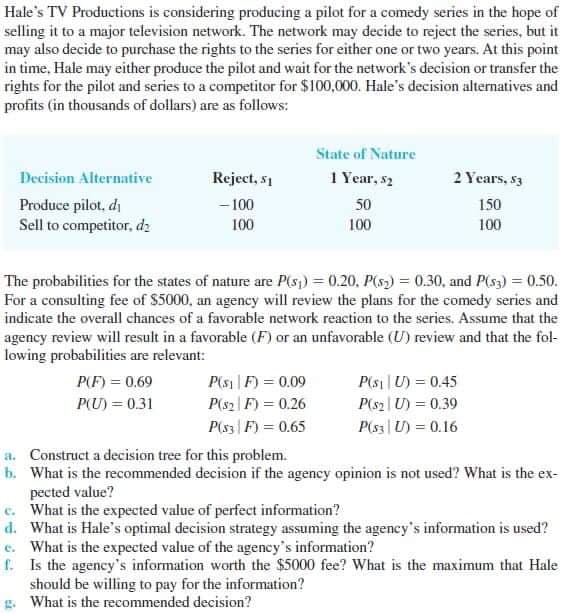

Hale's TV Productions is considering producing a pilot for a comedy series in the hope of selling it to a major television network. The network may decide to reject the series, but it may also decide to purchase the rights to the series for either one or two years. At this point in time, Hale may either produce the pilot and wait for the network's decision or transfer the rights for the pilot and series to a competitor for $100,000. Hale's decision alternatives and profits (in thousands of dollars) are as follows: State of Nature 1 Year, s2 2 Years, s3 Decision Alternative Reject, s1 Produce pilot, di Sell to competitor, dz - 100 50 150 100 100 100 The probabilities for the states of nature are Pls) = 0.20, P(s) = 0.30, and P(s3) = 0.50. For a consulting fee of $5000, an agency will review the plans for the comedy series and indicate the overall chances of a favorable network reaction to the series. Assume that the agency review will result in a favorable (F) or an unfavorable (U) review and that the fol- lowing probabilities are relevant: P(F) = 0.69 P(s1 |F) = 0.09 P(si|U) = 0.45 P(U) = 0.31 P(s2|F) = 0.26 P(s2| U) = 0.39 P(s3| F) = 0.65 P(s3 |U) = 0.16 a. Construct a decision tree for this problem. h. What is the recommended decision if the agency opinion is not used? What is the ex- pected value? c. What is the expected value of perfect information? d. What is Hale's optimal decision strategy assuming the agency's information is used? e. What is the expected value of the agency's information? f. Is the agency's information worth the $5000 fee? What is the maximum that Hale should be willing to pay for the information? g. What is the recommended decision?

Critical Path Method

The critical path is the longest succession of tasks that has to be successfully completed to conclude a project entirely. The tasks involved in the sequence are called critical activities, as any task getting delayed will result in the whole project getting delayed. To determine the time duration of a project, the critical path has to be identified. The critical path method or CPM is used by project managers to evaluate the least amount of time required to finish each task with the least amount of delay.

Cost Analysis

The entire idea of cost of production or definition of production cost is applied corresponding or we can say that it is related to investment or money cost. Money cost or investment refers to any money expenditure which the firm or supplier or producer undertakes in purchasing or hiring factor of production or factor services.

Inventory Management

Inventory management is the process or system of handling all the goods that an organization owns. In simpler terms, inventory management deals with how a company orders, stores, and uses its goods.

Project Management

Project Management is all about management and optimum utilization of the resources in the best possible manner to develop the software as per the requirement of the client. Here the Project refers to the development of software to meet the end objective of the client by providing the required product or service within a specified Period of time and ensuring high quality. This can be done by managing all the available resources. In short, it can be defined as an application of knowledge, skills, tools, and techniques to meet the objective of the Project. It is the duty of a Project Manager to achieve the objective of the Project as per the specifications given by the client.

Letter E only please

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 5 images