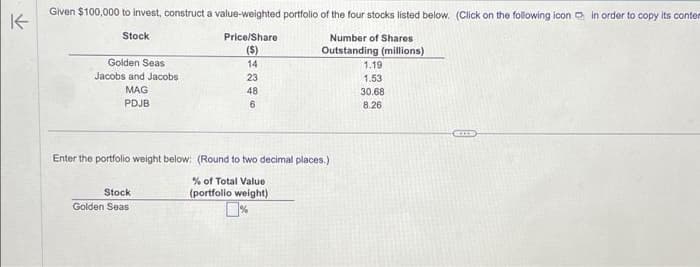

Given $100,000 to invest, construct a value-weighted portfolio of the four stocks listed below. (Click on the following icon in order to copy its conte Stock Price/Share ($) Number of Shares Outstanding (millions) Golden Seas Jacobs and Jacobs MAG PDJB 54346 Stock Golden Seas 14 23 48 Enter the portfolio weight below: (Round to two decimal places.) % of Total Value (portfolio weight) 1.19 1.53 30.68 8.26

Q: Find the duration of a bond with a settlement date of May 27, 2023, and maturity date November 15,…

A: Duration of bond show that how much is the change interest rate have effect on the prices of bonds…

Q: Johnson Ltd requires advice on its debt collection policy. Its directors are considering two options…

A: While considering debt collection costs, Objective of Company is to keep it's debt collection cost…

Q: Navel County Choppers, Incorporated, is experiencing rapid growth. The company expects dividends to…

A: In the given case, we have provided the dividend just paid per share. And, the expected growth rate…

Q: Consider a portfolio with two assets and three states of nature at the end of the year. Would it be…

A: In the field of finance, portfolio management involves constructing a combination of assets to…

Q: Top management of Markel Company is considering whether to lease or purchase an aircraft to…

A: The PV of the cash flows refers to their cumulative value after they have been discounted to the…

Q: In the compound interest example on P.344. Calculate S20 and T240. Which is the better investment…

A: Simple interest refers to the method of earning interest where the principal amount remains fixed…

Q: What is the expected return of the optimal stock portfolio?

A: First let us note the formula used to determine the expected return and risk of the portfolio.

Q: The parents of a newborn decide to make deposits into an educational savings account on each of…

A: It is a case where the parents of a daughter want to calculate the present value of an alternative…

Q: Hunter plc requires advice on its debt collection policy. Its directors are considering two…

A: Company is required to incur various costs when sales are made on credit . Such costs include Annual…

Q: How can a company offset risk using interest rate swaps?

A: Interest rate swaps means swapping the rate of interest between 2 counter-parties.It can be used to…

Q: A firm invests $10.70 million in a new stamping machine. It depreciates straight-line for tax…

A: It is a problem that requires the calculation of the present value of tax savings due to…

Q: You observe the following yield curve for risk-free government zeros: Years to Maturity Yield 3 6% 6…

A: The bond refers to an instrument used for raising debt capital from investors. A zero-coupon bond…

Q: Assuming there are 500,000 shares outstanding common stock, what will be the yearly dividend per…

A: Here,Projected annual earnings:1st yearP900,0002nd year1,200,0003rd year850,0004th year1,350,000No.…

Q: Bruin, Incorporated, has identified the following two mutually exclusive projects: Year Cash Flow…

A: NPV represents the profit generated by a project or an investment and is expressed in absolute…

Q: Mack Aroni, a bank robber, is worried about his retirement. He decides to start a savings account.…

A: Future value is the estimation of the future worth of an investment which is likely to be received…

Q: You have an opportunity to invest $49,200 now in return for $60,900 in one year. If your cost of…

A: Net Present Value(NPV) is one of the modern techniques of capital budgeting which considers the time…

Q: A bank pays 10.6% compounded monthly on certain types of deposits. If interest is compounded…

A: Effective rate of interest is the interest rate considering the effect of compounding. Higher the…

Q: your future trading account have just bought your first HSI June 2023 futures contract today @…

A: In futures you do not have to whole money for trading but you can trade on some initial margin that…

Q: The market consensus is that Analog Electronic Corporation has an ROE = 14%, a beta of 1.85, and…

A: EPS is the earning available for shareholders after all debt obligations.Price earning ratio is the…

Q: Your investment club has only two stocks in its portfolio. $25,000 is invested in a stock with a…

A: Hi studentSince there are multiple questions, we will answer only first question. Portfolio is the…

Q: Suppose there are two independent economic factors, M1 and M2. The risk-free rate is 4%, and all…

A: Expected Return Beta Relationship =Rf +β(M1) + β(M2)Portfolio A = 4% + 1.6xM1 + 2.4xM2 =…

Q: Use the following information to calculate the expected return and standard deviation of a portfolio…

A:

Q: Red Lizard Co loan payment O A rate equ A rate les: O A rate equ O A rate equ O A rate equ 20000

A: The effective annual rate refers to the interest rate that is being charged on the borrowing amount…

Q: Write a minimum of 150 words addressing: Explain why the timing and quantity of cash flows are…

A: Capital Investment decisions refers to the decision made for the selection of project from different…

Q: Part 1 On April 1, 2023, ET Inc. has available for issue $332,000 bonds due in four years. Interest…

A: Bond valuation (BV) refers to a method or technique which is used to compute the current value or…

Q: Using the binomial call option model to find the current value of a call option with a $25 exercise…

A: Hedge ratio refers to the comparison protected through the use of hedge position with the entire…

Q: Mary's Music Store reported net income of $146,000. Beginning balances in Accounts Receivable and…

A: The net cash flows from operations refer to the amount of money that the company receives or pays…

Q: Consider three bonds with 6.70% coupon rates, all making annual coupon payments and all selling at…

A: Coupon rate = 6.70%Par value = $1000Short-term bond maturity = 4 yearsIntermediate bond maturity = 8…

Q: If I can invest R120 today and I want to have R500 in my account 4 years from today at what interest…

A: Amount invested Today=120Year-2 , Amount invested=100Year-4, Amount Received =500Time period=4…

Q: What semiannually compounded rate is equivalent to 6% compounded: a. Annually? (Do not round the…

A: The idea of the time value of money (TVM) holds that a quantity of money is valued currently more…

Q: What are the trade-offs facing an investor who is considering buying a put option on an existing…

A: A put option gives the right but not the obligation to sell at the strike price while a call option…

Q: What is a bank syndicate? How is syndication supposed to work/function? What is the difference…

A: A bank syndicate is a group of banks or financial institutions that collaboratively provide funding…

Q: M11-8 (Algo) Calculating Net Present Value, Predicting Internal Rate of Return [LO 11-3, 11-4]…

A: NPV is also known as Net Present Value. It is a capital budgeting techniques which help in decision…

Q: Suppose you are a British venture capitalist holding a major stake in an e-commerce start-up in…

A: Foreign exchange exposure:The sensitivity of the value of assets denominated in foreign currency to…

Q: Using the data in the table to the right, calculate the return for investing in the stock from…

A: Dates Price…

Q: You have just been offered a contract worth $1.03 million per year for 7 years. However, to take the…

A: The maximum capital investment that can be made for a project is the present value of all returns…

Q: Your tax return will be $500 this year. You have decided that you will invest it in the ProShares…

A: Future value refers to the value of the current asset at some future date affected by interest…

Q: What is the fair value for a two-year American put option with a strike price of $85 over a stock…

A: The put option refers to the derivative that provides the choice of selling the associated asset to…

Q: Consider the following table, which gives a security analyst’s expected return on two stocks and the…

A: ScenarioProbabilityMarket ReturnAggressive StockDefensive Stock10.56%2.0%5.0%20.5203215

Q: settle a loan on March 24th, 2018 by paying $6,500. What amount should he pay if he decides to…

A: Loans are easy source of money but these loans are to be paid with interest and these interest carry…

Q: Which of the following statements is CORRECT? O The yield on á 5-year Treasury bond cannot exceed…

A: The yield of a bond is found as the sum of the expected risk premium, inflation rate and the…

Q: Consider Rhye, amid-size pharmaceutical company. Rhye’s equity has a book value of $2.8 billion and…

A:

Q: Kingston, Inc. has evaluated a project that will cost the company $250,000. The project will provide…

A: Payback Period is the period in which cash outflow of the company is recovered from cash inflows. In…

Q: Assume both portfolios A and B are well diversified, that E(rA) = 12.6% and E(rB) = 13.6%. If the…

A: Risk-free rate refers to the rate that are being offered by the investment at the point where the…

Q: If a bond is issued at the price of $10,000 per contract and promises a 5.7% interest every year,…

A: Here,ParticularsValuesIssue price $ 10,000Coupon rate5.70%Time to maturity8Redemption value $…

Q: cel to calculate the issue price of the bonds.

A: Issue price or value of a bond is the present value of all the future cash flows associated with the…

Q: A 30-year maturity, 8% coupon bond paying coupons semiannually is callable in five years at a call…

A: Yield to Maturity refers to the internal rate of return of a bond. It is the percentage of return on…

Q: what about in terms of present value?

A: Present value helps us know the value of future cash flows in the present time. A higher interest…

Q: Neighborhood Insurance sells fire insurance policies to local homeowners. The premium is $150, the…

A: As per our guidelines, we are supposed to answer only 3 sub-parts (if there are multiple sub-parts…

Q: If you could pay for your mortgage forever, how much would you have to pay per month for a…

A: A mortgage refers to a loan taken out to purchase property with the property itself acting as…

Finance

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

- Given $100,000 to invest, construct a value-weighted portfolio of the four stocks listed below. (Click on the following icon in order to copy its contents into a spreadsheet.) Stock Price/Share ($) Number of Shares Outstanding (millions) Golden Seas 13 1.21 Jacobs and Jacobs 23 1.2 MAG 41 32.87 PDJB 12 9.76Jill Valentine has $100,000 invested in a 2-stock portfolio. $30,000 is invested in Stock X, and the remainder is invested in Stock Y. Stock X's Beta is 1.40 and Y's Beta is 0.90. What is the portfolio's Beta? (Ch. 8) Group of answer choices 1.25 0.90 1.40 1.16 1.05 PreviousNextDonald Gilmore has $100,000 invested in a 2-stock portfolio. $32,500 is invested in Stock X and the remainder is invested in Stock Y. X's beta is 1.50 and Y's beta is 0.70. What is the portfolio's beta? Select the correct answer. a. 0.87 b. 0.90 c. 0.93 d. 0.99 e. 0.96

- Investor Z has $100,000 invested in a 2-stock portfolio. $33,000 is invested in Stock X, and the remainder is invested in Stock Y. Stock X's Beta is 1.50 and Y's Beta is 1.10. What is the portfolio's Beta? Group of answer choices 1.42 1.10 1.50 1.37 1.23Consider the following table. Name Stocks Bonds Other Assets Liabilities Outstanding Shares Amount to Invest XYZ $150 million $50 million $300,000 $10 million 5 million $60,000 (a) Find the NAV of one share.$___________ (b) Find the number of shares you can buy when you invest the amount of money shown in the last column of the table. (Enter your answer as a whole number.) __________sharesUse the following tables to assess the worthiness of Verticon stock as an investment. Verticon Stock Data (Current and Historical) 3:45PM EDT Aug 16, 2011 Price 18.85 USD Change +0.64 (+3.51%) Mkt cap 147.1B Div/yield 0.20/4.24 Shares 8,012 Beta 0.70 Book/share 11.335 EPS 1.11 12/2010 12/2009 12/2008 (Millions of Dollars) Total Assets 195,014 195,949 111,148 Total Liabilities 107,201 122,935 53,592 Preferred Shareholders’ Equity 52 61 73 Common Shareholders’ Equity 87,761 72,953 57,483 Shares Outstanding 8,012 8,070 6746 Book/Share ? 9.040 8.521 Q1 (Mar ’11) 2010 Net profit margin 15.24% 12.24% Return on equity 11.60% 9.30% Which one in bold? One of the most important features of a stock is its book value. The book value per share of Verticon’s stock for the year 2010 was equal to (10.954, 13.693, 11.502). Looking at the (Market cap, EPS, change in price, beta value, ROE) ,…

- You have been provided with the following information for the year ended 30 June 2022 for ABCLtd:RNet profit for the year -R1 800 000Weighted average number of shares (WANOS) outstanding during the year-R 120 000Average fair value per share -R30.00Weighted average number of shares (WANOS) under option during the year -R25 000Exercise price for shares under option during the year -R28.00REQUIRED:Q.2.1 Explain the purpose and objective of disclosing diluted earnings per share.The following common stocks are available for investment: COMMON STOCK (Ticker Symbol) BETA Nanyang Business Systems (NBS) 1.40 Yunnan Garden Supply, Inc. (YUWHO) 0.80 Bird Nest Soups Company (SLURP) 0.60 Wacho.com! (WACHO) 1.80 Park City Cola Company (BURP) 1.05 Oldies Records, Ltd. (SHABOOM) 0.90 A; If you invest 20 percent of your funds in each of the first three securities, and 15 percent in each of the last two, what is the beta of your portfolio? B; If the risk-free rate is 8 percent and the expected return on the market portfolio is 14 percent, what will be the portfolio’s expected return?Brandon is an analyst at a wealth management firm. One of his clients holds a $10,000 portfolio that consists of four stocks. The investment allocation in the portfolio along with the contribution of risk from each stock is given in the following table: Stock Investment Allocation Beta Standard Deviation Atteric Inc. (AI) 35% 0.750 23.00% Arthur Trust Inc. (AT) 20% 1.500 27.00% Li Corp. (LC) 15% 1.100 30.00% Transfer Fuels Co. (TF) 30% 0.500 34.00% Brandon calculated the portfolio’s beta as 0.8775 and the portfolio’s expected return as 8.83%. Brandon thinks it will be a good idea to reallocate the funds in his client’s portfolio. He recommends replacing Atteric Inc.’s shares with the same amount in additional shares of Transfer Fuels Co. The risk-free rate is 4%, and the market risk premium is 5.50%. According to Brandon’s recommendation, assuming that the market is in equilibrium, how much will the portfolio’s required return change? (Note: Round your…

- Consider an index fund that contains the following four stocks: American Campus Communities, Inc. (ACC), Global Net Lease, Inc. (GNL), Jones Lang LaSalle Incorporated (JLL), and Merck & Co., Inc. (MRK). On March 30, 2022, the stock prices at close were: ACC $56.73 GNL $15.65 JLL $243.22 MRK $82.40 The mutual fund held the following numbers of shares in these companies: Shares (million) ACC 2.087 GNL 1.558 JLL 0.748 MRK 37.950 On March 30, the mutual fund had 25 million shares outstanding. Calculate the net asset value per mutual fund share (in dollars). During the day on March 30, the fund had a net cash inflow of $250 million. How many shares of MRK did the index fund manager have to purchase in order to maintain a portfolio with the same portfolio weights as at the start of the day? You should assume that the fund manager invests all net inflows in securities at market close prices on March 30. She holds no cash balance.The following common stocks are available for investment: COMMON STOCK (Ticker Symbol) BETA Nanyang Business Systems (NBS) 1.40 Yunnan Garden Supply, Inc. (YUWHO) 0.80 Bird Nest Soups Company (SLURP) 0.60 Wacho.com! (WACHO) 1.80 Park City Cola Company (BURP) 1.05 Oldies Records, Ltd. (SHABOOM) 0.90 If you invest 30 percent of your funds in each of the first two securities, and 10 percent in each of the last four, what is the beta of your portfolio? If the risk-free rate is 8 percent and the expected return on the market portfolio is 14 percent, what will be the portfolio’s expected return?The following question is based on the following information about the stocks of Whitestone REIT, HCC Insurance Holdings, Inc., and SanDisk Corporation.† Price($) Dividend Yield(%) WSR(WSR Whitestone REIT) 16 7 HCC(HCC Insurance Holdings, Inc.) 56 2 SNDK(SanDisk Corporation) 80 2 You invested a total of $12,400 in shares of the three stocks at the given prices, and expected to earn $328 in annual dividends. If you purchased a total of 250 shares, how many shares of each stock did you purchase? WSR shares = HCC shares = SNDK shares =