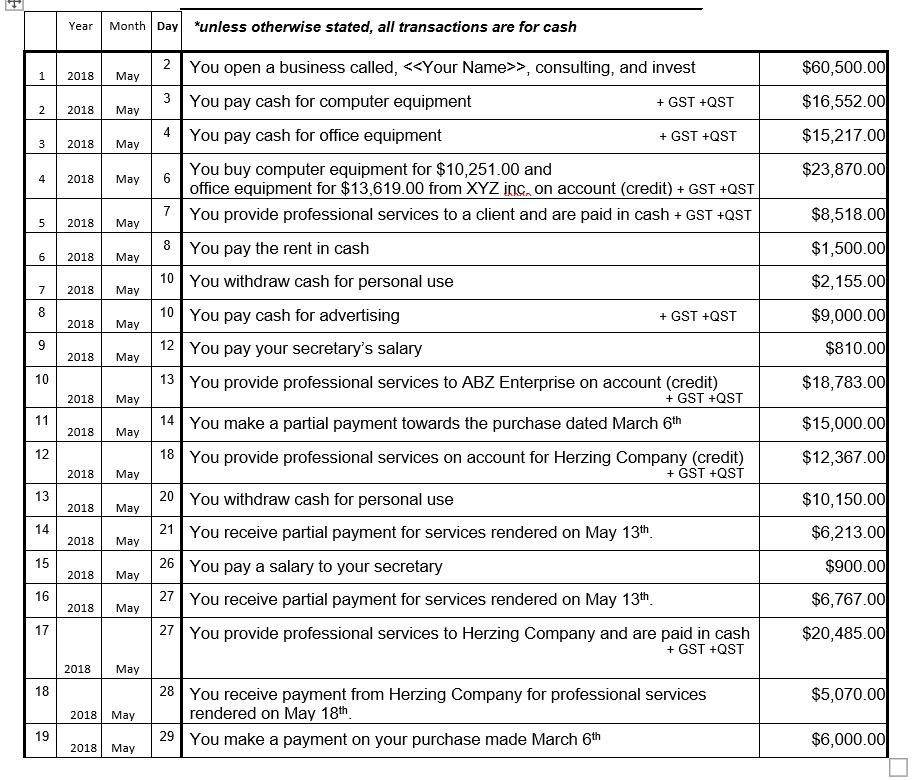

GST -5% QST- 9.975% Prepare Journal entries,Post to General Ledger,Trial Balance,, Income statement, Owner Equity and Balance Sheet.

GST -5% QST- 9.975% Prepare Journal entries,Post to General Ledger,Trial Balance,, Income statement, Owner Equity and Balance Sheet.

Chapter3: Analyzing And Recording Transactions

Section: Chapter Questions

Problem 19EB: A business has the following transactions: A. The business is started by receiving cash from an...

Related questions

Question

100%

GST -5% QST- 9.975%

Prepare

Transcribed Image Text:Year

Month Day *unless otherwise stated, all transactions are for cash

2 You open a business called, <<Your Name>>, consulting, and invest

$60,500.00

1

2018

Мay

$16,552.00

3

You pay cash for computer equipment

+ GST +QST

2018

May

$15,217.00

4

You pay cash for office equipment

+ GST +QST

2018

May

You buy computer equipment for $10,251.00 and

6.

$23,870.00

4

2018

May

office equipment for $13,619.00 from XYZ inc, on account (credit) + GST +QST

7 You provide professional services to a client and are paid in cash + GST +QST

$8,518.00

2018

May

$1,500.00

8

You pay the rent in cash

6

2018

May

10 You withdraw cash for personal use

$2,155.00

7

2018

May

$9,000.00

8.

10 You pay cash for advertising

+ GST +QST

2018

May

12 You pay your secretary's salary

$810.00

2018

May

10

13 You provide professional services to ABZ Enterprise on account (credit)

$18,783.00

2018

May

+ GST +QST

$15,000.00

11

14 You make a partial payment towards the purchase dated March 6th

2018

May

18 You provide professional services on account for Herzing Company (credit)

+ GST +QST

12

$12,367.00

2018

May

13

20 You withdraw cash for personal use

$10,150.00

2018

May

21 You receive partial payment for services rendered on May 13th

May

$6,213.00

14

2018

15

26 You pay a salary to your secretary

$900.00

2018

May

27 You receive partial payment for services rendered on May 13th.

May

$6,767.00

16

2018

$20,485.00

17

27 You provide professional services to Herzing Company and are paid in cash

+ GST +QST

2018

May

$5,070.00

18

28 You receive payment from Herzing Company for professional services

rendered on May 18th

29 You make a payment on your purchase made March 6th

2018

May

$6,000.00

19

2018

May

2.

3.

9.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 21 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning