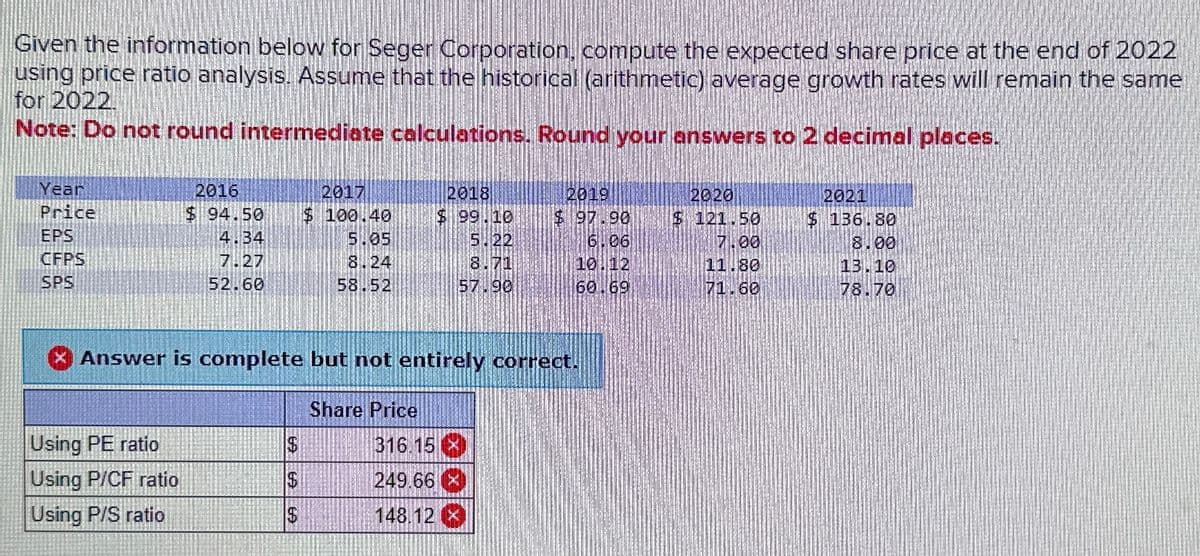

Given the information below for Seger Corporation, compute the expected share price at the end of 2022 using price ratio analysis. Assume that the historical (arithmetic) average growth rates will remain the same for 2022. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Year Price EPS CFPS SPS 2016 $94.50 4.34 7.27 52.60 Using PE ratio Using P/CF ratio Using P/S ratio $ $ 69 69 2017 $100.40 Answer is complete but not entirely correct. $ 5.05 8.24 58.52 2018 $99.10 5,22 8.71 57.90 Share Price 2019 $97.90 6.06 10.12 60.69 316.15 X 249.66 X 148.12 X 2020 $ 121.50 7.00 11.80 71.60 2021 $136.80 8.00 13.10 78.70

Given the information below for Seger Corporation, compute the expected share price at the end of 2022 using price ratio analysis. Assume that the historical (arithmetic) average growth rates will remain the same for 2022. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Year Price EPS CFPS SPS 2016 $94.50 4.34 7.27 52.60 Using PE ratio Using P/CF ratio Using P/S ratio $ $ 69 69 2017 $100.40 Answer is complete but not entirely correct. $ 5.05 8.24 58.52 2018 $99.10 5,22 8.71 57.90 Share Price 2019 $97.90 6.06 10.12 60.69 316.15 X 249.66 X 148.12 X 2020 $ 121.50 7.00 11.80 71.60 2021 $136.80 8.00 13.10 78.70

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter13: Corporations: Organization, Stock Transactions, And Dividends

Section: Chapter Questions

Problem 4CP

Related questions

Question

Nikul

Transcribed Image Text:Given the information below for Seger Corporation, compute the expected share price at the end of 2022

using price ratio analysis. Assume that the historical (arithmetic) average growth rates will remain the same

for 2022.

Note: Do not round intermediate calculations. Round your answers to 2 decimal places.

Year

Price

EPS

CFPS

SPS

2016

$94.50

4.34

7.27

52.60

Using PE ratio

Using P/CF ratio

Using P/S ratio

2017

$ 100.40

5.05

8.24

58.52

$

$

Answer is complete but not entirely correct.

2018

$ 99.10

5.22

8.71

57.90

Share Price

2919

$97.90

6.06

10.12

60.69

316.15

249.66

148.12 x

2020

$ 121.50

7.00

11.80

71.60

2021

$ 136.80

8.00

13.10

78.70

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT