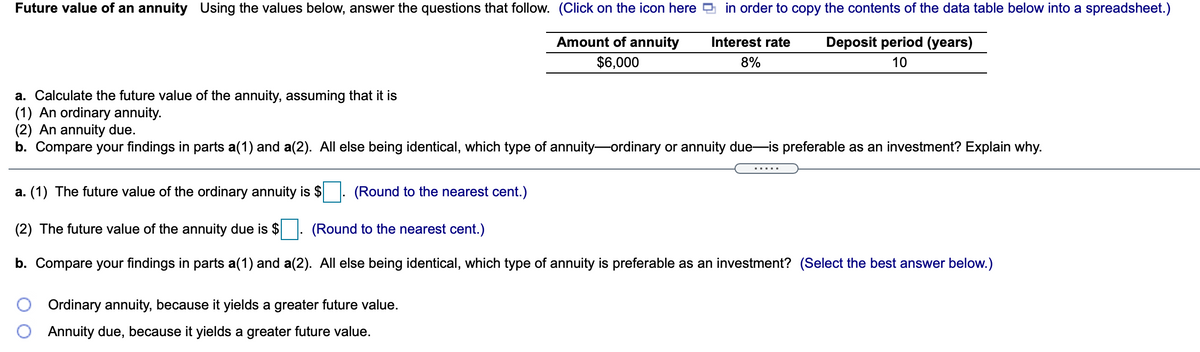

Future value of an annuity Using the values below, answer the questions that follow. (Click on the icon here O in order to copy the contents of the data table below into a spreadsheet.) Amount of annuity Interest rate Deposit period (years) $6,000 8% 10 a. Calculate the future value of the annuity, assuming that it is (1) An ordinary annuity. (2) An annuity due. b. Compare your findings in parts a(1) and a(2). All else being identical, which type of annuity-ordinary or annuity due-is preferable as an investment? Explain why.

Future value of an annuity Using the values below, answer the questions that follow. (Click on the icon here O in order to copy the contents of the data table below into a spreadsheet.) Amount of annuity Interest rate Deposit period (years) $6,000 8% 10 a. Calculate the future value of the annuity, assuming that it is (1) An ordinary annuity. (2) An annuity due. b. Compare your findings in parts a(1) and a(2). All else being identical, which type of annuity-ordinary or annuity due-is preferable as an investment? Explain why.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA3: Time Value Of Money

Section: Chapter Questions

Problem 12E

Related questions

Question

Transcribed Image Text:Future value of an annuity Using the values below, answer the questions that follow. (Click on the icon here 9 in order to copy the contents of the data table below into a spreadsheet.)

Amount of annuity

Interest rate

Deposit period (years)

$6,000

8%

10

a. Calculate the future value of the annuity, assuming that it is

(1) An ordinary annuity.

(2) An annuity due.

b. Compare your findings in parts a(1) and a(2). All else being identical, which type of annuity-ordinary or annuity due-is preferable as an investment? Explain why.

.....

a. (1) The future value of the ordinary annuity is $

(Round to the nearest cent.)

(2) The future value of the annuity due is $

(Round to the nearest cent.)

b. Compare your findings in parts a(1) and a(2). All else being identical, which type of annuity is preferable as an investment? (Select the best answer below.)

Ordinary annuity, because it yields a greater future value.

Annuity due, because it yields a greater future value.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,