Future value. You are a new employee with the Metro Daily Planet. The Planet offers three different retirement plans. Plan 1 starts the first day of work and puts $1,000 away in your rebrement acEBU 40 years. Plan 2 starts after 10 years and puts away $1,500 every year for 30 years. Plan 3 starts after 20 years and puts away $4.000 every year for the last 20 years of employment All three plans guarantee an annual growth rate of 5%. a. Which plan should you choose if you plan to work at the Planet for 40 years? b. Which plan should you choose if you plan to work at the-Planet for only the next 30 years? c. Which plan should you choose if you plan to work at the Planet for only the next 20 years? d. Which plan should you choose if you plan to work at the Planet for only the next 10 years? e. What do the answers in parts (a) through (d) imply about savings? a. Which plan should you choose if you plan to work at the Planet for 40 years? (Select the best response.) O A. Plan 3 because it offers the highest future value OB. Plan 1 because it offers the highest future value OC. Plan 2 because it offers the highest future value they offer the same future value

Future value. You are a new employee with the Metro Daily Planet. The Planet offers three different retirement plans. Plan 1 starts the first day of work and puts $1,000 away in your rebrement acEBU 40 years. Plan 2 starts after 10 years and puts away $1,500 every year for 30 years. Plan 3 starts after 20 years and puts away $4.000 every year for the last 20 years of employment All three plans guarantee an annual growth rate of 5%. a. Which plan should you choose if you plan to work at the Planet for 40 years? b. Which plan should you choose if you plan to work at the-Planet for only the next 30 years? c. Which plan should you choose if you plan to work at the Planet for only the next 20 years? d. Which plan should you choose if you plan to work at the Planet for only the next 10 years? e. What do the answers in parts (a) through (d) imply about savings? a. Which plan should you choose if you plan to work at the Planet for 40 years? (Select the best response.) O A. Plan 3 because it offers the highest future value OB. Plan 1 because it offers the highest future value OC. Plan 2 because it offers the highest future value they offer the same future value

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 44P

Related questions

Question

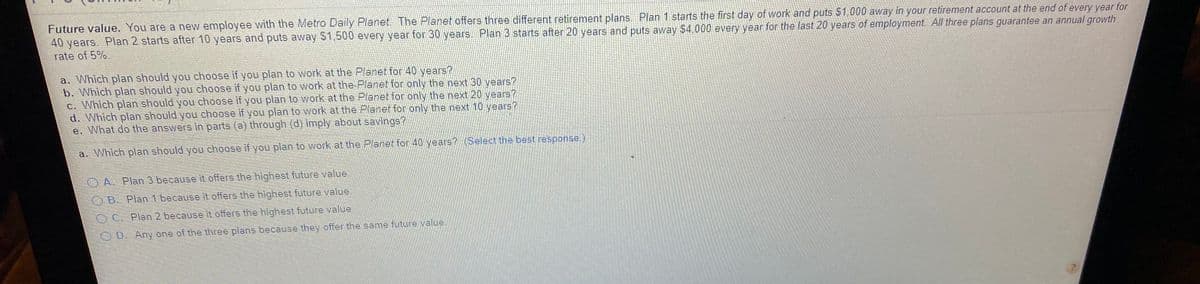

Transcribed Image Text:Future value. You are a new employee with the Metro Daily Planet. The Planet offers three different retirement plans. Plan 1 starts the first day of work and puts $1,000 away in your retirement account at the end of every year for

40 years. Plan 2 starts after 10 years and puts away S1,500 every year for 30 years. Plan 3 starts after 20 years and puts away $4,000 every year for the last 20 years of employment. All three plans guarantee an annual growth

rate of 5%.

a. Which plan should you choose if you plan to work at the Planet for 40 years?

b. Which plan should you choose if you plan to work at the Planet for only the next 30 years?

c. Which plan should you choose if you plan to work at the Planet for only the next 20 years?

d. Which plan should you choose if you plan to work at the Planet for only the next 10 years?

e. What do the answers in parts (a) through (d) imply about savings?

a. Which plan should you choose if you plan to work at the Planet for 40 years? (Select the best response.)

OA. Plan 3 because it offers the highest future value.

OB. Plan 1 because it offers the highest future value.

OC. Plan 2 because it offers the highest future value.

OD. Any one of the three plans because they offer the same future value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning