Greene Corporation loaned $150,000 to another corporation on December 1, 17) 2021 and received a 3-month, 8% interest-bearing note with a face value of $150,000. What adjusting entry should Greene make on December 31, 2021?

Greene Corporation loaned $150,000 to another corporation on December 1, 17) 2021 and received a 3-month, 8% interest-bearing note with a face value of $150,000. What adjusting entry should Greene make on December 31, 2021?

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 22MC: A company collects an honored note with a maturity date of 24 months from establishment, a 10%...

Related questions

Question

17,18,19 and 20

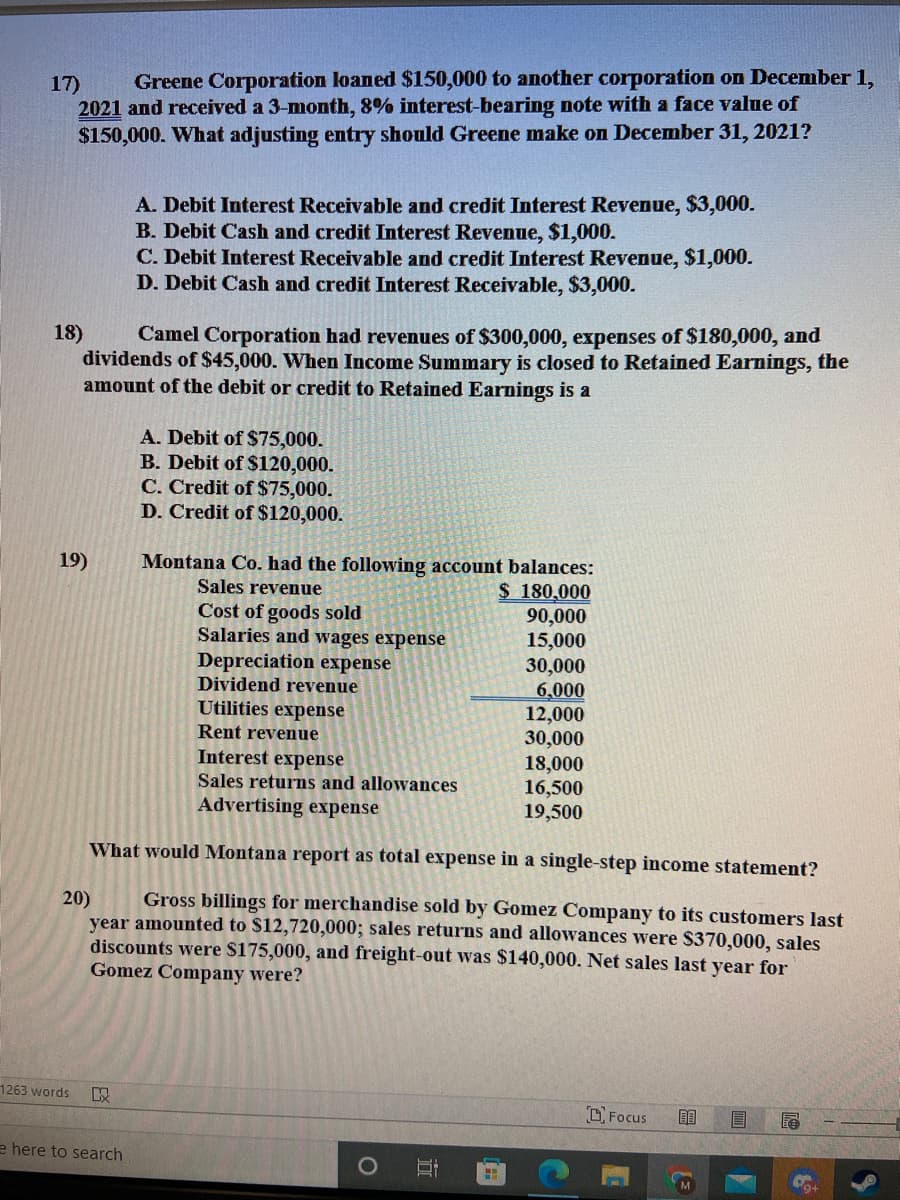

Transcribed Image Text:17)

Greene Corporation loaned $150,000 to another corporation on December 1,

2021 and received a 3-month, 8% interest-bearing note with a face value of

$150,000. What adjusting entry should Greene make on December 31, 2021?

A. Debit Interest Receivable and credit Interest Revenue, $3,000.

B. Debit Cash and credit Interest Revenue, $1,000.

C. Debit Interest Receivable and credit Interest Revenue, $1,000.

D. Debit Cash and credit Interest Receivable, $3,000.

18)

Camel Corporation had revenues of $300,000, expenses of $180,000, and

dividends of $45,000. When Income Summary is closed to Retained Earnings, the

amount of the debit or credit to Retained Earnings is a

A. Debit of $75,000.

B. Debit of $120,000.

C. Credit of $75,000.

D. Credit of $120,000.

19)

Montana Co. had the following account balances:

Sales revenue

$ 180,000

90,000

15,000

30,000

6,000

12,000

30,000

18,000

16,500

19,500

Cost of goods sold

Salaries and wages expense

Depreciation expense

Dividend revenue

Utilities expense

Rent revenue

Interest expense

Sales returns and allowances

Advertising expense

What would Montana report as total expense in a single-step income statement?

Gross billings for merchandise sold by Gomez Company to its customers last

20)

year amounted to $12,720,000; sales returns and allowances were $370,000, sales

discounts were S175,000, and freight-out was $140,000. Net sales last year for

Gomez Company were?

1263 words

O Focus

目

e here to search

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning