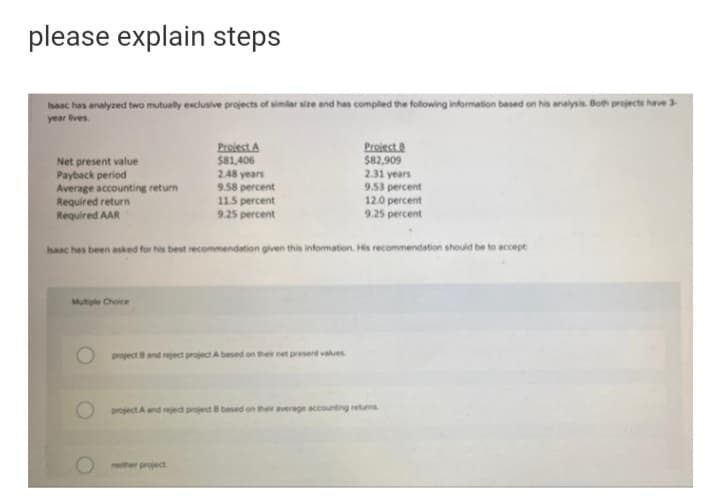

haac has analyzed two mutualy exclusive projects of simlar sire and has compled the following information based on his analysis. Both projects have year lives Net present value Payback period Average accounting return Required return Required AAR Proiest A $81,406 2.48 years 9.58 percent 11.5 percent 9.25 percent Project $82.909 2.31 years 9.53 percent 12.0 percent 9.25 percent haac has been asked for his best recommendation given this information. His recommendation should be to accept Mutiple Choice project and reject project A beed on their net present values project A and rejed project B based on their average accounting retuns nether project

haac has analyzed two mutualy exclusive projects of simlar sire and has compled the following information based on his analysis. Both projects have year lives Net present value Payback period Average accounting return Required return Required AAR Proiest A $81,406 2.48 years 9.58 percent 11.5 percent 9.25 percent Project $82.909 2.31 years 9.53 percent 12.0 percent 9.25 percent haac has been asked for his best recommendation given this information. His recommendation should be to accept Mutiple Choice project and reject project A beed on their net present values project A and rejed project B based on their average accounting retuns nether project

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter15: Capital Investment Analysis

Section: Chapter Questions

Problem 15.3.2P

Related questions

Question

M2

Transcribed Image Text:please explain steps

saac has analyzed two mutualy exclusive projects of similar size and has compled the following information besed on his analysis. Both projects have 3

year lives.

Net present value

Payback period

Average accounting return

Required return

Required AAR

Proiect A

$81,406

2.48 years

9.58 percent

11.5 percent

Proiect a

$82,909

2.31 years

9.53 percent

12.0 percent

9.25 percent

9.25 percent

haac has been asked for his best recommendation given this information. His recommendation should be to accept

Multiple Choice

project and reject project A besed on their net present values

project A and reject project B based on their average accounting returns

O nether project

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning