has been the rtunity. A law i 10 tain ner ayment of $48,000. In return, for the next year the firm would have access to eight hours of her time n alternative payment arrangement, the firm would pay Professor Smith's hourly rate for the eight h Smith's rate is $535 per hour and her opportunity cost of capital is 15% per year. What does the IRR egarding the payment arrangement? (Hint: Find the monthly rate that will yield an effective annual ra bout the NPV rule? The annual IRR is 13.44 %. (Round to two decimal places.) The IRR rule advises: (Select the best choice below.)

has been the rtunity. A law i 10 tain ner ayment of $48,000. In return, for the next year the firm would have access to eight hours of her time n alternative payment arrangement, the firm would pay Professor Smith's hourly rate for the eight h Smith's rate is $535 per hour and her opportunity cost of capital is 15% per year. What does the IRR egarding the payment arrangement? (Hint: Find the monthly rate that will yield an effective annual ra bout the NPV rule? The annual IRR is 13.44 %. (Round to two decimal places.) The IRR rule advises: (Select the best choice below.)

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter22: Providing And Obtaining Credit

Section: Chapter Questions

Problem 9MC: Now assume that it is several years later. The brothers are concerned about the firm’s current...

Related questions

Concept explainers

Question

The NPV is? Round to nearest dollar

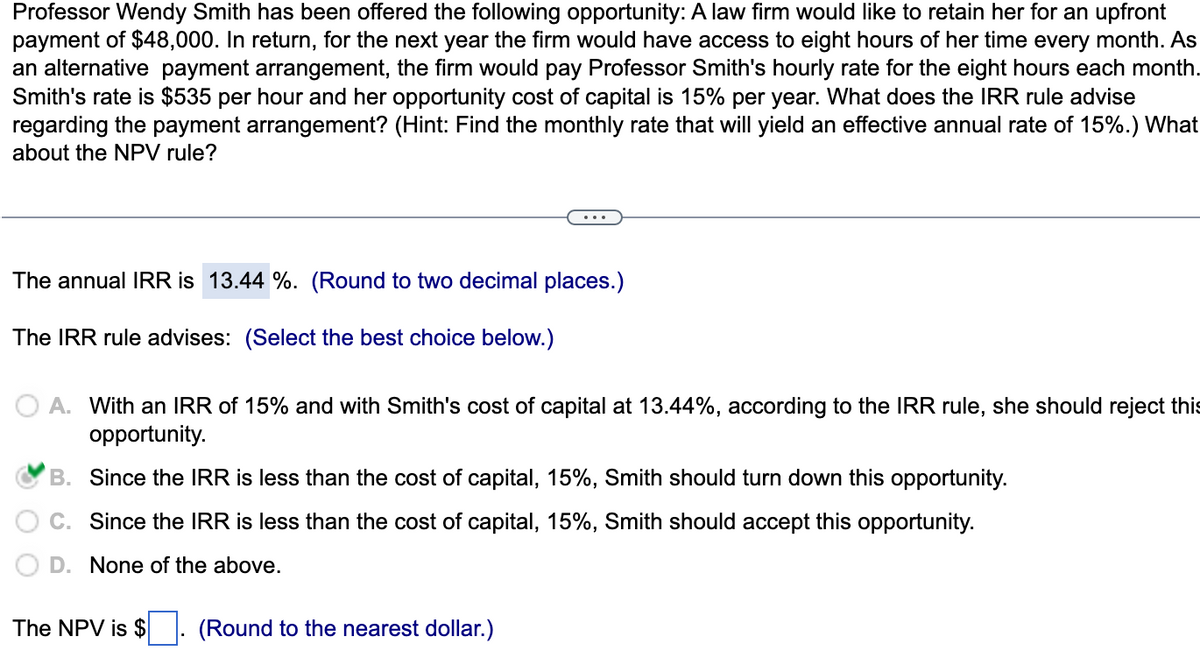

Transcribed Image Text:Professor Wendy Smith has been offered the following opportunity: A law firm would like to retain her for an upfront

payment of $48,000. In return, for the next year the firm would have access to eight hours of her time every month. As

an alternative payment arrangement, the firm would pay Professor Smith's hourly rate for the eight hours each month.

Smith's rate is $535 per hour and her opportunity cost of capital is 15% per year. What does the IRR rule advise

regarding the payment arrangement? (Hint: Find the monthly rate that will yield an effective annual rate of 15%.) What

about the NPV rule?

The annual IRR is 13.44 %. (Round to two decimal places.)

The IRR rule advises: (Select the best choice below.)

OA. With an IR of 15% and with Smith's cost of capital at 13.44%, according to the IRR rule, she should reject this

opportunity.

B. Since the IRR is less than the cost of capital, 15%, Smith should turn down this opportunity.

C. Since the IRR is less than the cost of capital, 15%, Smith should accept this opportunity.

D. None of the above.

The NPV is $

(Round to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub