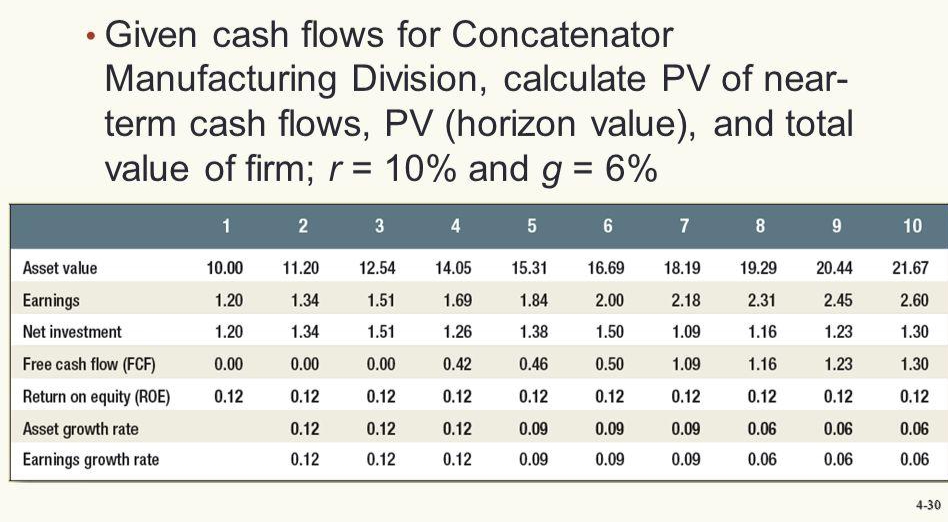

Given cash flows for Concatenator Manufacturing Division, calculate PV of near- term cash flows, PV (horizon value), and total value of firm; r= 10% and g = 6% 2 3 4 5 6 7 8 9 10 Asset value 10.00 11.20 12.54 14.05 15.31 16.69 18.19 19.29 20.44 21.67 Earnings 1.20 1.34 1.51 1.69 1.84 2.00 2.18 2.31 2.45 2.60 Net investment 1.20 1.34 1.51 1.26 1.38 1.50 1.09 1.16 1.23 1.30 Free cash flow (FCF) 0.00 0.00 0.00 0.42 0.46 0.50 1.09 1.16 1.23 1.30 Return on equity (ROE) 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 Asset growth rate 0.12 0.12 0.12 0.09 0.09 0.09 0.06 0.06 0.06 Earnings growth rate 0.12 0.12 0.12 0.09 0.09 0.09 0.06 0.06 0.06

Given cash flows for Concatenator Manufacturing Division, calculate PV of near- term cash flows, PV (horizon value), and total value of firm; r= 10% and g = 6% 2 3 4 5 6 7 8 9 10 Asset value 10.00 11.20 12.54 14.05 15.31 16.69 18.19 19.29 20.44 21.67 Earnings 1.20 1.34 1.51 1.69 1.84 2.00 2.18 2.31 2.45 2.60 Net investment 1.20 1.34 1.51 1.26 1.38 1.50 1.09 1.16 1.23 1.30 Free cash flow (FCF) 0.00 0.00 0.00 0.42 0.46 0.50 1.09 1.16 1.23 1.30 Return on equity (ROE) 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 Asset growth rate 0.12 0.12 0.12 0.09 0.09 0.09 0.06 0.06 0.06 Earnings growth rate 0.12 0.12 0.12 0.09 0.09 0.09 0.06 0.06 0.06

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter12: Capital Investment Analysis

Section: Chapter Questions

Problem 1CMA

Related questions

Question

Transcribed Image Text:Given cash flows for Concatenator

Manufacturing Division, calculate PV of near-

term cash flows, PV (horizon value), and total

value of firm; r = 10% and g = 6%

1

2

3

4

5

6

7

8

9

10

Asset value

10.00

11.20

12.54

14.05

15.31

16.69

18.19

19.29

20.44

21.67

Earnings

1.20

1.34

1.51

1.69

1.84

2.00

2.18

2.31

2.45

2.60

Net investment

1.20

1.34

1.51

1.26

1.38

1.50

1.09

1.16

1.23

1.30

Free cash flow (FCF)

0.00

0.00

0.00

0.42

0.46

0.50

1.09

1.16

1.23

1.30

Return on equity (ROE)

0.12

0.12

0.12

0.12

0.12

0.12

0.12

0.12

0.12

0.12

Asset growth rate

0.12

0.12

0.12

0.09

0.09

0.09

0.06

0.06

0.06

Earnings growth rate

0.12

0.12

0.12

0.09

0.09

0.09

0.06

0.06

0.06

4-30

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning