Given the estimated sales forecast and the estimated relationship between inventories and sales, what is your forecast of the company's year-end inventory level? Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55. Do not round intermediate calculations. Round your answer to two decimal places. $ million

Given the estimated sales forecast and the estimated relationship between inventories and sales, what is your forecast of the company's year-end inventory level? Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55. Do not round intermediate calculations. Round your answer to two decimal places. $ million

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter14: The Balanced Scorecard And Corporate Social Responsibility

Section: Chapter Questions

Problem 1CMA: Which of the following statements regarding the balanced scorecard is not correct? a. It seeks to...

Related questions

Concept explainers

Financial Ratios

A Ratio refers to a figure calculated as a reference to the relationship of two or more numbers and can be expressed as a fraction, proportion, percentage, or the number of times. When the number is determined by taking two accounting numbers derived from the financial statements, it is termed as the accounting ratio.

Return on Equity

The Return on Equity (RoE) is a measure of the profitability of a business concerning the funds by its stockholders/shareholders. ROE is a metric used generally to determine how well the company utilizes its funds provided by the equity shareholders.

Topic Video

Question

Practice problems, please help and write clearly

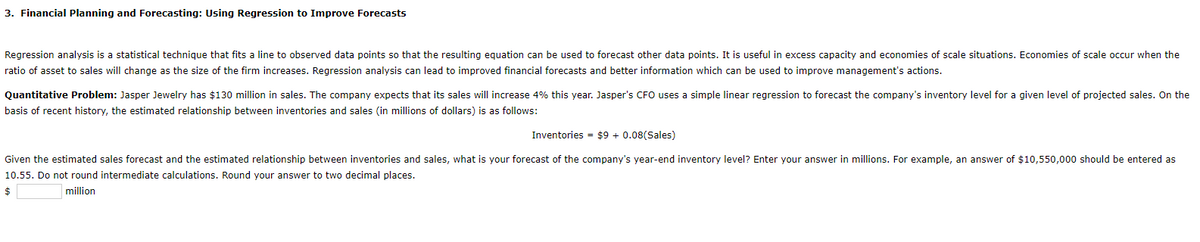

Transcribed Image Text:3. Financial Planning and Forecasting: Using Regression to Improve Forecasts

Regression analysis is a statistical technique that fits a line to observed data points so that the resulting equation can be used to forecast other data points. It is useful in excess capacity and economies of scale situations. Economies of scale occur when the

ratio of asset to sales will change as the size of the firm increases. Regression analysis can lead to improved financial forecasts and better information which can be used to improve management's actions.

Quantitative Problem: Jasper Jewelry has $130 million in sales. The company expects that its sales will increase 4% this year. Jasper's CFO uses a simple linear regression to forecast the company's inventory level for a given level of projected sales. On the

basis of recent history, the estimated relationship between inventories and sales (in millions of dollars) is as follows:

Inventories = $9 + 0.08(Sales)

Given the estimated sales forecast and the estimated relationship between inventories and sales, what is your forecast of the company's year-end inventory level? Enter your answer in millions. For example, an answer of $10,550,000 should be entered as

10.55. Do not round intermediate calculations. Round your answer to two decimal places.

$

million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning