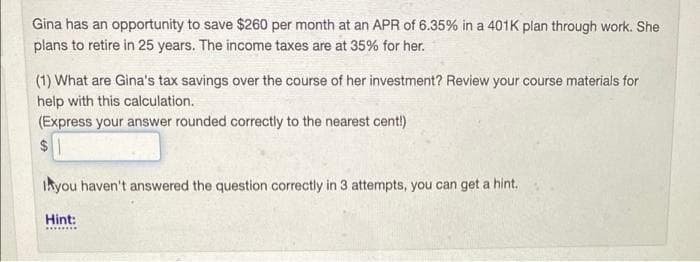

Gina has an opportunity to save $260 per month at an APR of 6.35% in a 401K plan through work. She plans to retire in 25 years. The income taxes are at 35% for her. (1) What are Gina's tax savings over the course of her investment? Review your course materials for help with this calculation. (Express your answer rounded correctly to the nearest cent!) $1 Ikyou haven't answered the question correctly in 3 attempts, you can get a hint. Hint: .....

Gina has an opportunity to save $260 per month at an APR of 6.35% in a 401K plan through work. She plans to retire in 25 years. The income taxes are at 35% for her. (1) What are Gina's tax savings over the course of her investment? Review your course materials for help with this calculation. (Express your answer rounded correctly to the nearest cent!) $1 Ikyou haven't answered the question correctly in 3 attempts, you can get a hint. Hint: .....

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter27: Time Value Of Money (compound)

Section: Chapter Questions

Problem 6E

Related questions

Question

2

Transcribed Image Text:Gina has an opportunity to save $260 per month at an APR of 6.35% in a 401K plan through work. She

plans to retire in 25 years. The income taxes are at 35% for her.

(1) What are Gina's tax savings over the course of her investment? Review your course materials for

help with this calculation.

(Express your answer rounded correctly to the nearest cent!)

2$

Ikyou haven't answered the question correctly in 3 attempts, you can get a hint.

Hint:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning