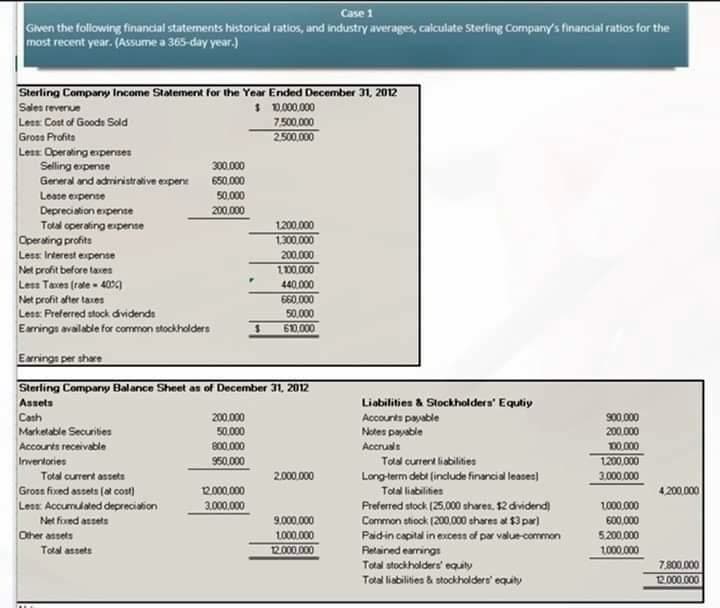

Given the following financial statements historical ratios, and industry averages, calculate Sterling Com most recent year. (Assume a 365-day year.)

Given the following financial statements historical ratios, and industry averages, calculate Sterling Com most recent year. (Assume a 365-day year.)

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 40E: Cuneo Companys income statements for the last 3 years are as follows: Refer to the information for...

Related questions

Question

Practice Pack

Notes:

a. The firm has an 8-year financial lease requiring annual beginning-of-year payments of $50,000. Five years of the lease have yet to run.

b. Annual credit purchases of $6,200,000 were made during the year.

c. The annual principal payment on the long-term debt is $100,000.

d. On December 31, 2012, the firm's common stock closed at $39.50 per share.

Questions:

1. What is the

2. What is the quick ratio?

3. What is the inventory turnover?

Transcribed Image Text:Case 1

Given the following financial statements historical ratios, and industry averages, calculate Stering Company's financial ratios for the

most recent year. (Assume a 365-day year.)

Sterling Company Income Statement for the Year Ended December 31, 2012

I D.0000

7.500,.000

2500.000

Sales reverue

Less Cost of Goods Sold

Gross Profits

Less: Operating expenses

Selling espense

Gereral and admiristralive expene

300.000

650.000

50.000

Lease espense

Depreciation expense

200.000

Total operaling espense

Operating profits

Less Irterest erpense

1200.000

1300,000

200.000

Net profit before taxes

Less Taxes (rale - 40)

Net profit after taxes

100.000

440.000

660.000

Less: Preferred stock dvidenda

50.000

Eamrings avalable for common stockholders

610.000

Earings per share

Sterling Company Bal arnce Sheet as of December 31, 2012

Assets

Liabilities & Stockholdera' Equliy

Accourts payable

Notes payable

Accruals

Cash

200.000

s00.000

Marketable Securites

Accounts receivable

50.00

200.000

800.000

0.000

1200,000

3.000.000

Inventories

950.000

Taal currert liabilities

Total current assets

2000.000

Gros fixed assets (at cost)

Long-term debt (include financial leases)

Tolal liabilities

20000

4.200,000

300000

L000.000

Preferred stock (25,000 shares. $2 dividend)

Common stiock (200.000 shares at $3 par)

Paidin capital in excess of par value-common

Less Accumulated depreciation

Net fired asseta

9.000.000

600.000

Other assets

1000.000

12.00000

5.00.000

Total assets

Relained earrings

1000.000

Total stockholders' equty

Total liabilities & stockholders' equity

7.800.000

12.000.000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning