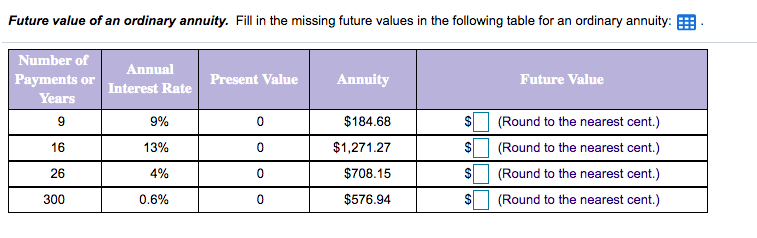

Future value of an ordinary annuity. Fill n the missing future values in the following table for an ordinary annuity: Number of Annual Payments or Present Value Annuity Future Value Interest Rate Years 9% $184.68 SO (Round to the nearest cent.) 16 13% $1,271.27 (Round to the nearest cent.) 26 4% $708.15 (Round to the nearest cent.) 300 0.6% $576.94 $4 (Round to the nearest cent.)

Future value of an ordinary annuity. Fill n the missing future values in the following table for an ordinary annuity: Number of Annual Payments or Present Value Annuity Future Value Interest Rate Years 9% $184.68 SO (Round to the nearest cent.) 16 13% $1,271.27 (Round to the nearest cent.) 26 4% $708.15 (Round to the nearest cent.) 300 0.6% $576.94 $4 (Round to the nearest cent.)

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

ChapterA: Appendix - Time Value Of Cash Flows: Compound Interest Concepts And Applications

Section: Chapter Questions

Problem 20E

Related questions

Question

Please see attached images

Transcribed Image Text:Future value of an ordinary annuity. Fill in the missing future values in the following table for an ordinary annuity:

Number of

Annual

Payments or

Present Value

Annuity

Future Value

Interest Rate

Years

9

9%

$184.68

$

(Round to the nearest cent.)

16

13%

$1,271.27

(Round to the nearest cent.)

26

4%

$708.15

2$

(Round to the nearest cent.)

300

0.6%

$576.94

(Round to the nearest cent.)

%24

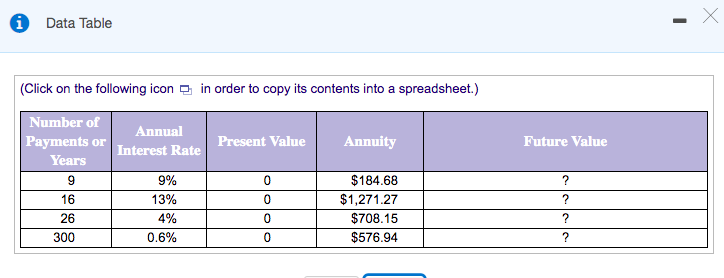

Transcribed Image Text:i Data Table

(Click on the following icon a in order to copy its contents into a spreadsheet.)

Number of

Annual

Payments or

Present Value

Annuity

Future Value

Interest Rate

Years

9%

$184.68

?

16

13%

$1,271.27

?

26

4%

$708.15

300

0.6%

$576.94

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning