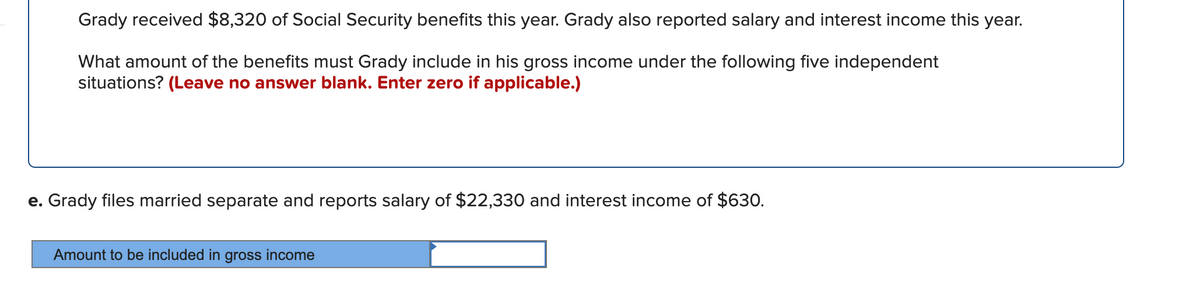

Grady received $8,320 of Social Security benefits this year. Grady also reported salary and interest income this year. What amount of the benefits must Grady include in his gross income under the following five independent situations? (Leave no answer blank. Enter zero if applicable.) e. Grady files married separate and reports salary of $22,330 and interest income of $630. Amount to be included in gross income

Grady received $8,320 of Social Security benefits this year. Grady also reported salary and interest income this year. What amount of the benefits must Grady include in his gross income under the following five independent situations? (Leave no answer blank. Enter zero if applicable.) e. Grady files married separate and reports salary of $22,330 and interest income of $630. Amount to be included in gross income

Chapter15: Choice Of Business Entity—other Considerations

Section: Chapter Questions

Problem 49P

Related questions

Question

Please explain every step. Thank you

Transcribed Image Text:Grady received $8,320 of Social Security benefits this year. Grady also reported salary and interest income this year.

What amount of the benefits must Grady include in his gross income under the following five independent

situations? (Leave no answer blank. Enter zero if applicable.)

e. Grady files married separate and reports salary of $22,330 and interest income of $63O.

Amount to be included in gross income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you