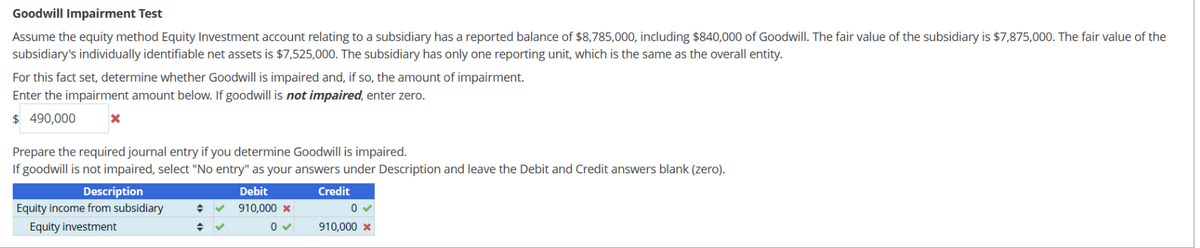

Goodwill Impairment Test Assume the equity method Equity Investment account relating to a subsidiary has a reported balance of $8,785,000, including $840,000 of Goodwill. The fair value of the subsidiary is $7,875,000. The fair value of the subsidiary's individually identifiable net assets is $7,525,000. The subsidiary has only one reporting unit, which is the same as the overall entity. For this fact set, determine whether Goodwill is impaired and, if so, the amount of impairment. Enter the impairment amount below. If goodwill is not impaired, enter zero. $490,000 x Prepare the required journal entry if you determine Goodwill is impaired. If goodwill is not impaired, select "No entry" as your answers under Description and leave the Debit and Credit answers blank (zero). Description Equity income from subsidiary Equity investment Debit Credit ÷ 910,000 x 0 0 910,000 x

Goodwill Impairment Test Assume the equity method Equity Investment account relating to a subsidiary has a reported balance of $8,785,000, including $840,000 of Goodwill. The fair value of the subsidiary is $7,875,000. The fair value of the subsidiary's individually identifiable net assets is $7,525,000. The subsidiary has only one reporting unit, which is the same as the overall entity. For this fact set, determine whether Goodwill is impaired and, if so, the amount of impairment. Enter the impairment amount below. If goodwill is not impaired, enter zero. $490,000 x Prepare the required journal entry if you determine Goodwill is impaired. If goodwill is not impaired, select "No entry" as your answers under Description and leave the Debit and Credit answers blank (zero). Description Equity income from subsidiary Equity investment Debit Credit ÷ 910,000 x 0 0 910,000 x

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

am.107.

Transcribed Image Text:Goodwill Impairment Test

Assume the equity method Equity Investment account relating to a subsidiary has a reported balance of $8,785,000, including $840,000 of Goodwill. The fair value of the subsidiary is $7,875,000. The fair value of the

subsidiary's individually identifiable net assets is $7,525,000. The subsidiary has only one reporting unit, which is the same as the overall entity.

For this fact set, determine whether Goodwill is impaired and, if so, the amount of impairment.

Enter the impairment amount below. If goodwill is not impaired, enter zero.

$490,000

x

Prepare the required journal entry if you determine Goodwill is impaired.

If goodwill is not impaired, select "No entry" as your answers under Description and leave the Debit and Credit answers blank (zero).

Description

Equity income from subsidiary

Equity investment

Debit

Credit

÷

910,000 x

0

0

910,000 x

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education