Garr Co. issued $6,000,000 of 12%, 5-year convertible bonds on December 1, 2018 for $6,025,480 plus accrued interest. The bonds were dated April 1, 2018 with interest payable April 1 and October 1. Bond premium is amortized each interest period on a straight-line basis. Garr Co. has a fiscal year end of September 30. On October 1, 2019, $3,000,000 of these bonds were converted into 42,000 shares of $15 par common stock. Accrued interest was paid in cash at the time of conversion. Instructions (a) Prepare the entry to record the interest expense at April 1, 2019. Assume that interest payable was credited when the bonds were issued (round to nearest dollar). (b) Prepare the entry to record the conversion on October 1, 2019. Assume that the entry to record amortization of the bond premium and interest payment has been made.

Garr Co. issued $6,000,000 of 12%, 5-year convertible bonds on December 1, 2018 for $6,025,480 plus accrued interest. The bonds were dated April 1, 2018 with interest payable April 1 and October 1. Bond premium is amortized each interest period on a straight-line basis. Garr Co. has a fiscal year end of September 30. On October 1, 2019, $3,000,000 of these bonds were converted into 42,000 shares of $15 par common stock. Accrued interest was paid in cash at the time of conversion. Instructions (a) Prepare the entry to record the interest expense at April 1, 2019. Assume that interest payable was credited when the bonds were issued (round to nearest dollar). (b) Prepare the entry to record the conversion on October 1, 2019. Assume that the entry to record amortization of the bond premium and interest payment has been made.

Chapter13: Long-term Liabilities

Section: Chapter Questions

Problem 6PA: Aggies Inc. issued bonds with a $500,000 face value, 10% interest rate, and a 4-year term on July 1,...

Related questions

Question

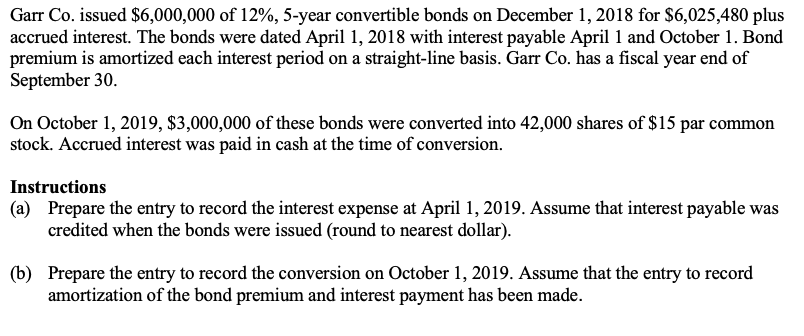

Transcribed Image Text:Garr Co. issued $6,000,000 of 12%, 5-year convertible bonds on December 1, 2018 for $6,025,480 plus

accrued interest. The bonds were dated April 1, 2018 with interest payable April 1 and October 1. Bond

premium is amortized each interest period on a straight-line basis. Garr Co. has a fiscal year end of

September 30.

On October 1, 2019, $3,000,000 of these bonds were converted into 42,000 shares of $15 par common

stock. Accrued interest was paid in cash at the time of conversion.

Instructions

(a) Prepare the entry to record the interest expense at April 1, 2019. Assume that interest payable was

credited when the bonds were issued (round to nearest dollar).

(b) Prepare the entry to record the conversion on October 1, 2019. Assume that the entry to record

amortization of the bond premium and interest payment has been made.

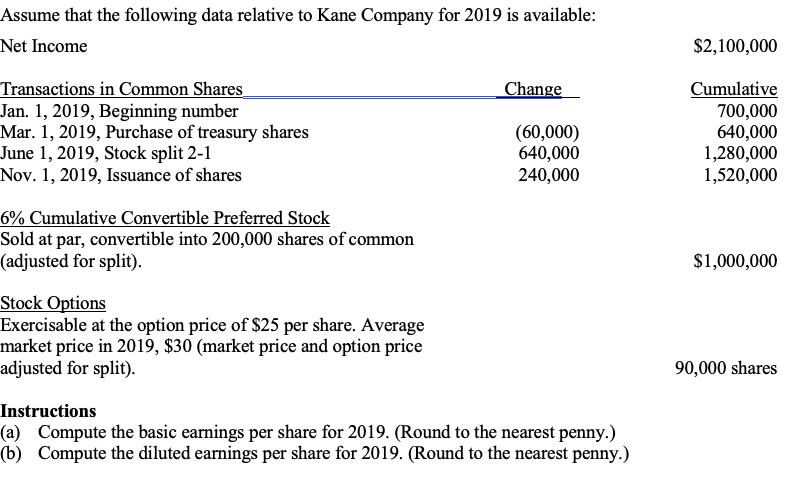

Transcribed Image Text:Assume that the following data relative to Kane Company for 2019 is available:

Net Income

$2,100,000

Transactions in Common Shares

Jan. 1, 2019, Beginning number

Mar. 1, 2019, Purchase of treasury shares

June 1, 2019, Stock split 2-1

Nov. 1, 2019, Issuance of shares

Change

(60,000)

640,000

240,000

Cumulative

700,000

640,000

1,280,000

1,520,000

6% Cumulative Convertible Preferred Stock

Sold at par, convertible into 200,000 shares of common

(adjusted for split).

$1,000,000

Stock Options

Exercisable at the option price of $25 per share. Average

market price in 2019, $30 (market price and option price

adjusted for split).

90,000 shares

Instructions

(a) Compute the basic earnings per share for 2019. (Round to the nearest penny.)

(b) Compute the diluted earnings per share for 2019. (Round to the nearest penny.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT