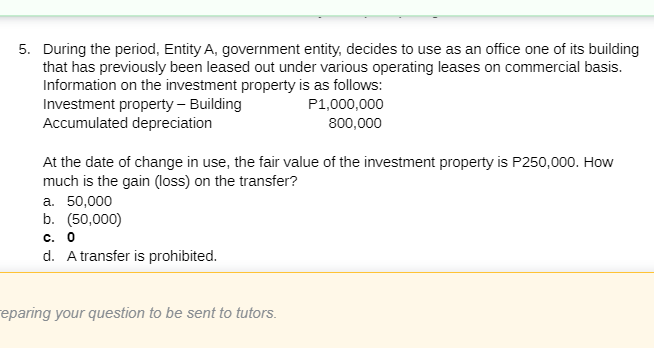

gain (loss) on the transfer

Q: Describe the exchanges in nonmonetary asset.

A: A non-monetary transaction refers to a commercial or business transaction that happens without the…

Q: Discuss the difference between an unrealized holding gain and a realized gain.

A: The gain is the excess of revenue earned over the expenses incurred.

Q: What is nonoperating current assets?

A: Non-operating current asset: It could be a type of current resources or assets that are not basic to…

Q: WHAT IS TECHNICAL OBSOLECENSE OF ASSET

A: The term obsolete refers to the fact that a commodity is no longer in use. Obsolescence refers to…

Q: Difference between present value and net present value.

A: Present value (PV) is the current value of a future sum of money or stream of cash flow given a…

Q: What is return on assets(roa)?

A: In general terms, ROA is similar to Return on Investment.

Q: Define the term nonmonetary assets.

A: Assets: These are the resources owned and controlled by business and used to produce benefits for…

Q: what is return on assets?

A: Return on Assets (ROA):- It is an indicator of how profitable a company is relative to its total…

Q: Brand recognition is an example of O a. Intangible asset O b. Expenses O C. Tangible asset O d.…

A: Brand recognition is situation when the customers can easily identify the products of particular…

Q: Describe two major types of interfund transfers. Under what circumstances is each used?

A: Inter-fund transfers are used for the purpose of transferring the balance of funds from one fund to…

Q: Explain how to defer gains using the like-kind exchange rules.

A: A like kind exchange is defined as the tax deferred transaction, which used to allow regarding the…

Q: Define the term Loss Contingencies.

A: A loss contingency is incurred by the business based on the result of a future event, such as…

Q: Define Loss contingency.

A: A loss contingency gives the reader of the financial statements early warning of an impending…

Q: Define refunding operation

A: Introduction: Refunding is the method of withdrawal or repayment of an existing bond issue by…

Q: What is profit contribution

A: The profit is calculated as difference between total revenue earned and total expenses incurred.

Q: Define the following relative to like-kind exchanges: Boot Postponed gain or loss Gain or loss…

A: The like kind exchange is defined as the transaction of tax deferred which allows for asset disposal…

Q: Return on assets

A: Return on assets is computed as net income upon total assets of the company.

Q: entory Expens

A: Current ratio is ratio of current assets to current laibilties.

Q: What is return on assets (roa ) ?? please comment own word.

A: Ratio analysis is based on the fact that a single accounting figure by itself may not communicate…

Q: example of assets

A: Assets represents the resources of an entity that are used for generation of resources of the…

Q: Explain the accounting for gain and loss contingencies.

A: Contingencies: Contingency is a situation where the outcome becomes uncertain and is resolved in…

Q: WHAT IS FUNCTIONAL OBSOLECENSE OF ASSETS?

A: Functional obsolescence of assets is discussed hereunder : The term ' Obsolescence' refers to…

Q: Define Return on assets.

A: Introduction: Return on Assets : Return on assest is a ratio which defines that how much profit…

Q: COMPUTE THE GOODWILL.

A: Step 1 Since as per given case, the acquirer has acquired all assets and liabilities or acquired…

Q: Example: Cost of acquisition n

A: Cost of acquistion is the cost of acquiring assets of the company . As…

Q: What amount of goodwill will be reported?

A: Consolidated balance sheet The financial position of a combination of two companies is represented…

Q: When are loss contingencies recorded?

A: Definition: Contingent liability: This is an uncertain obligation which might be incurred on a…

Q: What is the amount of Goodwill

A: Goodwill/Gain on Bargain purchase: Purchase consideration/Investment Add: Non controlling Interest…

Q: Access the glossary (“Master Glossary”) to answer the following. a. What does it mean to…

A: Answer: To capitalize an item means to use the item for the long term in the business and disclose…

Q: What is the transaction's profit

A: This question deals with the transaction's profit?

Q: Give differences between Revaluation account and Realisation account.

A: Revaluation account: The revaluation account is a nominal account opened to assess the values of the…

Q: Define the term Gain Contingencies.

A:

Q: Define the term Acquisitions.

A: An acquisition is when one company purchases most or all of another company's shares to gain control…

Q: Compute the goodwill (gain on bargain purchase).

A: The goodwill (gain on bargain purchase) is calculated as follows:Reference:

Q: on remeasurement nvestment is

A: Given as, To find the gain on the investment as,

Q: COMPUTE NCI IN NET ASSET (ONLY)

A: NCI- Non controlling interest is the portion of company's financial position which is still under…

Q: exchange gain or loss

A: As per IAS 21 ( The effect of changes in foreign exchange rates), a foreign currency monetary item…

Q: Compute for the goodwill.

A: Purchase consideration: Fair value of the equity investment + Purchase price paid for acquiring…

Q: COMPUTE FOR THE GOODWILL.

A: Goodwill is an intangible asset that is related to the takeover of one company by another. In fact,…

Q: compound interest.

A: Compound interest = P * (1 + (i2/m))mt - P

Q: Define Gains

A: Investment refers to flow of funds made to create capital in order to earn profits from that…

Q: unrealized gain

A: Unrealized gai or loss occur due to changes between cost and market value of a given security. If…

Q: Example of Capital Allocation Line (CAL)

A: Capital allocation line: Capital allocation line is also named as capital market line. Capital…

Q: Define Securitization.

A:

Step by step

Solved in 3 steps

- On January 1, 20x1, ABC Co. decided to lease out a building that was previously used as office space. The building has a historical cost of P 5,000,000 and accumulated depreciation of P 4,000,000. ABC Co. uses the fair value model for its investment property. The building has a fair value of P 800,000 on January 1, 20x1. What amount shall be recognized in the statement of financial performance on January 1, 20x1?He Company owns land and building classified as investment property . The land and building is being leased out under operating leases. The company uses the fair value model for all its other investment property. Data relating to the land and building follows: Cost FV Dec. 31, 2020 FV Dec. 31, 2021 FV Dec. 31, 2021Land -------- P 10,000,000 -- P14,000,000 -------P15,500,000 ------- P 17,000,000Building ----- 20,000,000 --- 9,000,000 -------- 9,500,000 ------- 10,000,000 How much fair value gain should He company report in profit or loss for year 2021?9. RST Company acquired a building on January 1, 2021, for P25,000,000. At that date, the building has a useful life of 50 years. The fair value of the building was P28,000,000 on December 31, 2021. The building was appropriately classified as investment property and RST is using the fair value model in accounting the investment property. What amount shall be used in the statement of financial position on December 31, 2021?

- On January 1, 20x8, Pares Company classified its property interest under an operating lease from Allan Company, the lessor, as investment property. The asset was recognized at P 8M with an estimated remaining useful life of 15 years. The fair value of such asset is P 8.1M on December 31, 20x8. Pares adopts the cost model in valuing its investment properties subsequent to initial recognition. The investment property account of Pares, excluding the transaction described above, is composed of the following Asset CV 1/1/x8 Remaining Useful Life FV 12/31/x8 A 4.5M NA 5M B 6.55M 16 4.89M C 10.6M 20 11.050MIf Pares uses the straight line method in computing for depreciation expense, how much is the net amount of investment property to be reported in the December 31, 20x8 statement of financial positionA Ltd owns an owner-occupied asset that is measured using the revaluation model. The asset’scarrying amount at the end of the financial year is R20 000. The fair value of the asset is R27 000.The entity has determined the fair value less costs to sell of the asset as R26 000 and the value inuse as R32 000.Required:Explain how you would calculate the carrying value of the asset and at what value the asset shouldbe presented at in the financial statements.She Company owns land and building classified as investment property . The land and building is being leased out under operating leases. The company uses the fair value model for all its other investment property. Data relating to the land and building follows: Cost FV Dec. 31, 2020 FV Dec. 31, 2021Land -------- P 10,000,000 ----- P14,000,000 -------P15,500,000Building ----- 20,000,000 ------ 9,000,000 -------- 8,500,000 On December 31, 2021, the company decided to use the land and building for its operations. How much gain on is to be recorded by She on reclassification of the asset?

- She Company owns land and building classified as investment property . The land and building is being leased out under operating leases. The company uses the fair value model for all its other investment property. Data relating to the land and building follows: Cost FV Dec. 31, 2020 FV Dec. 31, 2021Land -------- P 10,000,000 ----- P14,000,000 -------P15,500,000Building ----- 20,000,000 ------ 9,000,000 -------- 8,500,000 On December 31, 2021, the company decided to use the land and building for its operations. How much gain on is to be recorded by She on reclassification of the asset? At what amount should the land and building be recorded on December 31, 2021?1. PERIODIC REGULAR Co. acquired a building on January 1, 20x1 for a total cost of ₱24,000,000and classified it as investment property. PERIODIC Co. uses the fair value model for its investment property. On January 1, 20x5, when the carrying amount of the building is ₱16,000,000, the elevator in the building was replaced for a total cost of ₱3,200,000. It is impracticable to determine the fair value of the replaced part. The fair value of the building on December 31, 20x5 is ₱17,200,000. How much is the loss recognized during the year? please provide solutionThe information below is from the Takafel Company.: 1. Investment property is acquired August 11, 2008, at a cost of BD2100. 2. The Fair values of the investment property is determined by the company as follows: § On December 31, 2008 - BD2000 § On December 31, 2009 - BD2080 § On December 31, 2010 - BD2150 Assume that the company used Fair value model (FVM), do the necessary entries at the end of 2008, 2009 and 2010.

- Entity A acquires a building for ₱1,000,000. The building is to be leased out under various operating leases. The building has an estimated useful life of 10 years and zero residual value. Entity A uses the cost model for its property, plant and equipment and the fair value model for its investment property. At the end of Year 1, the building is assessed to have a fair value of ₱1,080,000. How much should Entity A recognize in profit or loss in relation to the building? a. 80,000 gain on change in fair value 100,000 depreciation 180,000 gain on change in fair value b and cEntity A acquires a building for ₱1,000,000. The building is to be leased out under various operating leases. The building has an estimated useful life of 10 years and zero residual value. Entity A uses the cost model for its property, plant and equipment and the fair value model for its investment property. At the end of Year 1, the building is assessed to have a fair value of ₱1,080,000. How much should Entity A recognize in profit or loss in relation to the building? * A. 100,000 depreciation B. No answer C. 180,000 gain on change in fair value D. 80,000 gain on change in fair valuePlease provide solution 1. On December 31, 20x1, DECAPITATE BEHEAD Co. decided to lease out under operating lease one of its buildings that was previously used as office space. The building has an original cost of ₱12,000,000 and accumulated depreciation of ₱8,000,000 as of January 1, 20x1. Annual depreciation is ₱400,000. DECAPITATE Co. uses the fair value model for investment property. The fair value of the building on December 31, 20x1 is ₱6,000,000. The entry to record the transfer of the building to investment property includes a: a. credit to gain on reclassification for ₱2,000,000. b. credit to revaluation surplus for ₱2,000,000. c. debit to building for ₱12,000,000. d. credit to revaluation surplus for ₱2,400,000.