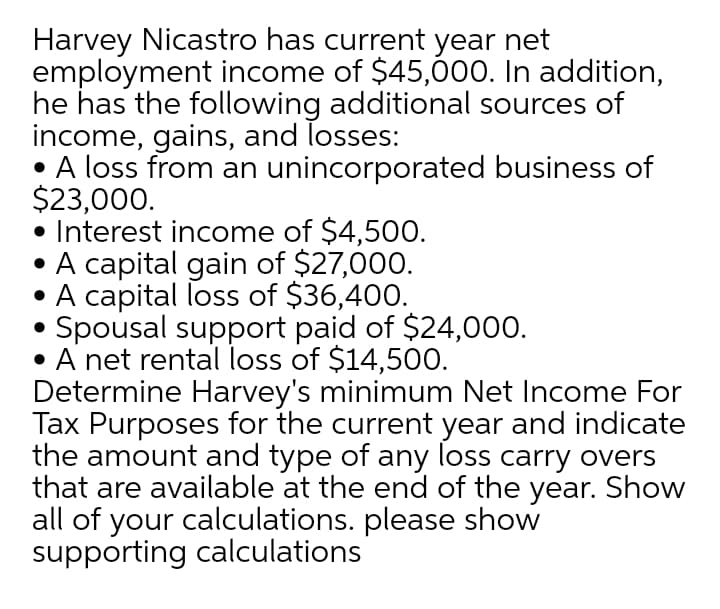

Harvey Nicastro has current year net employment income of $45,000. In addition, he has the following additional sources of income, gains, and losses: A loss from an unincorporated business of $23,000. Interest income of $4,500. A capital gain of $27,000. • A capital loss of $36,400. Spousal support paid of $24,000. • A net rental loss of $14,500. Determine Harvey's minimum Net Income For Tax Purposes for the current year and indicate the amount and type of any loss carry overs that are available at the end of the year. Show all of your calculations. please show supporting calculations

Harvey Nicastro has current year net employment income of $45,000. In addition, he has the following additional sources of income, gains, and losses: A loss from an unincorporated business of $23,000. Interest income of $4,500. A capital gain of $27,000. • A capital loss of $36,400. Spousal support paid of $24,000. • A net rental loss of $14,500. Determine Harvey's minimum Net Income For Tax Purposes for the current year and indicate the amount and type of any loss carry overs that are available at the end of the year. Show all of your calculations. please show supporting calculations

Chapter11: Investor Losses

Section: Chapter Questions

Problem 64P

Related questions

Question

Transcribed Image Text:Harvey Nicastro has current year net

employment income of $45,000. In addition,

he has the following additional sources of

income, gains, and losses:

A loss from an unincorporated business of

$23,000.

• Interest income of $4,500.

• A capital gain of $27,000.

• A capital loss of $36,400.

• Spousal support paid of $24,000.

A net rental loss of $14,500.

Determine Harvey's minimum Net Income For

Tax Purposes for the current year and indicate

the amount and type of any loss carry overs

that are available at the end of the year. Show

all of your calculations. please show

supporting calculations

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you