Gallatin Carpet Cleaning is a small, family-owned business operating out of Bozeman, Montana. For Its services, the company has always charged a flat fee per hundred square feet of carpet cleaned. The current fee Is $2225 per hundred square feet. However, there is some question about whether the company is actually making any money on Jobs for some customers-particularly those located on remote ranches that require considerable travel time. The owner's daughter, home for the summer from college, has suggested investigating this question using activity-based costing. After some discussion, she designed a simple system consisting of four activity cost pools. The activity cost pools and their activity measures appear below: Activity for the Year Activity Cost Pool Cleaning carpets Travel to jobs Job support Other (organization-sustaining costs and idle capacity costs) Activity Measure Square feet cleaned (ees) -13,500 hundred square feet 300,000 miles 1,700 jobs Miles driven Number of jobs None Not applicable The total cost of operating the company for the year Is $347,000 which Includes the following costs: $ 144,00e Wages Cleaning supplies cleaning equipment depreciation Vehicle expenses Office expenses President's compensation 32,000 8,e0e 26, e00 56,eee 81, eee S 347,e0e Total cost Resource consumption is distributed across the activities as follows: Distribution of Resource Consumption Across Activities Cleaning Travel to Jobs 11 Job Support Other Total Carpets 78% wages Cleaning supplies Lleaning equipment depreciation Vehicle expenses 11% 1eer 100% es zex 81% 19% OFfice expenses 64% 36% 1ees President's compensation 33% 67% 1e0x Job support consists of recetving calls from potential customers at the home office, scheduling Jobs. billing, resolving issues, and so on. Required: 1 Prepare the first-stage allocation of costs to the activity cost pools. 2 Compute the activity rates for the activity cost pools. 3 The company recently completed a 200 square foot carpet-cieaning Job at the Flying N Ranch-a 55-mile round-trlp journey from the company's offices In Bozeman. Compute the cost of this (ob using the activity-based costing system

Gallatin Carpet Cleaning is a small, family-owned business operating out of Bozeman, Montana. For Its services, the company has always charged a flat fee per hundred square feet of carpet cleaned. The current fee Is $2225 per hundred square feet. However, there is some question about whether the company is actually making any money on Jobs for some customers-particularly those located on remote ranches that require considerable travel time. The owner's daughter, home for the summer from college, has suggested investigating this question using activity-based costing. After some discussion, she designed a simple system consisting of four activity cost pools. The activity cost pools and their activity measures appear below: Activity for the Year Activity Cost Pool Cleaning carpets Travel to jobs Job support Other (organization-sustaining costs and idle capacity costs) Activity Measure Square feet cleaned (ees) -13,500 hundred square feet 300,000 miles 1,700 jobs Miles driven Number of jobs None Not applicable The total cost of operating the company for the year Is $347,000 which Includes the following costs: $ 144,00e Wages Cleaning supplies cleaning equipment depreciation Vehicle expenses Office expenses President's compensation 32,000 8,e0e 26, e00 56,eee 81, eee S 347,e0e Total cost Resource consumption is distributed across the activities as follows: Distribution of Resource Consumption Across Activities Cleaning Travel to Jobs 11 Job Support Other Total Carpets 78% wages Cleaning supplies Lleaning equipment depreciation Vehicle expenses 11% 1eer 100% es zex 81% 19% OFfice expenses 64% 36% 1ees President's compensation 33% 67% 1e0x Job support consists of recetving calls from potential customers at the home office, scheduling Jobs. billing, resolving issues, and so on. Required: 1 Prepare the first-stage allocation of costs to the activity cost pools. 2 Compute the activity rates for the activity cost pools. 3 The company recently completed a 200 square foot carpet-cieaning Job at the Flying N Ranch-a 55-mile round-trlp journey from the company's offices In Bozeman. Compute the cost of this (ob using the activity-based costing system

Chapter15: Choice Of Business Entity—other Considerations

Section: Chapter Questions

Problem 89TA

Related questions

Question

They said to ask the other part of question in another request?

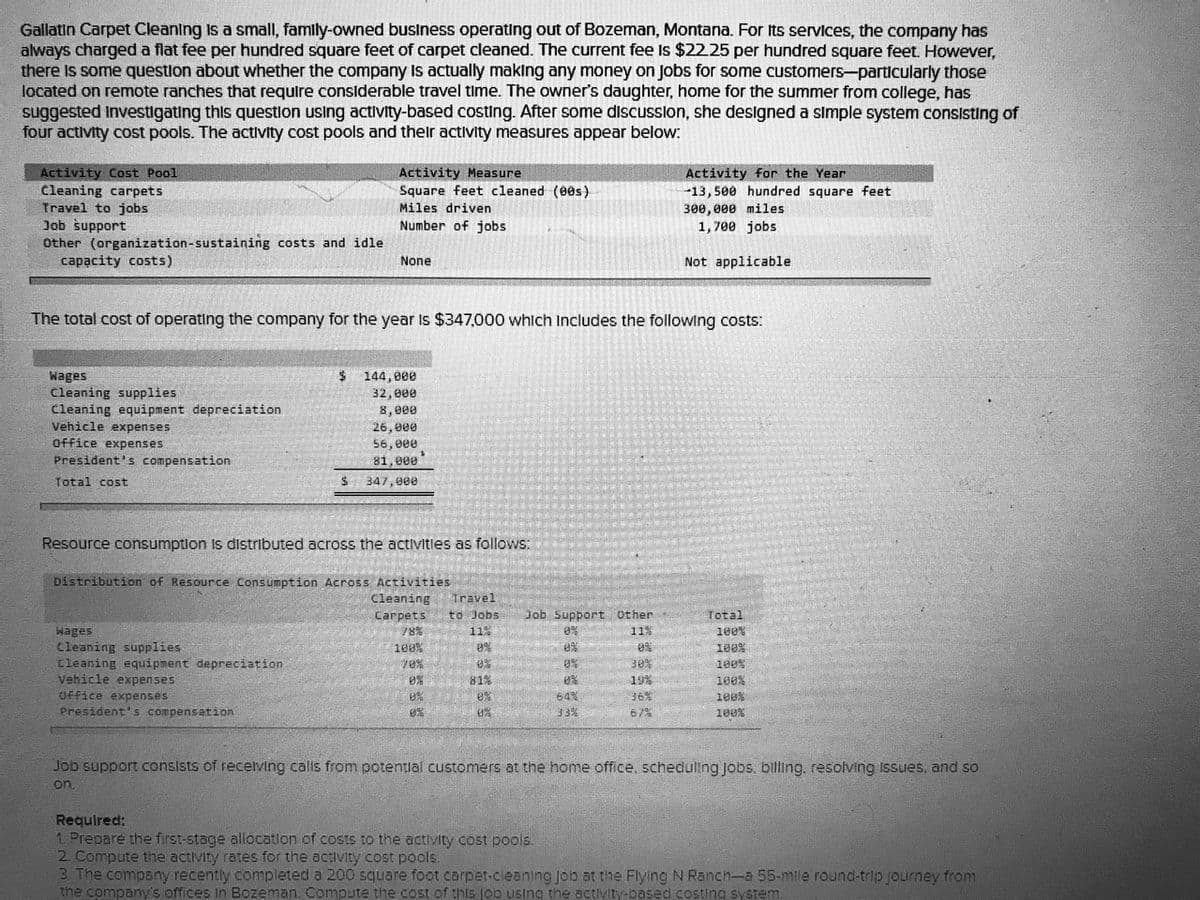

Transcribed Image Text:Gallatin Carpet Cleaning is a small, famly-owned business operating out of Bozeman, Montana. For Its services, the company has

always charged a flat fee per hundred square feet of carpet cleaned. The current fee Is $22.25 per hundred square feet. However,

there Is some question about whether the company Is actually making any money on Jobs for some customers-particularly those

located on remote ranches that require considerable travel time. The owner's daughter, home for the summer from college, has

suggested Investigating this question using activity-based costing. After some discussion, she designed a simple system consisting of

four activity cost pools. The activity cost pools and their activity measures appear below:

Activity Cost Pool

Cleaning carpets

Travel to jobs

Job support

Other (organization-sustaining costs and idle

capacity costs)

Activity Measure

Square feet cleaned (90s)

Activity for the Year

-13,500 hundred square feet

300,000 miles

1,700 jobs

Miles driven

Number of jobs

None

Not applicable

The total cost of operating the company for the year is $347,000 which Includes the following costs:

24

Wages

Cleaning supplies

cleaning equipment depreciation

Vehicle expenses

144,000

32,000

8,000

26, 000

56, 000

office expenses

81, eee

$ 347, 000

President's compensation

Total cost

Resource consumption is distributed across the activitles as follows:

Distribution of Resource Consumption Across Activities

Cleaning

Travel

Carpets

78%

to Jobs

11%

Job Support Other

11%

Total

wages

Cleaning supplies

Cleaning equipment depreciation

Vehicle expenses

Office expenses

President's compensation

0%

1e0%

100%

1ee%

70%

0%

0%

30%

1e0%

81%

19%

100%

0% e%

64%

36%

0%

33%

67%

100%

Job support consists of recetving calls from potential customers at the home office, scheduling Jobs. billing, resolving sues, and so

on.

Required:

1. Prepare the first-stage allocation of costs to the activity cost pools.

2 Compute the activity rates for the activity cost pools.

3 The company recently completed a 200 square foot carpet-cleaning Job at the Flying N Ranch-a 55-mile round-trip journey from

the company's offices In Bozeman. Compute the cost of this Job using the activity-based costing system.

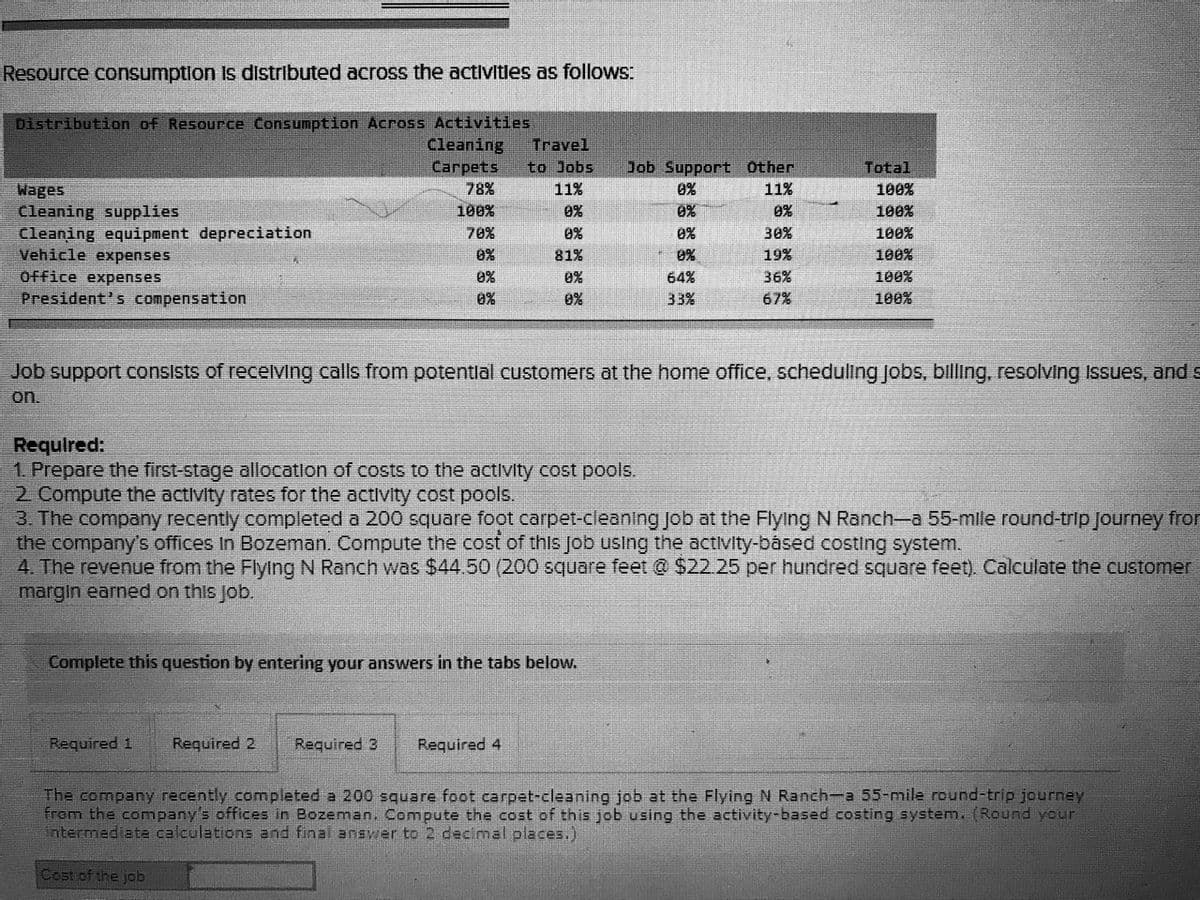

Transcribed Image Text:Resource consumptlon Is distributed across the activitles as follows:

Distribution of Resource Consumption Across Activities

Cleaning

Carpets

Travel

to Jobs

Job Support Other

Total

78%

100%

11%

Wages

Cleaning supplies

Cleaning equipment depreciation

Vehicle expenses

Office expenses

President's compensation

11%

0%

100%

0%

0%

0%

100%

70%

0%

0%

30%

100%

0%

81%

0%

19%

100%

0%

0%

64%

36%

100%

0%

0%

33%

67%

100%

Job support consists of recelvVing calls from potentlal customers at the home office, scheduling Jobs, billing, resolving Issues, and s

on.

Required:

1 Prepare the first-stage allocatlon of costs to the activity cost pools.

2 Compute the activity rates for the activity cost pools.

3. The company recently completed a 200 square foot carpet-cleaning job at the Flying N Ranch-a 55-mile round-trip Journey from

the company's offices in Bozeman. Compute the cost of this Job using the activity-básed costing system.

4. The revenue from the Flying N Ranch was $44.50 (200 square feet @ $22.25 per hundred square feet). Calculate the customer

margin earned on this job.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Required 3

Required 4

The company recently completed a 200 square foot carpet-cleaning job at the Flying N Ranch-a 55-mile round-trip journey

from the comnpany's offices in Bozeman, Compute the cost of this job using the activity-based costing system. (Round your

intermediate calculations and final answer to 2 decimal places.)

Cost of the job

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you