good

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter8: Inventories: Special Valuation Issues

Section: Chapter Questions

Problem 13RE: Refer to the information provided in RE8-4. If Paul Corporations inventory at January 1, 2019, had a...

Related questions

Question

Please answer in good accounting form. Thank you.

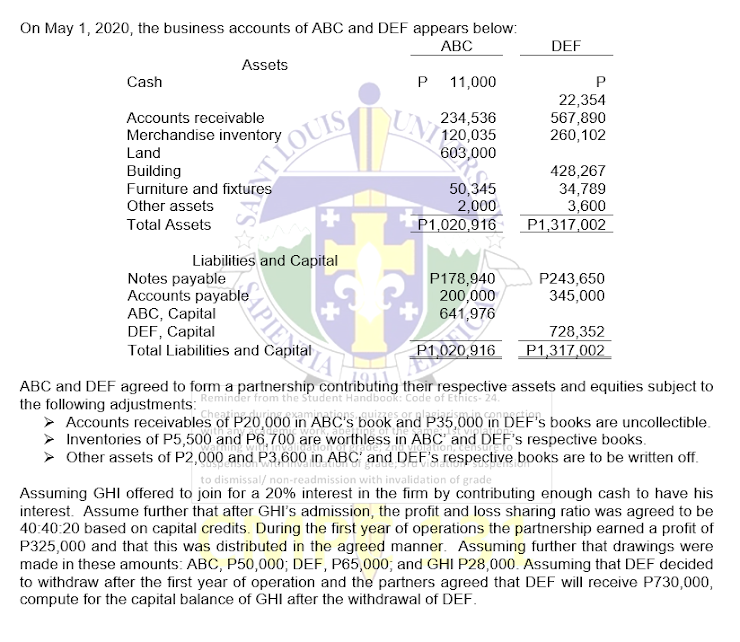

Transcribed Image Text:On May 1, 2020, the business accounts of ABC and DEF appears below:

ABC

Assets

Cash

P 11,000

P

22,354

234,536

567,890

Accounts receivable

Merchandise inventory

Land

120,035

260,102

603,000

Building

428,267

34,789

Furniture and fixtures

Other assets

Total Assets

50,345

2,000

P1,020,916

3,600

P1,317,002

P178,940

P243,650

200,000

345,000

Notes payable

Accounts payable

ABC, Capital

DEF, Capital

Total Liabilities and

728,352

P1,0

P1,317,002

contributing their respective assets and equities subject to

ABC and DEF agreed to form a partnership

the following adjustments:

Reminder from the Student Handbook: Code of Ethics- 24.

Accounts receivables of P20,000 in ABC's book and P35,000 in DEF's books are uncollectible.

➤ Inventories of P5,500 and P6,700 are worthless in ABC and DEF's respective books.

Other assets of P2,000 and P3,600 in ABC and DEF's respective books are to be written off.

to dismissal/ non-readmission with invalidation of grade

Assuming GHI offered to join for a 20% interest in the firm by contributing enough cash to have his

interest. Assume further that after GHI's admission, the profit and loss sharing ratio was agreed to be

40:40:20 based on capital credits. During the first year of operations the partnership earned a profit of

P325,000 and that this was distributed in the agreed manner. Assuming further that drawings were

made in these amounts: ABC, P50,000; DEF, P65,000; and GHI P28,000. Assuming that DEF decided

to withdraw after the first year of operation and the partners agreed that DEF will receive P730,000,

compute for the capital balance of GHI after the withdrawal of DEF.

SINOVS SAPIE moral com

UNI

DEF

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College