GreenUp, a calendar year, accrual basis taxpayer, provides landscaping installation and maintenance services to its customers. In August 2023, GreenUp contracted with a university to renovate its lawns and gardens. GreenUp agreed to complete the entire renovation by May 31, 2025, and the university prepaid the entire $100,000 fee. GreenUp completed 20 percent of the work in 2023, 65 percent in 2024, and 15 percent in 2025. Required: a. How much revenue should GreenUp report on its financial statements for 2023, 2024, and 2025? b. How much taxable income must GreenUp recognize in 2023, 2024, and 2025?

GreenUp, a calendar year, accrual basis taxpayer, provides landscaping installation and maintenance services to its customers. In August 2023, GreenUp contracted with a university to renovate its lawns and gardens. GreenUp agreed to complete the entire renovation by May 31, 2025, and the university prepaid the entire $100,000 fee. GreenUp completed 20 percent of the work in 2023, 65 percent in 2024, and 15 percent in 2025. Required: a. How much revenue should GreenUp report on its financial statements for 2023, 2024, and 2025? b. How much taxable income must GreenUp recognize in 2023, 2024, and 2025?

Chapter5: Introduction To Business Expenses

Section: Chapter Questions

Problem 81IIP

Related questions

Question

Transcribed Image Text:GreenUp, a calendar year, accrual basis taxpayer, provides landscaping installation and maintenance services to its customers. In

August 2023, GreenUp contracted with a university to renovate its lawns and gardens. GreenUp agreed to complete the entire

renovation by May 31, 2025, and the university prepaid the entire $100,000 fee. GreenUp completed 20 percent of the work in 2023,

65 percent in 2024, and 15 percent in 2025.

Required:

a. How much revenue should GreenUp report on its financial statements for 2023, 2024, and 2025?

b. How much taxable income must GreenUp recognize in 2023, 2024, and 2025?

Complete this question by entering your answers in the tabs below.

Required A Required B

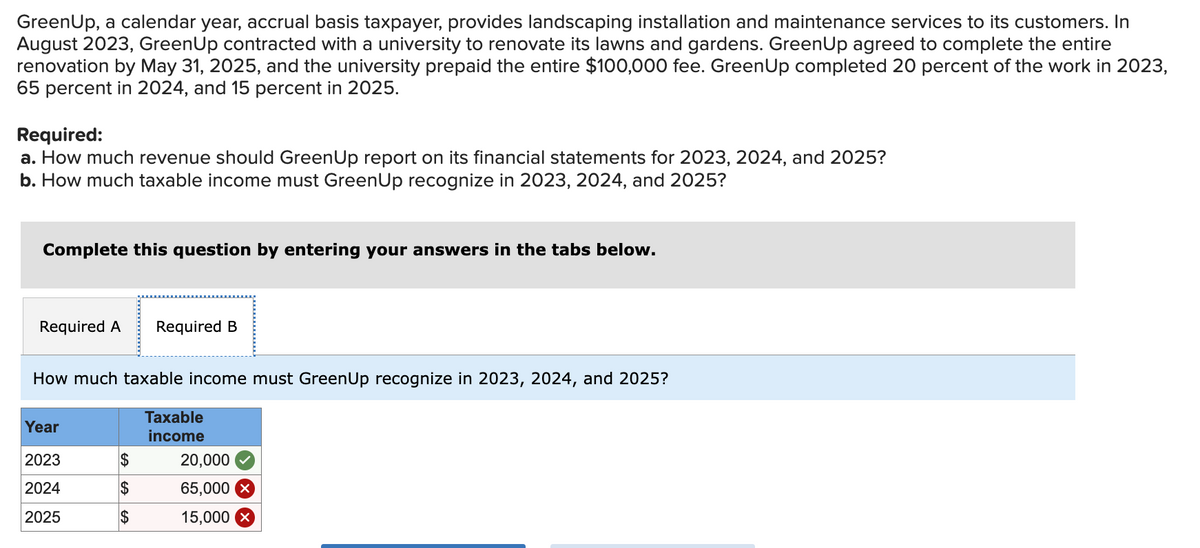

How much taxable income must GreenUp recognize in 2023, 2024, and 2025?

Year

2023

2024

2025

$

$

$

Taxable

income

20,000

65,000

15,000 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT