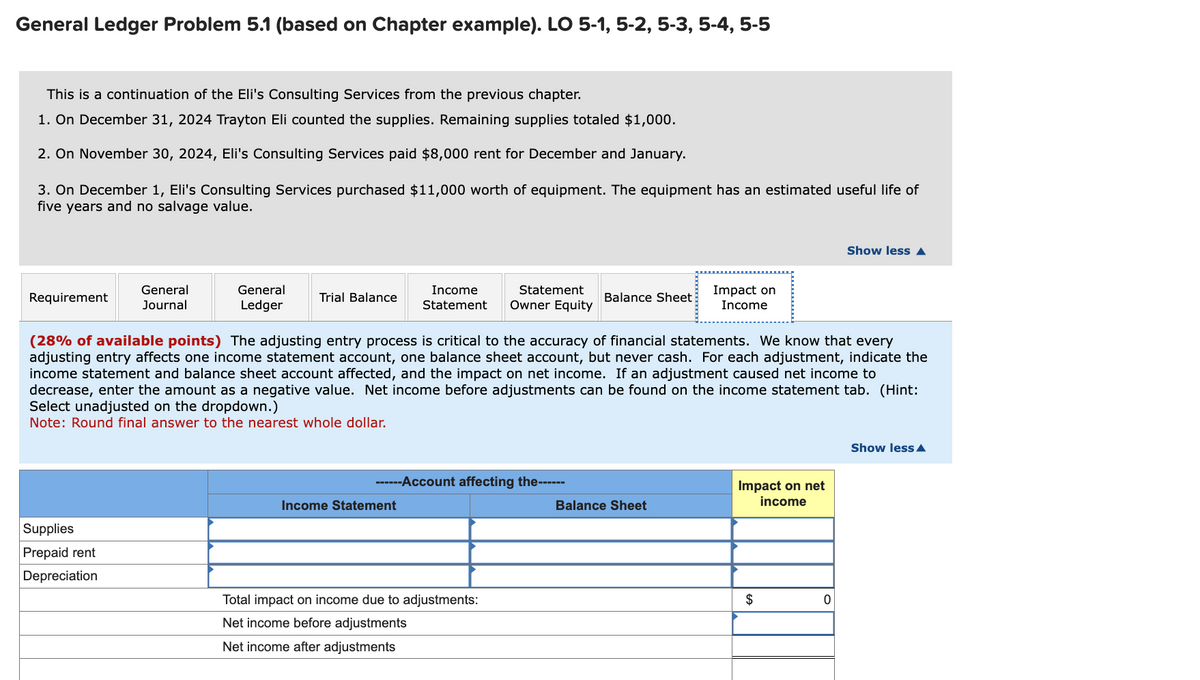

General Ledger Problem 5.1 (based on Chapter example). LO 5-1, 5-2, 5-3, 5-4, 5-5 This is a continuation of the Eli's Consulting Services from the previous chapter. 1. On December 31, 2024 Trayton Eli counted the supplies. Remaining supplies totaled $1,000. 2. On November 30, 2024, Eli's Consulting Services paid $8,000 rent for December and January. 3. On December 1, Eli's Consulting Services purchased $11,000 worth of equipment. The equipment has an estimated useful life of five years and no salvage value. Requirement General Journal Supplies Prepaid rent Depreciation General Ledger Trial Balance Income Statement Income Statement Statement Owner Equity ------Account affecting the------ (28% of available points) The adjusting entry process is critical to the accuracy of financial statements. We know that every adjusting entry affects one income statement account, one balance sheet account, but never cash. For each adjustment, indicate the income statement and balance sheet account affected, and the impact on net income. If an adjustment caused net income to decrease, enter the amount as a negative value. Net income before adjustments can be found on the income statement tab. (Hint: Select unadjusted on the dropdown.) Note: Round final answer to the nearest whole dollar. Total impact on income due to adjustments: Net income before adjustments Net income after adjustments Balance Sheet Impact on Income Balance Sheet Impact on net income $ Show less A 0 Show lessA

General Ledger Problem 5.1 (based on Chapter example). LO 5-1, 5-2, 5-3, 5-4, 5-5 This is a continuation of the Eli's Consulting Services from the previous chapter. 1. On December 31, 2024 Trayton Eli counted the supplies. Remaining supplies totaled $1,000. 2. On November 30, 2024, Eli's Consulting Services paid $8,000 rent for December and January. 3. On December 1, Eli's Consulting Services purchased $11,000 worth of equipment. The equipment has an estimated useful life of five years and no salvage value. Requirement General Journal Supplies Prepaid rent Depreciation General Ledger Trial Balance Income Statement Income Statement Statement Owner Equity ------Account affecting the------ (28% of available points) The adjusting entry process is critical to the accuracy of financial statements. We know that every adjusting entry affects one income statement account, one balance sheet account, but never cash. For each adjustment, indicate the income statement and balance sheet account affected, and the impact on net income. If an adjustment caused net income to decrease, enter the amount as a negative value. Net income before adjustments can be found on the income statement tab. (Hint: Select unadjusted on the dropdown.) Note: Round final answer to the nearest whole dollar. Total impact on income due to adjustments: Net income before adjustments Net income after adjustments Balance Sheet Impact on Income Balance Sheet Impact on net income $ Show less A 0 Show lessA

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

this is a practice exersise not an exam. I got stuck at part Impact of Income. Could you please help me step by step how to complete it?

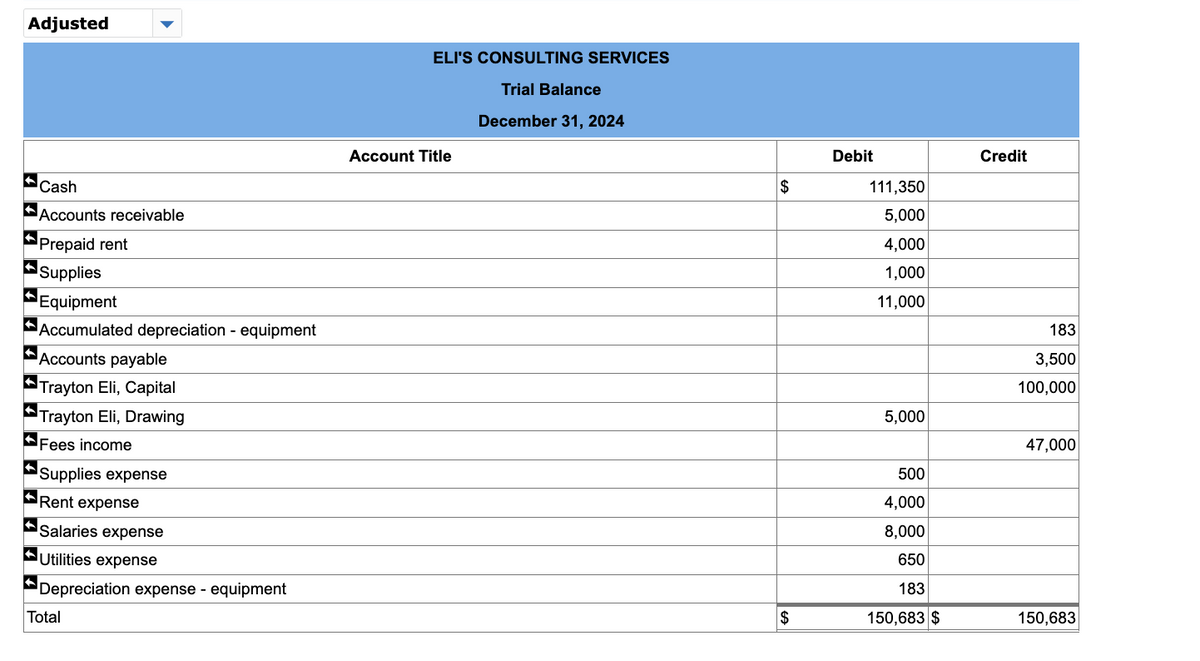

Transcribed Image Text:Adjusted

Cash

Accounts receivable

Prepaid rent

Supplies

Equipment

Accumulated depreciation - equipment

Accounts payable

Trayton Eli, Capital

Trayton Eli, Drawing

Fees income

Supplies expense

Rent expense

Salaries expense

Utilities expense

Depreciation expense - equipment

Total

ELI'S CONSULTING SERVICES

Trial Balance

December 31, 2024

Account Title

$

$

Debit

111,350

5,000

4,000

1,000

11,000

5,000

500

4,000

8,000

650

183

150,683 $

Credit

183

3,500

100,000

47,000

150,683

Transcribed Image Text:General Ledger Problem 5.1 (based on Chapter example). LO 5-1, 5-2, 5-3, 5-4, 5-5

This is a continuation of the Eli's Consulting Services from the previous chapter.

1. On December 31, 2024 Trayton Eli counted the supplies. Remaining supplies totaled $1,000.

2. On November 30, 2024, Eli's Consulting Services paid $8,000 rent for December and January.

3. On December 1, Eli's Consulting Services purchased $11,000 worth of equipment. The equipment has an estimated useful life of

five years and no salvage value.

Requirement

General

Journal

Supplies

Prepaid rent

Depreciation

General

Ledger

Trial Balance

Income

Statement

Income Statement

Statement

Owner Equity

------Account affecting the-----

(28% of available points) The adjusting entry process is critical to the accuracy of financial statements. We know that every

adjusting entry affects one income statement account, one balance sheet account, but never cash. For each adjustment, indicate the

income statement and balance sheet account affected, and the impact on net income. If an adjustment caused net income to

decrease, enter the amount as a negative value. Net income before adjustments can be found on the income statement tab. (Hint:

Select unadjusted on the dropdown.)

Note: Round final answer to the nearest whole dollar.

Total impact on income due to adjustments:

Net income before adjustments

Net income after adjustments

Balance Sheet

Impact on

Income

Balance Sheet

Impact on net

income

▶▶▶

$

Show less

0

Show less A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education