had lived under a classical tax system, which of the following is closest to the additional tax she would have to pay as a Rio shareholder?

had lived under a classical tax system, which of the following is closest to the additional tax she would have to pay as a Rio shareholder?

PFIN (with PFIN Online, 1 term (6 months) Printed Access Card) (New, Engaging Titles from 4LTR Press)

6th Edition

ISBN:9781337117005

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter3: Preparing Your Taxes

Section: Chapter Questions

Problem 2FPE: ESTIMATING TAXABLE INCOME, TAX LIABILITY, AND POTENTIAL REFUND. Hannah Owens is 24 years old and...

Related questions

Question

Transcribed Image Text:D

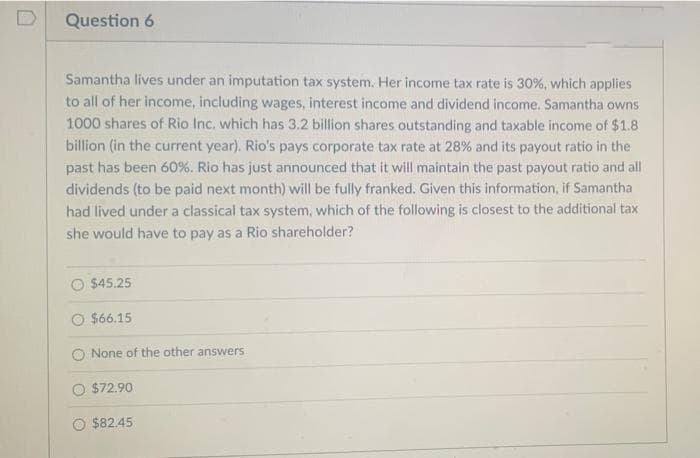

Question 6

Samantha lives under an imputation tax system. Her income tax rate is 30%, which applies

to all of her income, including wages, interest income and dividend income. Samantha owns

1000 shares of Rio Inc. which has 3.2 billion shares outstanding and taxable income of $1.8

billion (in the current year). Rio's pays corporate tax rate at 28% and its payout ratio in the

past has been 60%. Rio has just announced that it will maintain the past payout ratio and all

dividends (to be paid next month) will be fully franked. Given this information, if Samantha

had lived under a classical tax system, which of the following is closest to the additional tax

she would have to pay as a Rio shareholder?

$45.25

O $66.15

O None of the other answers

O $72.90

O $82.45

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT