Q: The Brigaphenski Co. has just paid a cash dividend of $2 per share. Investors expected return is…

A: Current value of the stock is calculated using following equation Current value of stock =…

Q: Question 2 The sum of $1,000 is deposited into an account paying 10% annually. If $500 is withdrawn…

A: Solution:- When an amount is invested somewhere, it earns interest on it. The amount initially…

Q: Leslie's Unique Clothing Stores offers a common stock that pays an annual dividend of $2.70 a share.…

A: A zero-growth model is a type of dividend discount model (DDM) that assumes a corporation or…

Q: Freight Terms Determine the amount to be paid in full settlement of each of two invoices, (a) and…

A: The fight term states who is liable to pay for the freight charges. The freight charges are related…

Q: (Related to Checkpoint 9.2) (Yield to maturity) The market price is $950 for a 9-year bond ($1,000…

A: Bond price is the sum of interest payments and maturity value discounted at yeild to maturity Bond…

Q: Discount rate used 10% 15% 20% NPV +£130k +£50k -£50k What is the approximate IRR of this project? O…

A: IRR is the internal rate of return. It is the rate at which net present value (NPV) is nil.

Q: You are the CFO of a company and have decided that your firm needs to borrow $5 million for an…

A: Effective annual interest rate(EAR) refers to the real rate of return that we earn on our savings or…

Q: On January 1 of the current year, a call option was purchased by Beats Co. for $40 , which allows…

A: A call option is a future contract that allows an investor to buy stock on a future date at a strike…

Q: 6. Calculating Annuity Values For each of the following annuities, calculate the present value.…

A: Present value The present worth of a future currency is called the present value. The present value…

Q: a. Use the appropriate formula to determine the periodic deposit. b. How much of the financial goal…

A: 1) Future Value of anuity = P * [ { (1 + r )n -1 } /r ] where, P = periodic payment r = interest…

Q: hich of the following would affect shareholders' equity? Group of answer choices A company…

A: Shareholder equity consists common equity , retained earning and shareholders equity belongs to…

Q: Railway Cabooses just paid its annual dividend of $3.30 per share. The company has been reducing…

A: Just paid dividend (D0) = $3.30 Growth rate (g) = - 0.121 Required return (r) = 0.14 Stock price = ?…

Q: How can exchange-rate risk be hedged using forward, futures, and options contracts? OA. Firms can…

A: Currency forwards, futures and options can be used to hedge currency related risk or risk associated…

Q: Consider a position consisting of a $100,000 investment in asset A and a $100,000 investment in…

A: Variance refers to the measurement of the dispersion of the returns of the portfolio. It is shown…

Q: eBook Assume that the risk-free rate is 2.5% and the required return on the market is 9%. What is…

A: Given: Risk free rate = 2.5% Market rate = 9% Beta = 2

Q: Dave Krug finances a new automobile by paying $7,100 cash and agreeing to make 10 monthly payments…

A: Data given: Cash down=$7100 Monthly payment =$540 n=10 months rate=12% p.a. Monthly rate=12%/12=1%

Q: K You have been asked to analyze the bids for 200 polished disks used in solar panels. These bids…

A: Import tax is a charge levied on imports to restrict excessive imports and promote domestic…

Q: To help out with her retirement savings, Linda invests in an ordinary annuity that earns 6.6%…

A: An annuity is a contract in which a series of payments are exchanged for a lump sum payment.…

Q: Gomez is considering a $250,000 investment with the following net cash flows. Gomez requires a 15%…

A: Here, Discount rate = 15% To Find: Part A. Net present value =? Part B. Decision to accept or not…

Q: Castles in the Sand generates a ROE of 25.0 percent and maintains a payout ratio of 0.6 . Its…

A: The Price Earnings Ratio is calculated with the help of following formula P/E Ratio = Market Price…

Q: 1) a. Suppose an investor can purchase a 6-year 10% coupon bond with a par value of $100 that pays…

A: The bonds are different kind of investment in which only interest is paid and face value is paid on…

Q: A printing press that costs $285,900 is depreciated using the 1.5 declining-balance method. The…

A: Under declining depreciation method, accelerated depreciation rate = straight line depreciation rate…

Q: m has an opportunity to buy a $1,000 par value bond with a coupon rate of 7% and a maturity of 5…

A: Price of bond is sum of the present value of coupon payment and present value of par value of bond…

Q: If a company has a forward (forecasted) EPS of 5.242 and a forward PE of 76.495, what is the…

A: Price Earning Ratio refers to a financial ratio that is being used in order to value a stock and…

Q: Explain how the NPV investment appraisal method can be applied in situations where capital is…

A: (Note: We’ll answer the first question since the exact one wasn’t specified. Please submit a new…

Q: On January 1, Boston Company completed the following transactions (use a 7% annual interest rate for…

A: Transaction Date 01-01-2022 Interest Rate 7%

Q: 1. Phoenix Company common stock is currently selling for $20 per share. Security analysts at Smith…

A: Expected return The profit or loss that is expected by the investors from the investment made is…

Q: Assume that you are 20 years old and started saving for retirement on January 1, 2022. You plan to…

A: Time period is 50 years Monthly investment , PMTis $300 Interest rate is 7% Compounded monthly…

Q: As an analyst for a domestic equity–income mutual fund, Robert Ass is evaluating Mosah Water Company…

A: Based on the information provided, we have to estimate the CAPM based required return on equity for…

Q: The promised cash flows of three securities are listed below. If the cash flows are risk-free, and…

A: Here, To Find: No-arbitrage price of security =?

Q: Your PE firm is considering acquiring a publicly traded digital advertising company, Star Dust…

A: We have the future dividends emanating from a stock. We have to find the expected dividend in next…

Q: Beale Manufacturing Company has a beta of 1.1, and Foley Industries has a beta of 0.20. The required…

A: Required return of a company is calculated using following equation Required return = Risk free rate…

Q: lvin Miller, owner of Miller Garage, estimates that he will need $18,000 for new equipment in 20…

A: Given: Future value "FV" = $18000 Time "n" = 20 Interest rate "r"= 12% Number of compounding period…

Q: Due to the limitations of the weighted scoring model (weighting scheme), briefly discuss how Coady…

A: Weighted scheme has some limitations because weights are assigned on arbitrary basis and sometimes…

Q: The PDQ Partnership earned ordinary income of $150,000 in 2018. The partnership has three equal…

A: The Tax Cuts and Jobs Act cuts the personal exemption amount to $0 for tax years from 2018 through…

Q: Company X is rated A and has 3 bonds issued 2 years ago. All the bonds were issued at par. Bond A is…

A: As per our guidelines, we are supposed to answer only 3 sub-parts (if there are multiple sub-parts…

Q: Given an annual rate of payment of f (t) 50e0.08t at time t for 7 years and a constant force of…

A: We have been provided with continuously varying payment stream and the force of interest. We have to…

Q: Jessica borrowed $3000 from a lender that charged simple interest at an annual rate of 8%. When…

A: Simple interest is the interest calculated only on the principal amount and ignores the accrued…

Q: ssume that you need $1,000 four years from today. Your bank compoundsinterest at an 8 percent annual…

A: The future value of the amount includes the amount being deposited and the amount of compound…

Q: Currently the market portfolio is providing a 5% return. A particular stock you're interested in is…

A: We need to undertake the valuation of a dividend paying stock under different scenarios. We will use…

Q: Consider a U.S.-based company that exports goods to Switzerland. The U.S. Company expects to receive…

A: Given: US risk free rate = 2.6% Swiss risk free rate = 1% Spot rate = CHF 1.1058 Periods = 180 days…

Q: Describe the two of the asset categories in working capital. 2. Why is working capital so important?…

A: As per our guidelines, we are supposed to answer only 3 sub-parts (if there are multiple sub-parts…

Q: BUSINESS ACTIVITY 20 Calculate the finance you need. This is the amount needed for investment and…

A: Finance estimation means preparing a financial statement with estimated figures for operating…

Q: You have accumulated savings of $50,000 and decided that you will invest in one of the following…

A: The bond is a debt instrument that the companies use to raise funds from their investors. Preferred…

Q: 8. Roger and Samantha are brother and sister that will split an inheritance equally. Roger spends…

A: A perpetuity is an annuity that pays a periodic amount to its holder forever. Perpetuity due is a…

Q: For 2021, the annual earnings for Thompson Computer Company were $9,800,000. The corporation has…

A: Net Income of the company = $9,800,000 Number of shares outstanding = 4,449,400 Annual dividend per…

Q: Bank L's balance sheet(in millions) is provided below.The bank does not have any off-balance-sheet…

A: Ans.1) Calculation of tier 1 capital 1.common stock =$45 2.retained earnings =$40 Total tier1…

Q: What is the discounted payback of a project that has an initial outlay of $20,000 and will generate…

A:

Q: Discuss a money management challenge in a personal setting and how you would overcome it.

A: Money is very important in the life but money is scarce but expenses are very large so lot of…

Q: 3. A loan of $50,000 due in one year is to be repaid by three equal payments due today, six months…

A: A loan is one where the lender provides money to the borrower on interest. The lender received…

12

Step by step

Solved in 2 steps with 1 images

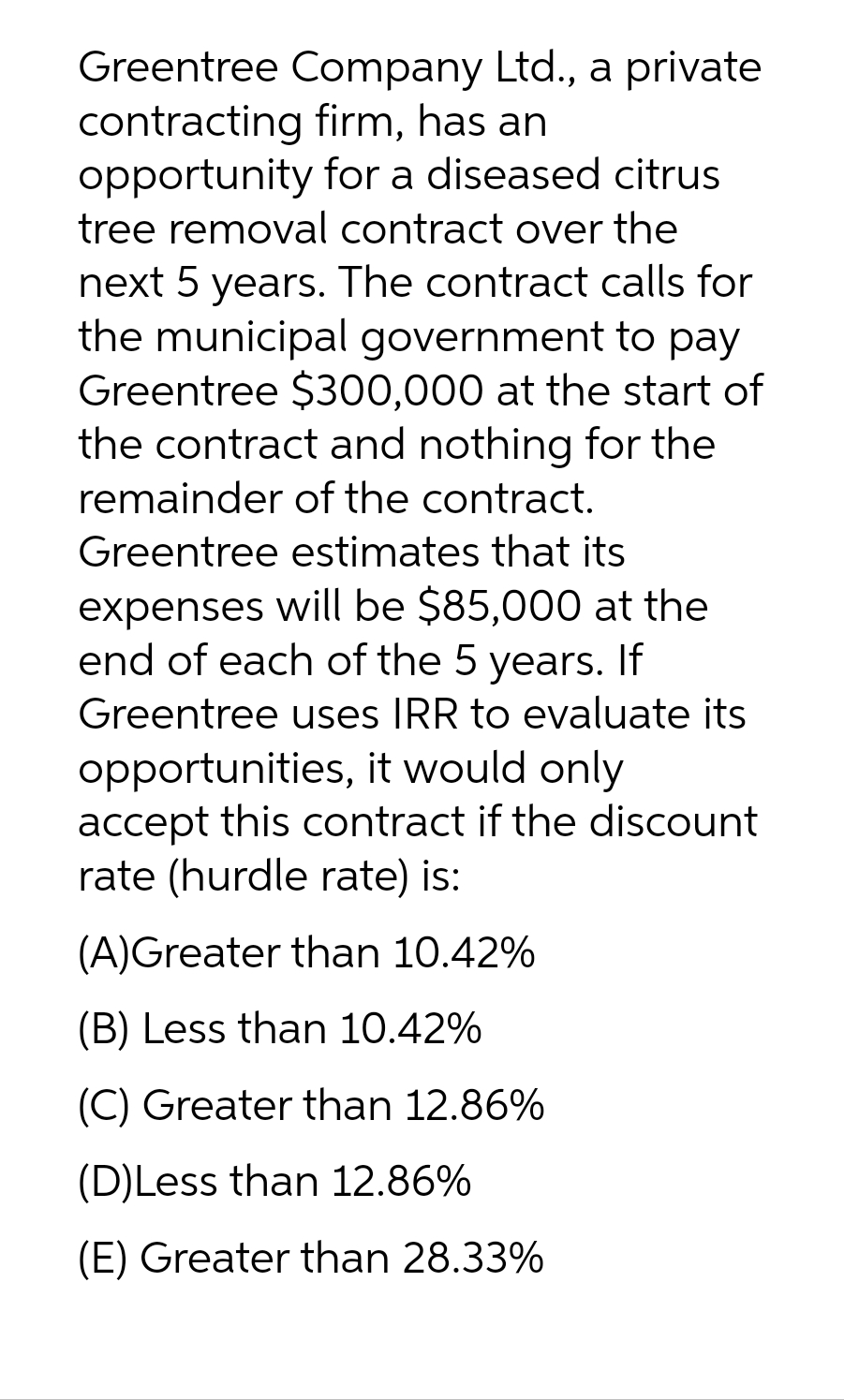

- Dr. Superhook, a private towing contractor, has an opportunity for a towing contract with the city over the next 5 years. The contract calls for the city to pay Dr. Superhook $4,000,000 at the start of the contract and nothing for the remainder of the contract. Dr. Superhook estimates that its expenses will be $1,200,000 at the end of each of the 5 years If Dr. Superhook uses IRR to evaluate its opportunities, under what values of the discount rate would the company accept the contract? Briefly explain why.McClelland Corporation agreed to purchase some landscaping equipment from Agri-Products for a cash price of $500,000. Before accepting delivery of the equipment, McClelland learned that the same equipment could be purchased from another dealer for $460,000. To avoid losing the sale, Agri-Products has offered McClelland a “no interest” payment plan—McClelland would pay $100,000 at delivery, $200,000 one year later, and the final $200,000 in two years. Use the following links to the present value tables to calculate answers.(PV of 1, PVAD of 1, and PVOA of 1) (Use the appropriate factor(s) from the tables provided.) Required: McClelland would usually pay 9% annual interest on a loan of this type. What is the present value of the Agri-Products loan at the delivery date? (Do not round intermediate calculations. Round your final answer to the nearest whole dollar.) What journal entry would McClelland make if it accepts the deal and buys from Agri-Products? (If no entry is required for a…Prophet Company signed a long-term purchase contract to buy timber from the U.S. Forest Service at $300 per thousand board feet. Under these terms, Prophet must cut and pay $6,000,000 for this timber during the next year. Currently, the market value is $250 per thousand board feet. At this rate, the market price is $5,000,000. Jerry Herman, the controller, wants to recognize the loss in value on the year-end financial statements, but the financial vice president, Billie Hands, argues that the loss is temporary and should be ignored. Herman notes that market value has remained near $250 for many months, and he sees no sign of significant change. Instructions (a) What are the ethical issues, if any? (b) Is any particular stakeholder harmed by the financial vice president's decision? (c) What should the controller do?

- Tulane Tires wrote a contract for a $100,000 sale of tires to the new Garden District Tour Company. Tulane only anticipates a slightly greater than 50 percent chance that Garden will be able to pay the amounts that Tulane is entitled to receive under the contract. Upon delivery of the tires, assuming no payment has yet been made by Garden, how much revenue should Tulane recognize under U.S. GAAP?On January 1, 2020, Optimistic Company was granted by a local government authority 5,000 hectares of land located near the slums outside the city limits. The condition attached to this grant was that the entity shall clean up this land and lay roads by employing laborers from the village where the land is located. The government has fixed the minimum wage payable to the workers. The entire operation will take 3 years and is estimated to cost P10,000,000. This amount will be spent P2,000,000 for 2020, P2,000,000 for 2021 and P6,000,000 for 2022. The fair value of this land is P12,000,000. Prepare the journal entry for 2020 in connection with this grantDelta Electric Company expects to have an annual taxable income of $500,000 from its residential accounts over the next two years. The company is also bidding on a two-year wiring service job for a large apartment complex. This commercial service requires the purchase of a new truck equipped with wire-pulling tools at a cost of $50,000. The equipment falls into the MACRS five-year class and will be retained for future use (instead of being sold) after two years, indicating no gain or loss on this property. The project will bring in additional annual revenue of $200,000, but it is expected to incur additional annual operating costs of $100,000. Compute the marginal tax rates applicable to the project's operating profits for the next two years.

- Delta Electric Company expects to have an annual taxable income of $500,000 from its residential accounts over the next two years. The company is also bidding on a two-year wiring service job for a large apartment complex. This commercial service requires the purchase of a new truck equipped with wirepulling tools at a cost of $50,000. The equipment falls into the MACRS five-year class and will be retained for future use (instead of being sold) after two years, indicating no gain or loss on this property. The project will bring in additional annual revenue of $200,000, but it is expected to incur additional annual operating costs of $100,000. Compute the marginal tax rates applicable to the project'soperating profits for the next two years.Tarhata Company received a government grant of 2,000,000 related to a factory building purchased in January 2021 from an industrialist identified by the government. If the entity did not purchase the building, which was located in the slums of the city, it would have been repossessed by the government agency. The entity purchased the building for 12,000,000. The useful life of the building is 5 years with no residual value. On January 1, 2022, the entire amount of the government grant became repayable by reason of non compliance with conditions attached to the grant. Required: Prepare journal entries assuming the government grant is accounted for using: Deferred income approach Deduction from asset approachAs of Jan. 1, 2020, ABC Corporation is constructing a new facility located in a community that has little livelihood sources. The entity received the land from the government on the condition that it hires 90% of its workers from the community throughout a 5-year period. The land is valued at P10,000,000. The construction of the building was partially financed by the entity and also the government. Information regarding the facility construction, government grant and funding sources can be seen in the attached image. By the end of 2020, construction is substantially completed. Date Amount Spent Jan. 1,2020 P 4,000,000 March 31,2020 5,000,000 June 30, 2020 8,000,000 Borrowing Interest Rate Principal Amount Specific Borrowing-Government 8% P 2,000,000 Genaral Borrowing A 9% 12,000,000 Genral Borrowing B 10% 4,000,000 All borrowings were outstanding throughout the year. Interest payments are due every Jan.1 1. How much is the capitalizable borrowing cost?…

- Burling Water Cooperative currently contracts the removal of small amounts of hydrogen sulfide from its well water using manganese dioxide filtration prior to the addition of chlorine and fluoride. Contract renewal for 5 years will cost $75,000 annually for the next 2 years and $100,000 in years 3, 4, and 5. Assume payment is made at the end of each contract year. Burling Coop can install the filtration equipment for $125,000 and perform the process for $50,000 per year. At a discount rate of 6% per year, does the contract service still save money?In November 20X2, an entity contracts with a customer to refurbish a 3-storey building and install new elevators for a total consideration of ₱5,000,000. The promised refurbishment service, including the installation of elevators, is a single performance obligation satisfied over time. Total expected costs are ₱4,000,000, including ₱1,500,000 for the elevators. The entity determines that it acts as a principal because it obtains control of the elevators before they are transferred to the customer. A summary of the transaction price and expected costs is as follows: Transaction price ₱5,000,000 Expected costs: Elevators ₱1,500,000 Other costs 2,500,000 Total expected costs ₱4,000,000 The entity uses an input method based on costs incurred to measure its…Supplier Corp. enters into a government contract during the year to provide computer equipment for $4,400,000. The contract consists of a single performance obligation to provide specified equipment in three years. Total costs estimated by Supplier Corp. for the contract are $3,080,000 . The equipment is highly specialized and has no alternative uses. As negotiated in the contract, any costs incurred by Supplier Corp. plus a specified profit margin will be paid to Supplier Corp. in the event of a contract cancellation. Actual costs incurred during the year were $1,408,000 including unexpected cost overruns of $176,000 due to labor inefficiencies. a. Would revenue be recognized over time or at a point in time for this contract? Answer Recognize revenue over time b. Calculate (1) recognized revenue, (2) the gross profit, and (3) adjusted contract margin to be recorded during the year. 1. Recognized revenue Answer 2. Gross profit Answer 3. Adjusted contract margin Answer Note:- Do not…