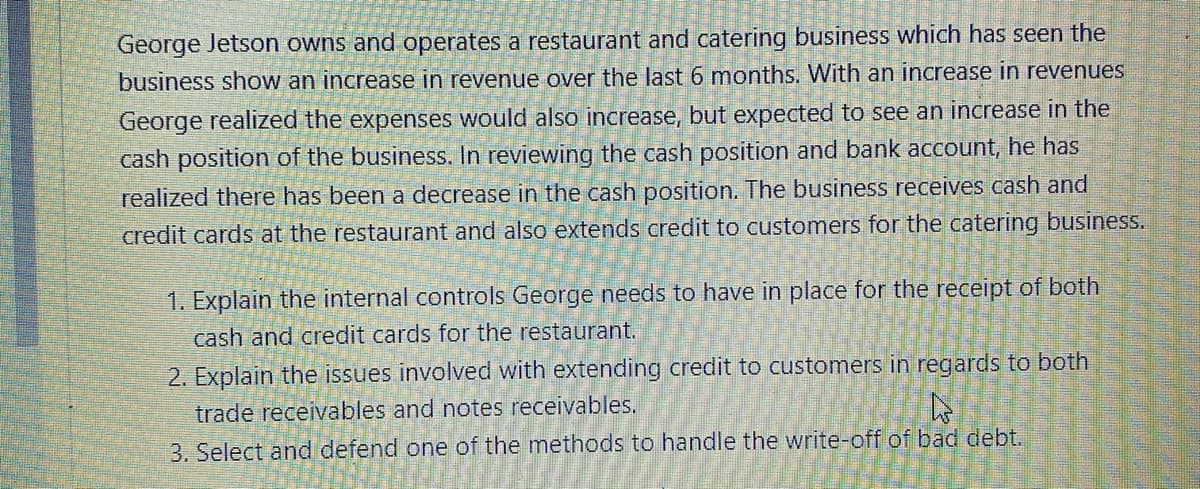

George Jetson owns and operates a restaurant and catering business which has seen the business show an increase in revenue over the last 6 months. With an increase in revenues George realized the expenses would also increase, but expected to see an increase in the cash position of the business. In reviewing the cash position and bank account, he has realized there has been a decrease in the cash position. The business receives cash and credit cards at the restaurant and also extends credit to customers for the catering business. 1. Explain the internal controls George needs to have in place for the receipt of both cash and credit cards for the restaurant. 2. Explain the issues involved with extending credit to customers in regards to both trade receivables and notes receivables, 3. Select and defend one of the methods to handle the write-off of bad debt.

Internal Controls to be placed for the receipt of both cash and credit cards for the restaurant:

- Segregation of duties, or mitigating controls, exists within transaction processes, custody, and recording functions.

- Transactions and events are properly recorded.

- Staff understands their duties, responsibilities, and accountabilities.

- Cash handling practices are documented and in compliance with state laws and regulations and, credit cards are in compliance with Payment Card Industry Standards.

- Transaction activities are properly authorized.

- Cash records for authorization and transactions are maintained in accordance with established requirements.

- Transactions are properly verified before disbursement and records are maintained according to established requirements.

- Accountability for refunds and credits are maintained.

- Accounting records are protected from theft, obsolescence, or destruction.

- There is an accurate statement of cash on hand and in the bank.

The issues involved with extending credit to customers in regards to both trade receivables and notes receivables:

TRADE RECEIVABLES or ACCOUNT RECEIVABLES:

Accounts or Trade receivables are usually current assets that arise from selling merchandise or providing services to customers on credit.

NOTES RECEIVABLES:

Notes receivable is an asset of a company, bank or other organization that holds a written promissory note from another party. For example, if a company lends one of its suppliers $10,000 and the supplier signs a written promise to repay the amount, the company will enter the amount in its asset account Notes Receivable. The supplier will also enter the amount in its liability account Notes Payable.

- Getting paid in a timely manner or getting paid within the agreed upon terms.

- Actually getting paid or getting the money, vs. receiving empty promises from customers.

- Maintaining good customer relations with late paying customers.

- Having enough time to manage the collections process.

- Actually reaching customers or the right person when trying to follow up.

- Dealing with credit approvals and offering lines of credit.

- Collecting from customers that appear to be failing.

- Resolving payment disputes.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps