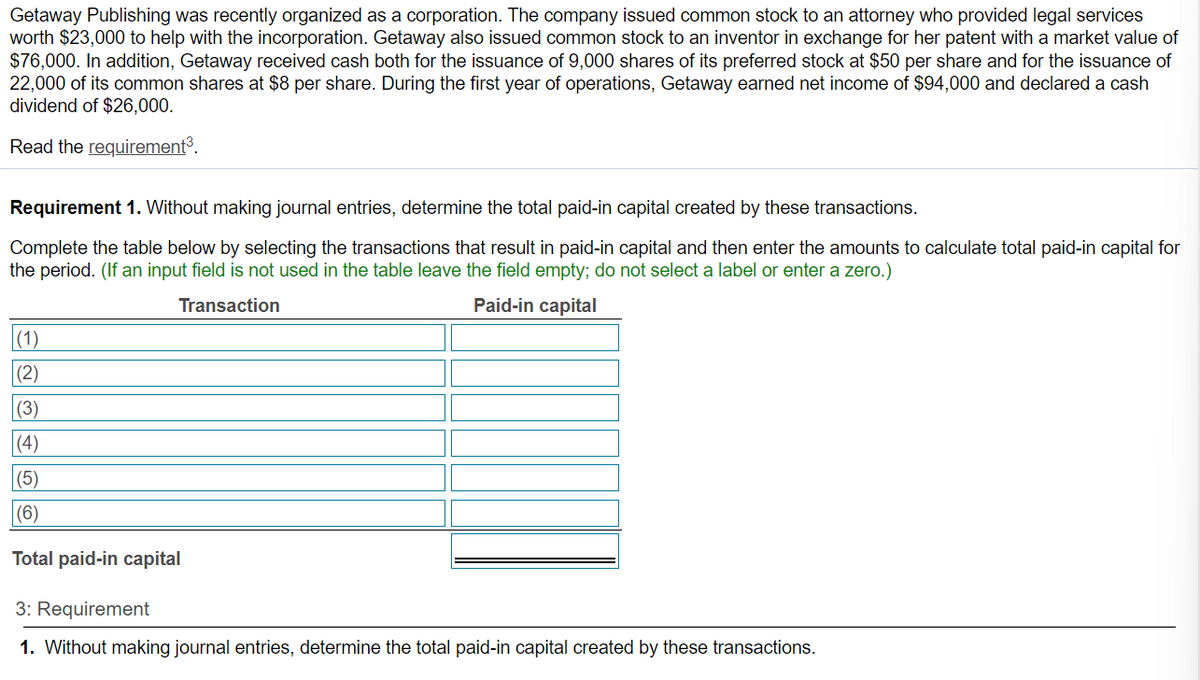

Getaway Publishing was recently organized as a corporation. The company issued common stock to an attorney who provided legal services worth $23,000 to help with the incorporation. Getaway also issued common stock to an inventor in exchange for her patent with a market value of $76,000. In addition, Getaway received cash both for the issuance of 9,000 shares of its preferred stock at $50 per share and for the issuance of 22,000 of its common shares at $8 per share. During the first year of operations, Getaway earned net income of $94,000 and declared a cash dividend of $26,000. Read the requirement³. Requirement 1. Without making journal entries, determine the total paid-in capital created by these transactions. Complete the table below by selecting the transactions that result in paid-in capital and then enter the amounts to calculate total paid-in capital for the period. (If an input field is not used in the table leave the field empty; do not select a label or enter a zero.) Transaction Paid-in capital (1) (2) (3) (4) (5) (6) Total paid-in capital 3: Requirement 1. Without making journal entries, determine the total paid-in capital created by these transactions.

Getaway Publishing was recently organized as a corporation. The company issued common stock to an attorney who provided legal services worth $23,000 to help with the incorporation. Getaway also issued common stock to an inventor in exchange for her patent with a market value of $76,000. In addition, Getaway received cash both for the issuance of 9,000 shares of its preferred stock at $50 per share and for the issuance of 22,000 of its common shares at $8 per share. During the first year of operations, Getaway earned net income of $94,000 and declared a cash dividend of $26,000. Read the requirement³. Requirement 1. Without making journal entries, determine the total paid-in capital created by these transactions. Complete the table below by selecting the transactions that result in paid-in capital and then enter the amounts to calculate total paid-in capital for the period. (If an input field is not used in the table leave the field empty; do not select a label or enter a zero.) Transaction Paid-in capital (1) (2) (3) (4) (5) (6) Total paid-in capital 3: Requirement 1. Without making journal entries, determine the total paid-in capital created by these transactions.

Chapter18: Corporations: Organization And Capital Structure

Section: Chapter Questions

Problem 24CE

Related questions

Question

H1.

Transcribed Image Text:Getaway Publishing was recently organized as a corporation. The company issued common stock to an attorney who provided legal services

worth $23,000 to help with the incorporation. Getaway also issued common stock to an inventor in exchange for her patent with a market value of

$76,000. In addition, Getaway received cash both for the issuance of 9,000 shares of its preferred stock at $50 per share and for the issuance of

22,000 of its common shares at $8 per share. During the first year of operations, Getaway earned net income of $94,000 and declared a cash

dividend of $26,000.

Read the requirement³.

Requirement 1. Without making journal entries, determine the total paid-in capital created by these transactions.

Complete the table below by selecting the transactions that result in paid-in capital and then enter the amounts to calculate total paid-in capital for

the period. (If an input field is not used in the table leave the field empty; do not select a label or enter a zero.)

Transaction

Paid-in capital

(1)

(2)

(3)

(4)

(5)

(6)

Total paid-in capital

3: Requirement

1. Without making journal entries, determine the total paid-in capital created by these transactions.

Transcribed Image Text:0000

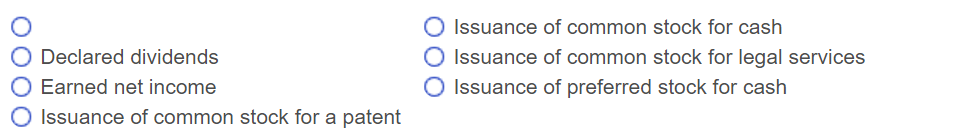

Declared dividends

O Earned net income

O Issuance of common stock for a patent

O Issuance of common stock for cash

O Issuance of common stock for legal services

Issuance of preferred stock for cash

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College