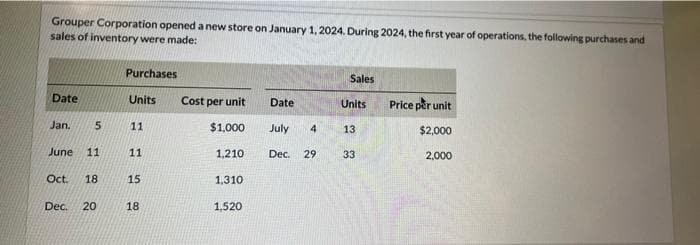

Grouper Corporation opened a new store on January 1, 2024. During 2024, the first year of operations, the following purchases and sales of inventory were made: Date Jan. 5 June 11 Oct. 18 Dec. 20 Purchases Units 11 11 15 18 Cost per unit $1,000 1,210 1,310 1,520 Date July 4 Dec. 29 Sales Units 13 33 Price per unit $2,000 2,000

Grouper Corporation opened a new store on January 1, 2024. During 2024, the first year of operations, the following purchases and sales of inventory were made: Date Jan. 5 June 11 Oct. 18 Dec. 20 Purchases Units 11 11 15 18 Cost per unit $1,000 1,210 1,310 1,520 Date July 4 Dec. 29 Sales Units 13 33 Price per unit $2,000 2,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter8: Inventories: Special Valuation Issues

Section: Chapter Questions

Problem 8MC: At December 31, 2019, the following information was available from Crisford Companys books: Sales...

Related questions

Topic Video

Question

do not give solution in image

Transcribed Image Text:Grouper Corporation opened a new store on January 1, 2024. During 2024, the first year of operations, the following purchases and

sales of inventory were made:

Date

Jan.

5

June 11

Oct. 18

Dec. 20

Purchases

Units

11

11

15

18

Cost per unit

$1,000

1,210

1,310

1,520

Date

July 4

Dec. 29

Sales

Units

13

33

Price per unit

$2,000

2,000

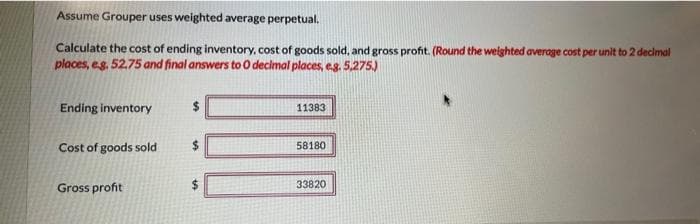

Transcribed Image Text:Assume Grouper uses weighted average perpetual.

Calculate the cost of ending inventory, cost of goods sold, and gross profit. (Round the weighted average cost per unit to 2 decimal

places, e.g. 52.75 and final answers to O decimal places, e.g. 5,275.)

Ending inventory

Cost of goods sold

Gross profit

11383

58180

33820

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT