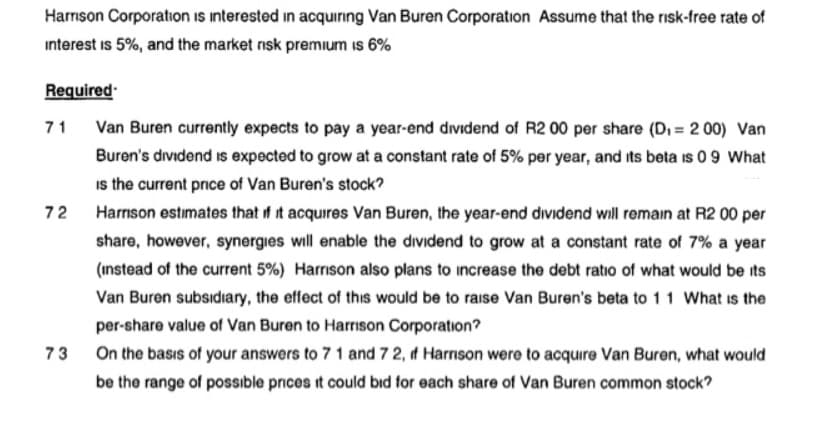

Harrison Corporation is interested in acquiring Van Buren Corporation Assume that the risk-free rate of interest is 5%, and the market risk premium is 6% Required 71 Van Buren currently expects to pay a year-end dividend of R2 00 per share (Di = 2 00) Van Buren's dividend is expected to grow at a constant rate of 5% per year, and its beta is 0 9 What is the current price of Van Buren's stock? 72 Harrson estimates that if it acquires Van Buren, the year-end dividend will remain at R2 00 per share, however, synergies will enable the dividend to grow at a constant rate of 7% a year (instead of the current 5%) Harrison also plans to increase the debt ratio of what would be its Van Buren subsidiary, the effect of this would be to raise Van Buren's beta to 11 What is the per-share value of Van Buren to Harrison Corporation? 73 On the basıs of your answers to 7 1 and 72, d Harnson were to acquire Van Buren, what would be the range of possible prces it could bıd for each share of Van Buren common stock?

Harrison Corporation is interested in acquiring Van Buren Corporation Assume that the risk-free rate of interest is 5%, and the market risk premium is 6% Required 71 Van Buren currently expects to pay a year-end dividend of R2 00 per share (Di = 2 00) Van Buren's dividend is expected to grow at a constant rate of 5% per year, and its beta is 0 9 What is the current price of Van Buren's stock? 72 Harrson estimates that if it acquires Van Buren, the year-end dividend will remain at R2 00 per share, however, synergies will enable the dividend to grow at a constant rate of 7% a year (instead of the current 5%) Harrison also plans to increase the debt ratio of what would be its Van Buren subsidiary, the effect of this would be to raise Van Buren's beta to 11 What is the per-share value of Van Buren to Harrison Corporation? 73 On the basıs of your answers to 7 1 and 72, d Harnson were to acquire Van Buren, what would be the range of possible prces it could bıd for each share of Van Buren common stock?

Chapter7: Common Stock: Characteristics, Valuation, And Issuance

Section: Chapter Questions

Problem 11P

Related questions

Question

Transcribed Image Text:Harrison Corporation is interested in acquiring Van Buren Corporation Assume that the risk-free rate of

interest is 5%, and the market risk premium is 6%

Required

71 Van Buren currently expects to pay a year-end dividend of R2 00 per share (Di = 2 00) Van

Buren's dividend is expected to grow at a constant rate of 5% per year, and its beta is 0 9 What

is the current price of Van Buren's stock?

72

Harrson estimates that if it acquires Van Buren, the year-end dividend will remain at R2 00 per

share, however, synergies will enable the dividend to grow at a constant rate of 7% a year

(instead of the current 5%) Harrison also plans to increase the debt ratio of what would be its

Van Buren subsidiary, the effect of this would be to raise Van Buren's beta to 11 What is the

per-share value of Van Buren to Harrison Corporation?

73 On the basıs of your answers to 7 1 and 72, d Harnson were to acquire Van Buren, what would

be the range of possible prces it could bıd for each share of Van Buren common stock?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning