Glass time repairs chips in car windshields. The company incurred the following operating cost for the month of March 2024 Glass time earned $28,000 in service revenues for the month of March by repairing 250 windshields. All cost shown are considered to be directly related to the repair service. 1) prepare an income statement for the month of March 2) compute the cost per unit of repairing one windshield 3) the manager of glass time must keep the unit operating costs below $60 per windshield in order to get his bonus. Did he meet the goal?

Glass time repairs chips in car windshields. The company incurred the following operating cost for the month of March 2024 Glass time earned $28,000 in service revenues for the month of March by repairing 250 windshields. All cost shown are considered to be directly related to the repair service. 1) prepare an income statement for the month of March 2) compute the cost per unit of repairing one windshield 3) the manager of glass time must keep the unit operating costs below $60 per windshield in order to get his bonus. Did he meet the goal?

Chapter4: Job Order Costing

Section: Chapter Questions

Problem 12EA: During the month, Job AB2 used specialized machinery for 450 hours and incurred $500 in utilities on...

Related questions

Question

100%

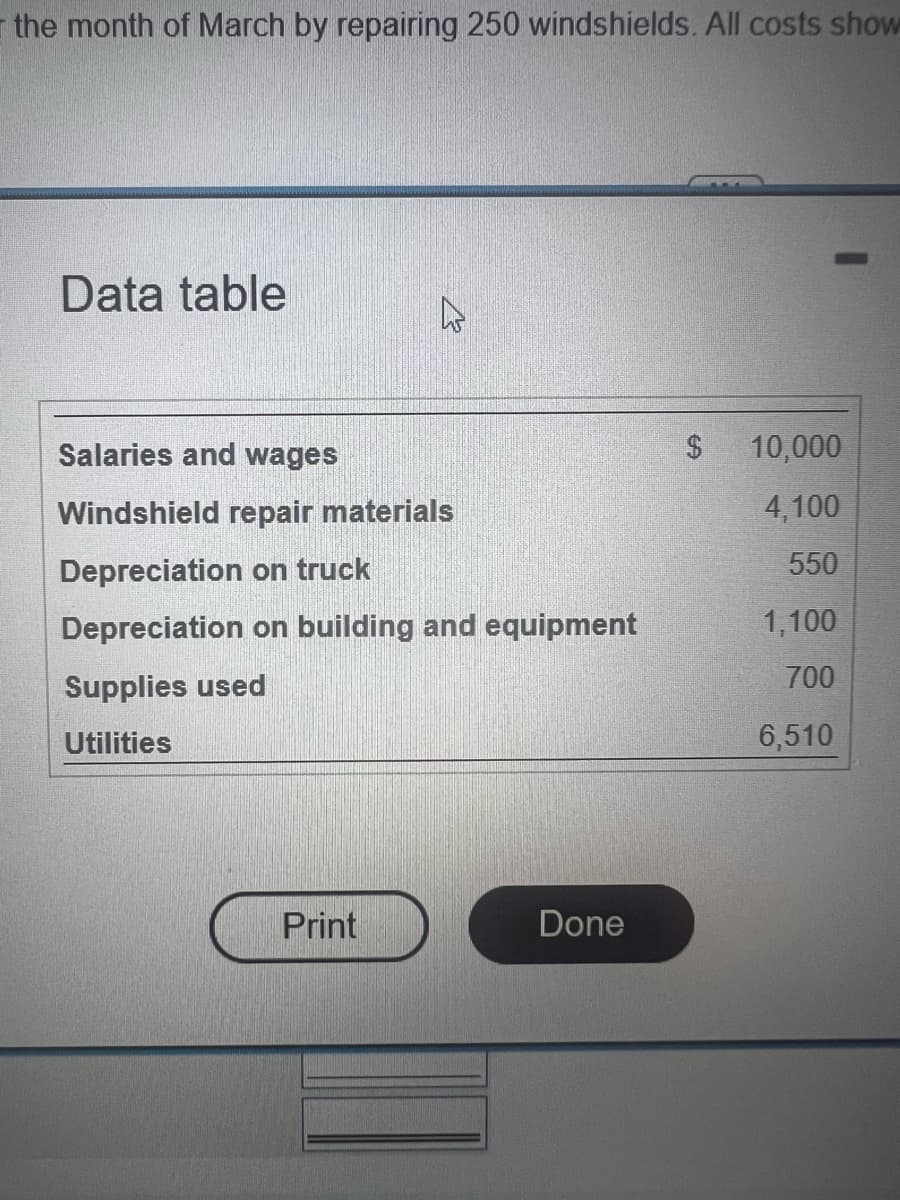

Glass time repairs chips in car windshields. The company incurred the following operating cost for the month of March 2024

Glass time earned $28,000 in service revenues for the month of March by repairing 250 windshields. All cost shown are considered to be directly related to the repair service.

1) prepare an income statement for the month of March

2) compute the cost per unit of repairing one windshield

3) the manager of glass time must keep the unit operating costs below $60 per windshield in order to get his bonus. Did he meet the goal?

Transcribed Image Text:the month of March by repairing 250 windshields. All costs show

Data table

Salaries and wages

Windshield repair materials

Depreciation on truck

Depreciation on building and equipment

Supplies used

Utilities

4

Print

Done

-

$ 10,000

4,100

550

1,100

700

6,510

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College