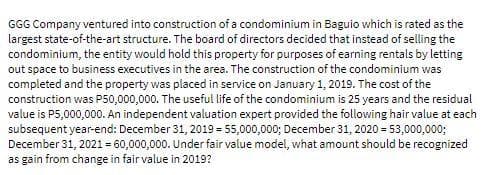

GGG Company ventured into construction of a condominium in Baguio which is rated as the largest state-of-the-art structure. The board of directors decided that instead of selling the condominium, the entity would hold this property for purposes of earning rentals by letting out space to business executives in the area. The construction of the condominium was completed and the property was placed in service on January 1, 2019. The cost of the construction was P50,000,000. The useful life of the condominium is 25 years and the residual value is P5,000,000. An independent valuation expert provided the following hair value at each subsequent year-end: December 31, 2019 - 55,000,000; December 31, 2020 = 53,000,000; December 31, 2021 = 60,000,000. Under fair value model, what amount should be recognized as gain from change in fair value in 2019?

GGG Company ventured into construction of a condominium in Baguio which is rated as the largest state-of-the-art structure. The board of directors decided that instead of selling the condominium, the entity would hold this property for purposes of earning rentals by letting out space to business executives in the area. The construction of the condominium was completed and the property was placed in service on January 1, 2019. The cost of the construction was P50,000,000. The useful life of the condominium is 25 years and the residual value is P5,000,000. An independent valuation expert provided the following hair value at each subsequent year-end: December 31, 2019 - 55,000,000; December 31, 2020 = 53,000,000; December 31, 2021 = 60,000,000. Under fair value model, what amount should be recognized as gain from change in fair value in 2019?

Chapter12: Nonrecognition Transactions

Section: Chapter Questions

Problem 30P

Related questions

Question

100%

Transcribed Image Text:GGG Company ventured into construction of a condominium in Baguio which is rated as the

largest state-of-the-art structure. The board of directors decided that instead of selling the

condominium, the entity would hold this property for purposes of earning rentals by letting

out space to business executives in the area. The construction of the condominium was

completed and the property was placed in service on January 1, 2019. The cost of the

construction was P50,000,000. The useful life of the condominium is 25 years and the residual

value is P5,000,000. An independent valuation expert provided the following hair value at each

subsequent year-end: December 31, 2019 = 55,000,000; December 31, 2020 = 53,000,000;

December 31, 2021 = 60,000,000. Under fair value model, what amount should be recognized

as gain from change in fair value in 2019?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning