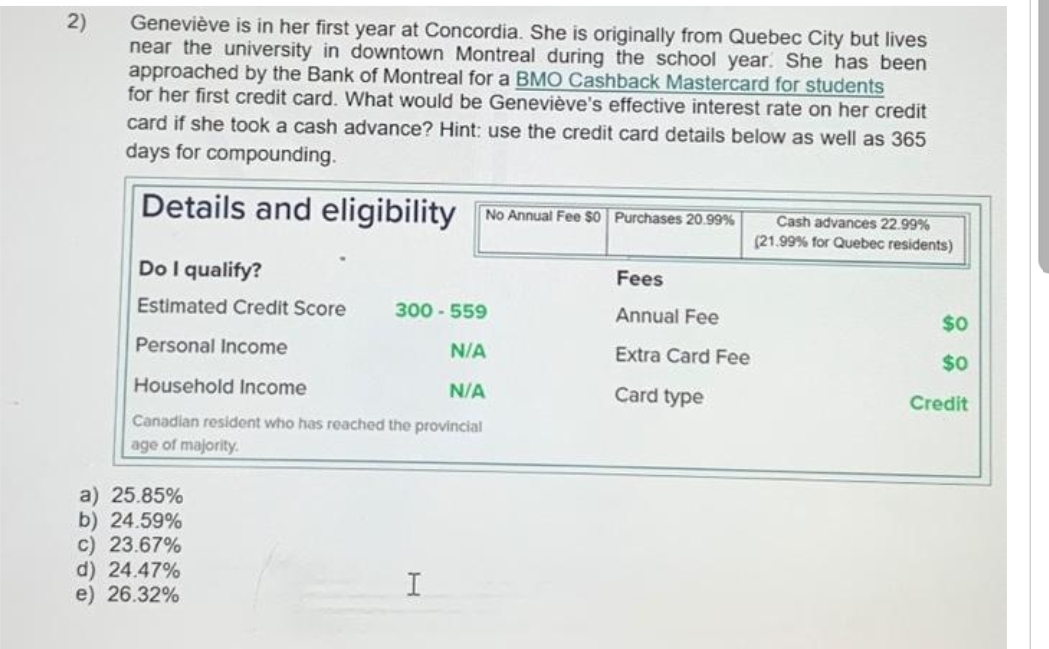

Geneviève is in her first year at Concordia. She is originally from Quebec City but lives near the university in downtown Montreal during the school year. She has been approached by the Bank of Montreal for a BMO Cashback Mastercard for students for her first credit card. What would be Geneviève's effective interest rate on her credit card if she took a cash advance? Hint: use the credit card details below as well as 365 days for compounding. Details and eligibility No Annual Fee $0 Purchases 20.99% Cash advances 22.99% (21.99 % for Quebec residents)

Geneviève is in her first year at Concordia. She is originally from Quebec City but lives near the university in downtown Montreal during the school year. She has been approached by the Bank of Montreal for a BMO Cashback Mastercard for students for her first credit card. What would be Geneviève's effective interest rate on her credit card if she took a cash advance? Hint: use the credit card details below as well as 365 days for compounding. Details and eligibility No Annual Fee $0 Purchases 20.99% Cash advances 22.99% (21.99 % for Quebec residents)

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

G.325.

Transcribed Image Text:2)

Geneviève is in her first year at Concordia. She is originally from Quebec City but lives

near the university in downtown Montreal during the school year. She has been

approached by the Bank of Montreal for a BMO Cashback Mastercard for students

for her first credit card. What would be Geneviève's effective interest rate on her credit

card if she took a cash advance? Hint: use the credit card details below as well as 365

days for compounding.

Details and eligibility No Annual Fee $0 Purchases 20.99%

Do I qualify?

Estimated Credit Score

Personal Income

N/A

Household Income

N/A

Canadian resident who has reached the provincial

age of majority.

a) 25.85%

b) 24.59%

c) 23.67%

d) 24.47%

e) 26.32%

300-559

H

Fees

Annual Fee

Extra Card Fee

Card type

Cash advances 22.99%

(21.99 % for Quebec residents)

$0

$0

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education