Garth is a single cash basis activities/transactions in 2021. In 2020, Garth had adjusted gross ince itemized deductions of $12,700, and paid $23,012 in federal income tax. Indicate the amount of each independent statement below that is included in Garth's recognized income (i.e. gross income) for tax year 2021. • Sold primary family home for $700,000. The home was purchased in 1980 for $450,000. Include • Received state income tax refund of $625 for overpayment of 2020 state income tax. Include rod on his tree-cutting job.

Garth is a single cash basis activities/transactions in 2021. In 2020, Garth had adjusted gross ince itemized deductions of $12,700, and paid $23,012 in federal income tax. Indicate the amount of each independent statement below that is included in Garth's recognized income (i.e. gross income) for tax year 2021. • Sold primary family home for $700,000. The home was purchased in 1980 for $450,000. Include • Received state income tax refund of $625 for overpayment of 2020 state income tax. Include rod on his tree-cutting job.

Chapter5: Gross Income: Exclusions

Section: Chapter Questions

Problem 18DQ

Related questions

Question

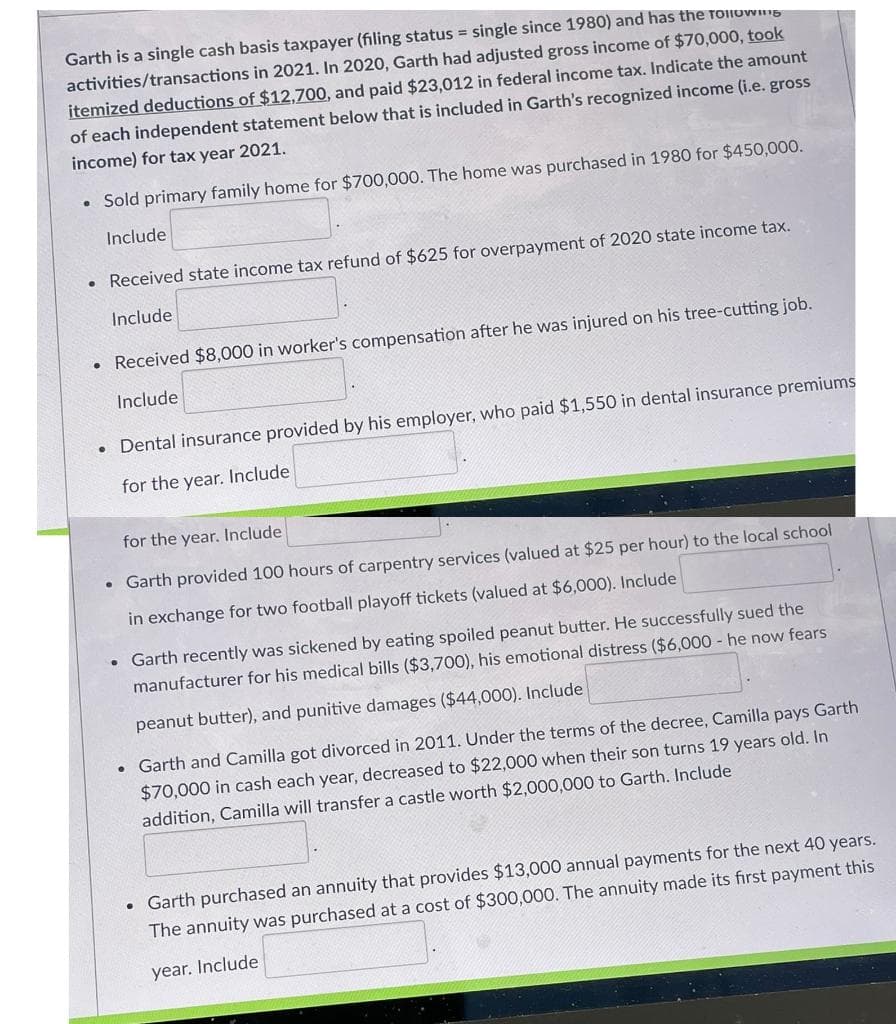

Transcribed Image Text:Garth is a single cash basis taxpayer (filing status = single since 1980) and has the foilowng

activities/transactions in 2021. In 2020, Garth had adjusted gross income of $70,000, took

itemized deductions of $12,700, and paid $23,012 in federal income tax. Indicate the amount

of each independent statement below that is included in Garth's recognized income (i.e. gross

income) for tax year 2021.

• Sold primary family home for $700,000. The home was purchased in 1980 for $450,000.

Include

• Received state income tax refund of $625 for overpayment of 2020 state income tax.

Include

• Received $8,000 in worker's compensation after he was injured on his tree-cutting job.

Include

• Dental insurance provided by his employer, who paid $1,550 in dental insurance premiums

for the year. Include

for the year. Include

Garth provided 100 hours of carpentry services (valued at $25 per hour) to the local school

in exchange for two football playoff tickets (valued at $6,000). Include

• Garth recently was sickened by eating spoiled peanut butter. He successfully sued the

manufacturer for his medical bills ($3,700), his emotional distress ($6,000 he now fears

peanut butter), and punitive damages ($44,000). Include

• Garth and Camilla got divorced in 2011. Under the terms of the decree, Camilla pays Garth

$70,000 in cash each year, decreased to $22,000 when their son turns 19 years old. In

addition, Camilla will transfer a castle worth $2,000,000 to Garth. Include

Garth purchased an annuity that provides $13,000 annual payments for the next 40 years.

The annuity was purchased at a cost of $300,000. The annuity made its first payment this

year. Include

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT