hġ case study - 1 Student boarding with friends Mai is 22 and is studying a Bachelor of Business/Bachelor of Laws full-time at Parramatta Campus. She has completed her business subjects, and is in her final year of law subjects. She had to move out of home last year due to family difficulties, and is boarding with a family at Bossley Park. Mai receives Youth Allowance at the living away from home rate of $355.40 per fortnight. She works two shifts each weekend in a local restaurant, and earns around $100 per week, depending on tips. This session she had to borrow $400 from Centrelink to pay for textbooks, so her Youth Allowance will be reduced to $280 for six months. Her HECS is around $2700 per session, and she has deferred this until she is working full-time. Mai pays $100 a week board, which includes electricity costs and some meals. She spends around $50-70 extra each week on food-lunches, snacks, etc. Mai doesn't use the home phone, since she has a mobile phone her parents bought her when she had to move out, and she uses pre-paid calls. She bought furniture for her bedroom gradually, as she could afford it. Textbooks are Mai's most expensive uni cost, with law texts costing a minimum of $300 per session. She has to buy all essential texts because they are often used in open book exams. Occasionally she has been able to find second hand texts. Mai doesn't have a computer. She does all her assignments in the uni computer labs, which are open 24 hours a day. She prints her assignments in the labs. Mai doesn't have a car, she catches public transport (a bus then two trains) to uni and gets a bus to work or the shops. She doesn't buy many clothes, but shops at bargain outlets or looks for specials at jeans shops, etc. She says that when you haven't got much money, it's really important to write out a budget and to have the willpower not to overspend.

hġ case study - 1 Student boarding with friends Mai is 22 and is studying a Bachelor of Business/Bachelor of Laws full-time at Parramatta Campus. She has completed her business subjects, and is in her final year of law subjects. She had to move out of home last year due to family difficulties, and is boarding with a family at Bossley Park. Mai receives Youth Allowance at the living away from home rate of $355.40 per fortnight. She works two shifts each weekend in a local restaurant, and earns around $100 per week, depending on tips. This session she had to borrow $400 from Centrelink to pay for textbooks, so her Youth Allowance will be reduced to $280 for six months. Her HECS is around $2700 per session, and she has deferred this until she is working full-time. Mai pays $100 a week board, which includes electricity costs and some meals. She spends around $50-70 extra each week on food-lunches, snacks, etc. Mai doesn't use the home phone, since she has a mobile phone her parents bought her when she had to move out, and she uses pre-paid calls. She bought furniture for her bedroom gradually, as she could afford it. Textbooks are Mai's most expensive uni cost, with law texts costing a minimum of $300 per session. She has to buy all essential texts because they are often used in open book exams. Occasionally she has been able to find second hand texts. Mai doesn't have a computer. She does all her assignments in the uni computer labs, which are open 24 hours a day. She prints her assignments in the labs. Mai doesn't have a car, she catches public transport (a bus then two trains) to uni and gets a bus to work or the shops. She doesn't buy many clothes, but shops at bargain outlets or looks for specials at jeans shops, etc. She says that when you haven't got much money, it's really important to write out a budget and to have the willpower not to overspend.

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter2: Using Financial Statements And Budgets

Section: Chapter Questions

Problem 5FPE

Related questions

Question

3

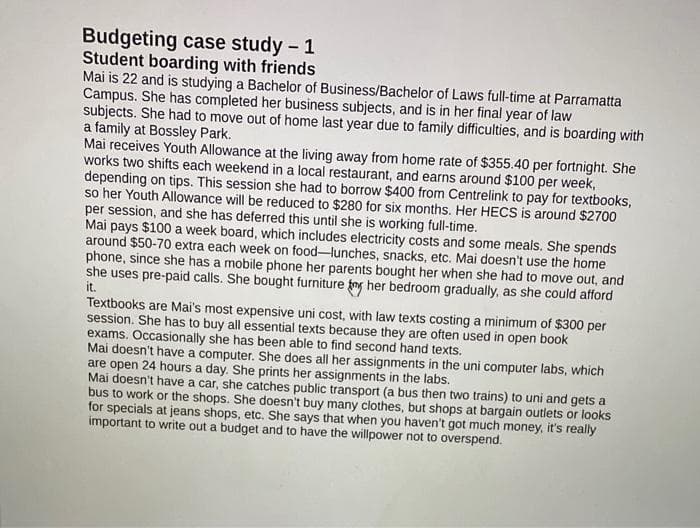

Transcribed Image Text:Budgeting case study - 1

Student boarding with friends

Mai is 22 and is studying a Bachelor of Business/Bachelor of Laws full-time at Parramatta

Campus. She has completed her business subjects, and is in her final year of law

subjects. She had to move out of home last year due to family difficulties, and is boarding with

a family at Bossley Park.

Mai receives Youth Allowance at the living away from home rate of $355.40 per fortnight. She

works two shifts each weekend in a local restaurant, and earns around $100 per week,

depending on tips. This session she had to borrow $400 from Centrelink to pay for textbooks,

so her Youth Allowance will be reduced to $280 for six months. Her HECS is around $2700

per session, and she has deferred this until she is working full-time.

Mai pays $100 a week board, which includes electricity costs and some meals. She spends

around $50-70 extra each week on food-lunches, snacks, etc. Mai doesn't use the home

phone, since she has a mobile phone her parents bought her when she had to move out, and

she uses pre-paid calls. She bought furniture fy her bedroom gradually, as she could afford

it.

Textbooks are Mai's most expensive uni cost, with law texts costing a minimum of $300 per

session. She has to buy all essential texts because they are often used in open book

exams. Occasionally she has been able to find second hand texts.

Mai doesn't have a computer. She does all her assignments in the uni computer labs, which

are open 24 hours a day. She prints her assignments in the labs.

Mai doesn't have a car, she catches public transport (a bus then two trains) to uni and gets a

bus to work or the shops. She doesn't buy many clothes, but shops at bargain outlets or looks

for specials at jeans shops, etc. She says that when you haven't got much money, it's really

important to write out a budget and to have the willpower not to overspend.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning