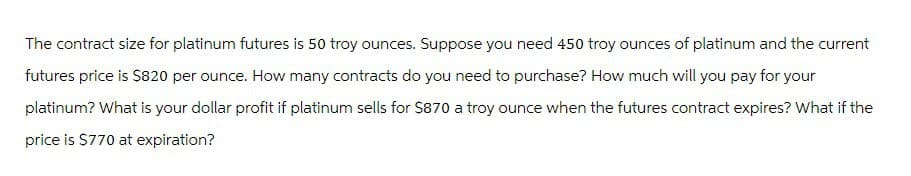

futures price is $820 per ounce. How many contracts do you need to purchase? How much will you pay for your platinum? What is your dollar profit if platinum sells for $870 a troy ounce when the futures contract expires? What if the price is $770 at expiration?

Q: eBook Dynamic Systems has an outstanding bond that has a $1,000 par value and a 10 percent coupon…

A: Given Data: Face Value1000Coupon rate10% Time to Maturity13 Yield12%

Q: George Jefferson established a trust fund that will provide $194,500 per year in scholarships. The…

A: Present values of the deferred perpetuity formula will be used. The payment will be made from…

Q: Monroe Corporation is considering the purchase of new equipment. The equipment will cost $38,000…

A: The present value of the annuity can be computed by multiplying the PVIFA annuity factor for a given…

Q: Two investments have the following pattern of expected returns: Investment A Year 1 BTCF $6,000 Year…

A: Here, YearInvestment AInvestment BCash FlowCash…

Q: You find a certain stock that had returns of 16 percent. -23 percent, 24 percent, and 9 percent for…

A: The average, also known as the mean, is a measure of central tendency that represents the typical…

Q: When an individual makes a purchase without considering the financial consequences of that purchase,…

A: The objective of the question is to identify the aspect of financial planning that is being ignored…

Q: Briefly explain each filing status. How does filing status affect who must fileincome taxes? How…

A: Filing Statuses and Their Impact on Tax Filing and DeductionsFiling status determines several…

Q: Vijay

A: The objective of the question is to calculate the actuarial rate for a home loan. The actuarial rate…

Q: Emperor's Clothes Fashions can Invest $6 million in a new plant for producing Invisible makeup. The…

A: Initial investment = $6,000,000Useful life = 5 yearsExpected sales = 7,000,000 jarsFixed costs =…

Q: Firm A has $9,000 in assets entirely financed with equity. Firm B also has $9,000 in assets, but…

A: 1.Firm A: $5,500Firm B: $5,500 2.Firm A: $5,500Firm B: $4,825 3.Firm A: 35.45%Firm B: 40.41% 4.The…

Q: For the cash flows shown, determine the incremental cash flow between machines B and A (a) in year…

A: Variables in the question:

Q: Here are the returns on two stocks. Digital Cheese Executive Fruit January +14 +8 February -4 +2…

A: The Standard Deviation and Variance:The standard deviation measures the average volatility of stock…

Q: E-Eyes.com has a new issue of preferred stock it calls 20/20 preferred. The stock will pay a $20…

A: In a preferred stock the dividend will be paid for infinite period i.e for perpetuity.

Q: Fill in the table using the following information.Assets required for operation: $3,000Case A—firm…

A: The answer is explained below.Explanation:

Q: If the inflation rate is 6% per year and you want to earn a real return of 10% per year, how many…

A: To calculate the future value we will use the below formulaFuture value = P*(1+r)n*(1+i)nWhereP -…

Q: A hedge fund with $2.4 billion of assets charges a management fee of 1% and an incentive fee of 10%…

A: The following information is given:Total Assets=Management fee=Incentive fee=Money market rate…

Q: None

A: The calculation of the payback period is associated with finding out the time period within which…

Q: Monroe Printing is evaluating the pamphlet project. The project would require an initial investment…

A: Operating cash flow is the cash flow from the core business activities of the company after payments…

Q: Company A and Company B have the same assets. Company B is more highly levered. Which company has a…

A: Company A and Company B have the same assets. Company B is more highly levered. Which company has a…

Q: A firm has the following total revenue and total cost schedules: TR = $2Q. TC = $3,500 + $1.6Q.…

A: Break-even analysis is an important concept of CVP analysis i.e. cost volume profit analysis. At…

Q: Matt plans to start his own business once he graduates from college. He plans to save $2,900 every…

A:

Q: EBOOK Mike Suerth sold a call option on Canadian dollars for $0.01 per unit. The strike price was…

A: The objective of this question is to calculate the net profit Mike made from selling a call option…

Q: Your company is considering delivering their own products instead of relying on 3rd party logistics…

A: NPV, or Net Present Value, is a financial metric used to evaluate the profitability of an investment…

Q: er & Stone, Incorporated, is looking at setting up a new manufacturing plant in South Park to…

A: Cash flow refers to the transfer of funds into and out of a business or individual's accounts,…

Q: Edelman Engines has $15 billion in total assets- of which cash and equivalents total $120 million.…

A: Total assets$15,000,000,000.00Common equity$6,000,000,000.00Common shares…

Q: Nikul

A: The objective of the question is to calculate the maximum RRSP (Registered Retirement Savings Plan)…

Q: Project A: Initial investment: $100,000 Cash flows: $40,000 per year for 3 years Project B: Initial…

A: Both Internal Rate of Return (IRR) and Net Present Value (NPV) are methods in capital budgeting used…

Q: In order to calculate a person’s savings ratio, the amount saved each month is divided by net…

A: The answer is in the explanation.Explanation:The statement is true and explains a standard savings…

Q: eprinted from 3a (above) pot rate of British Pound = $1.57 80-Day forward rate of British Pound =…

A: Arbitrage is the risk free profit which can be obtained by buying one currency and selling another…

Q: You are evaluating a project for The Ultimate recreational tennis racket, guaranteed to correct that…

A: Free cash flow is a financial measure that shows the amount of cash a company generates after…

Q: Jill invested her savings, a total of $28,000 in a virtual currency platform for Bitcoin, Eureka and…

A: We make investments in different financial assets. We make investments so as to save for our future…

Q: Consider a student loan of $25,000 at a fixed AP a. Calculate the monthly payment. b. Determine the…

A: Loan amount = $25,000Interest rate = 9%Number of years = 30 years

Q: The Paulson Company's year-end balance sheet is shown below. Its cost of common equity is 15%, its…

A: The objective of this question is to calculate the Weighted Average Cost of Capital (WACC) for…

Q: Suppose the MARR is 3%. Use the following table to answer the question--The IRR on the incremental…

A: Incremental internal rate of return refers to the excess return earned by one project over the other…

Q: A washer-dryer combination can be purchased from a department store by making monthly credit card…

A: Monthly payment refers to an amount that is paid at every month by the borrower to the lender at a…

Q: Matt plans to start his own business once he graduates from college. He plans to save $3,000 every…

A: Time value of money is a financial concept which is used to analyze various investments and…

Q: mpany with $720,000 in operating assets is considering the purchase of a machine that costs $80,000…

A: The payback period is one of the techniques used in capital budgeting to find out the time required…

Q: (Future value) Sarah Wiggum would like to make a single lump-sum investment and have $1.7…

A: Case 1 - If the annual return is 7% Amount Sarah must invest today = $255,683.76 Case 2 - If the…

Q: You have the following information: t1 t2 t3 t4 TSLA Returns 0.05 -0.04 0.1 -0.01 Market Returns 0…

A: The objective of the question is to calculate the covariance between the returns of TSLA and the…

Q: Exodus Limousine Company has $1,000 par value bonds outstanding at 19 percent interest. The bonds…

A: Annual coupon amount (C) = $190 (i.e. $1000 * 0.19)Maturity period (n) = 50 yearsMaturity value (Z)…

Q: The profitability index (PI) is a capital budgeting tool that is defined as the present value of a…

A: Project's Profitability Index (PI) = 0.6033So, the correct answer is C) 0.6033 Blue Moose Home…

Q: If you need to take out a $20,000 student loan 2 years before graduating, which loan option will…

A: A subsidized loan refers to a loan that is specified for meeting the needs of the students who are…

Q: One year ago, your company purchased a machine used in manufacturing for $110,000. You have learne…

A: If a firm needs to decide whether a machine should be replaced or not, it is known as replacement…

Q: Your factory has been offered a contract to produce a part for a new printer. The contract would…

A: Net Present Value (NPV) is a financial tool used to evaluate the profitability of an investment or…

Q: Project L requires an initial outlay at t = 0 of $35,000, its expected cash inflows are $11,000 per…

A: MIRR stands for modified internal rate of returns. It is one of the capital budgeting techniques to…

Q: Assume the following information: Quoted Bid Price Quoted Ask Price Value of a Brazilian real (BRL)…

A: A strategy for buying and selling currencies or other kinds of assets to generate profits is called…

Q: The composition of the Fingroup Fund portfolio is as follows: Stock Shares Price A 200,000 $ 35 B…

A: The Portfolio turnover rate shows the rate at which assets [securites] are replaced within a fund.…

Q: (Appendix 13A) The following data pertain to an investment; Cost of the Investment Life of the…

A: Net present value : Net present value is the difference between the present value of the cash…

Q: You are considering an investment in Justus Corporation's stock, which is expected to pay a dividend…

A:

Q: O a $7,856.83 Ob Oc C Od Oe 9 D $17,616.21 $3,492.86 $1,912.37 $7,916.67

A: Future Value- Future value (FV) is the value of a current asset at a future date based on an assumed…

Step by step

Solved in 3 steps with 5 images

- The contract size for platinum futures is 50 troy ounces. Suppose you need 500 troy ounces of platinum and the current futures price is $2,000 per ounce. What is your dollar profit/loss if platinum sells for $2,050 a troy ounce when the futures contract expires? What's the answer?? a- Loss 1,250,000 b- Profit 1,250,000 C-Loss 2,500 d- Profit 2,500The futures price of gold is $800. Futures contracts are for 100 ounces of gold, and the margin requirement is $4,000 a contract. The maintenance market requirement is $1,200. You expect the price of gold to rise and enter into a contract to buy gold. How much must you initially remit? Round your answer to the nearest dollar. $ If the futures price of gold rises to $855, what is the profit and return on your position? Round your answer for profit to the nearest dollar and for return to the nearest whole number. Profit: $ Return: % If the futures price of gold declines to $784, what is the loss on the position? Round your answer to the nearest dollar. Enter the answer as a positive value. $ If the futures price declines to $756, what must you do? Round your answer to the nearest dollar. Enter the answer as a positive value. The investor will have to $ to restore the initial $4,000 margin. If the futures price continues to decline to $740, how much do you have in your…Suppose that you enter into a short futures contract to sell July silver for $17.20 per ounce. The size of the contract is 5,000 ounces. The initial margin is $4,000, and the maintenance margin is $3,000.What change in the futures price will lead to a margin call?What happens if you do not meet the margin call?

- Suppose you buy a December futures contract on a hypothetical 10-year, 6% semiannualcoupon note with a settlement price today of 125-060. You post the initialmargin required for this transaction ($1,430 per $100,000 contract). What nominalannual yield to maturity is implied by the settlement price? If interest rates fall to2.4%, what return would you earn on one futures contract? If interest rates rose to3.2%, what is the return on one futures contract?Consider a three-month futures contract on gold. The fixed charge is Rs.310 per deposit and thevariable storage costs are Rs.52.5 per week. Assume that the storage costs are paid at the timeof deposit. Assume further that the spot gold price is Rs.15000 per 10 grams and the risk-freerate is 7% per annum. What would the price of three month gold futures if the delivery unit is onekg? Assume that 3 months are equal to 13 weeksA gold futures contract requires the long trader to buy 100 troy ounces of gold. The initial margin requirement is $ 2,000 and the support margin requirement is $ 1,500. Matthew Evans enters long June gold futures contract at $ 320 per troy ounce. When could Evans receive a support margin call?

- Suppose that you trade a forward contract today that matures after one year. The forward price is $105 and the simple interest rate is 7 percent per year. If after six months from today, the spot price is going to be $125 and the value of the forward contract is $20, the arbitrage profit that you can make today by trading one forward contract and other securities is?The spot price of gold today is $1, 507 per troy ounce, and the futures price for a contract maturing in seven months is $1, 548 per troy ounce. If Golddy Plc puts on a futures hedge today and lifts the hedge after five months. a) Calculate the cost of carry for gold. b) If the spot price of gold in five months' time turns out to be $1,520. What will be the futures price five months from now? c) How much is the basis in five months' time?Suppose that you bought two one-year gold futures contracts when the one-year futures price of gold was US$1,340.30 per troy ounce. You then closed the position at the end of the sixth trading day. The initial margin requirement is US$5,940 per contract, and the maintenance margin requirement is US$5,400 per contract. One contract is for 100 troy ounces of gold. The daily prices on the intervening trading days are shown in the following table. Day Settlement Price 0 1340.30 1 1345.50 2 1339.20 3 1330.60 4 1327.70 5 1337.70 6 1340.60 Assume that you deposit the initial margin and do not withdraw the excess on any given day. Whenever a margin call occurs on Day t, you would make a deposit to bring the balance up to meet the initial margin requirement at the start of trading on Day t+1, i.e., the next day. a. What are the initial margin and maintenance margin on your margin account?

- Suppose that you bought two one-year gold futures contracts when the one-year futures price of gold was US$1,340.30 per troy ounce. You then closed the position at the end of the sixth trading day. The initial margin requirement is US$5,940 per contract, and the maintenance margin requirement is US$5,400 per contract. One contract is for 100 troy ounces of gold. The daily prices on the intervening trading days are shown in the following table. Day Settlement Price 0 1340.30 1 1345.50 2 1339.20 3 1330.60 4 1327.70 5 1337.70 6 1340.60 Assume that you deposit the initial margin and do not withdraw the excess on any given day. Whenever a margin call occurs on Day t, you would make a deposit to bring the balance up to meet the initial margin requirement at the start of trading on Day t+1, i.e., the next day. b. Fill the appropriate numbers in the blank cells in the following table. (Hint: See solution to Q19 in Lesson 2 Learning…Suppose that you bought two one-year gold futures contracts when the one-year futures price of gold was US$1,340.30 per troy ounce. You then closed the position at the end of the sixth trading day. The initial margin requirement is US$5,940 per contract, and the maintenance margin requirement is US$5,400 per contract. One contract is for 100 troy ounces of gold. The daily prices on the intervening trading days are shown in the following table. Day Settlement Price 0 1340.30 1 1345.50 2 1339.20 3 1330.60 4 1327.70 5 1337.70 6 1340.60 Assume that you deposit the initial margin and do not withdraw the excess on any given day. Whenever a margin call occurs on Day t, you would make a deposit to bring the balance up to meet the initial margin requirement at the start of trading on Day t+1, i.e., the next day. c. What is your total profit after you closed out your position?Fred enters into a futures contract to buy 10,000 pounds of cotton for $8 per pound. The initial margin is 5% of contract value, and the maintenance margin is 75% of the initial margin. What price (per pound) of cotton futures will trigger a margin call? ______. What amount would Fred’s broker have to post in response to this margin call? ______.