Gateway Communications is considering a project with an initial fixed assets cost of $1.50 million that will be depreciated straight-line to a zero book value over the 9-year life of the project. At the end of the project the equipment will be sold for an estimated $245,000. The project will not change sales but will reduce operating costs by $409,000 per year. The tax rate is 40 percent and the required return is 12.7 percent. The project will require $54,500 In net working capital, which will be recouped when the project ends. What is the project's NPV?

Gateway Communications is considering a project with an initial fixed assets cost of $1.50 million that will be depreciated straight-line to a zero book value over the 9-year life of the project. At the end of the project the equipment will be sold for an estimated $245,000. The project will not change sales but will reduce operating costs by $409,000 per year. The tax rate is 40 percent and the required return is 12.7 percent. The project will require $54,500 In net working capital, which will be recouped when the project ends. What is the project's NPV?

Chapter9: Capital Budgeting Techniques

Section: Chapter Questions

Problem 7PROB

Related questions

Question

Transcribed Image Text:Check my

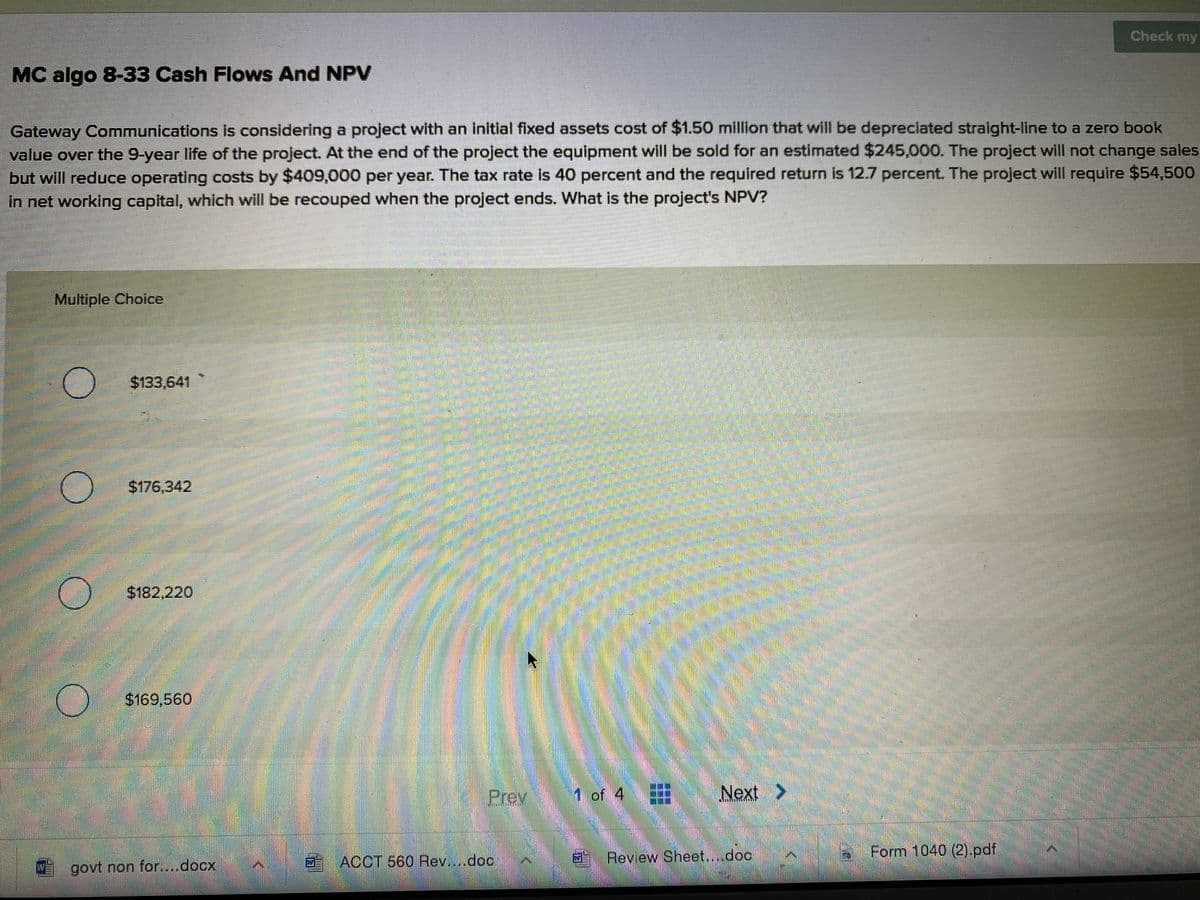

MC algo 8-33 Cash Flows And NPV

Gateway Communications is considering a project with an initial fixed assets cost of $1.50 million that will be depreciated straight-line to a zero book

value over the 9-year life of the project. At the end of the project the equipment will be sold for an estimated $245,000. The project will not change sales

but will reduce operating costs by $409,000 per year. The tax rate is 40 percent and the required return is 12.7 percent. The project will require $54,500

in net working capital, whlch will be recouped when the project ends. What is the project's NPV?

Multiple Choice

$133,641

$176,342

$182,220

$169,560

Prev

1 of 4

Next >

Review Sheet....doc

Form 1040 (2).pdf

govt non for....docx

ACCT 560 Rev,...doc

WE

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning