he Darlington Equipment Company purchased a machine 5 years ago, prior to the TCJA, at a cost of $95,000. The machine had an expected he time of purchase, and it is being depreciated by the straight-line method by $9,500 per year. If the machine is not replaced, it can be sold he end of its useful life. new machine can be purchased for $180,000, including installation costs. During its 5-year life, it will reduce cash operating expenses by $4 ales are not expected to change. At the end of its useful life, the machine is estimated to be worthless. The new machine is eligible for 100% epreciation at the time of purchase. he old machine can be sold today for $50,000. The firm's tax rate is 25%. The appropriate WACC is 9%. . If the new machine is purchased, what is the amount of the initial cash flow at Year 0 after bonus depreciation is considered? Cash outflow indicated by a minus sign. Round your answer to the nearest dollar. -135,000 . What are the incremental cash flows that will occur at the end of Years 1 through 5? Round your answers to the nearest dollar. Year 1 Year 2 Year 3 Year 4 Year 5 30,500 $ $ 30,500 $ 30,500 $ 30,500 $ 30,500

he Darlington Equipment Company purchased a machine 5 years ago, prior to the TCJA, at a cost of $95,000. The machine had an expected he time of purchase, and it is being depreciated by the straight-line method by $9,500 per year. If the machine is not replaced, it can be sold he end of its useful life. new machine can be purchased for $180,000, including installation costs. During its 5-year life, it will reduce cash operating expenses by $4 ales are not expected to change. At the end of its useful life, the machine is estimated to be worthless. The new machine is eligible for 100% epreciation at the time of purchase. he old machine can be sold today for $50,000. The firm's tax rate is 25%. The appropriate WACC is 9%. . If the new machine is purchased, what is the amount of the initial cash flow at Year 0 after bonus depreciation is considered? Cash outflow indicated by a minus sign. Round your answer to the nearest dollar. -135,000 . What are the incremental cash flows that will occur at the end of Years 1 through 5? Round your answers to the nearest dollar. Year 1 Year 2 Year 3 Year 4 Year 5 30,500 $ $ 30,500 $ 30,500 $ 30,500 $ 30,500

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 13PB: Montezuma Inc. purchases a delivery truck for $20,000. The truck has a salvage value of $8,000 and...

Related questions

Question

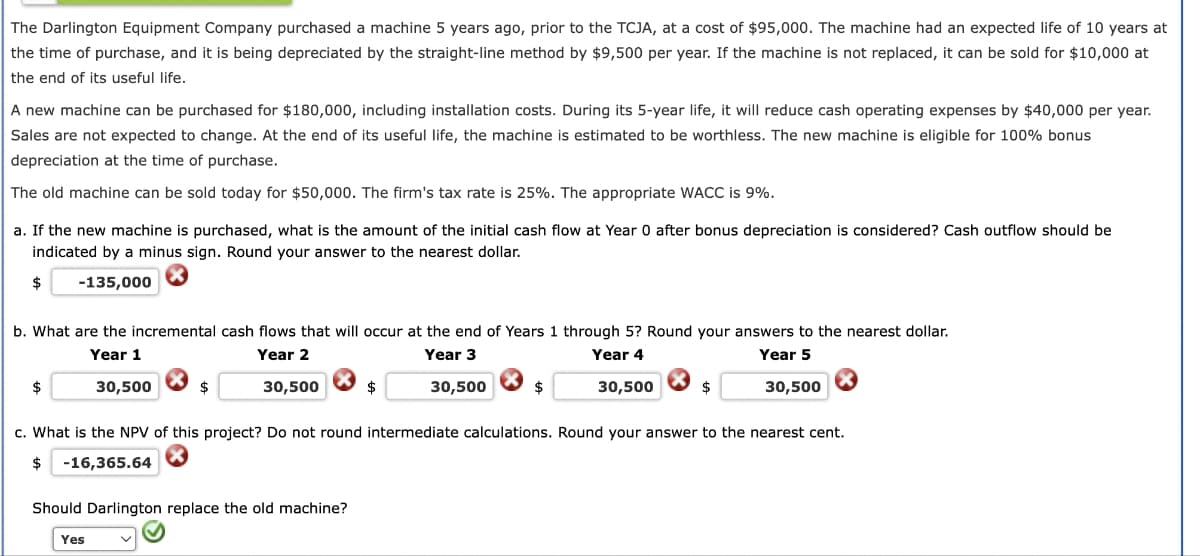

Transcribed Image Text:The Darlington Equipment Company purchased a machine 5 years ago, prior to the TCJA, at a cost of $95,000. The machine had an expected life of 10 years at

the time of purchase, and it is being depreciated by the straight-line method by $9,500 per year. If the machine is not replaced, it can be sold for $10,000 at

the end of its useful life.

A new machine can be purchased for $180,000, including installation costs. During its 5-year life, it will reduce cash operating expenses by $40,000 per year.

Sales are not expected to change. At the end of its useful life, the machine is estimated to be worthless. The new machine is eligible for 100% bonus

depreciation at the time of purchase.

The old machine can be sold today for $50,000. The firm's tax rate is 25%. The appropriate WACC is 9%.

a. If the new machine is purchased, what is the amount of the initial cash flow at Year 0 after bonus depreciation is considered? Cash outflow should be

indicated by a minus sign. Round your answer to the nearest dollar.

-135,000

$

b. What are the incremental cash flows that will occur at the end of Years 1 through 5? Round your answers to the nearest dollar.

Year 1

Year 2

Year 3

Year 4

Year 5

30,500

30,500

$

$

Should Darlington replace the old machine?

Yes

$

30,500

$

30,500

$

c. What is the NPV of this project? Do not round intermediate calculations. Round your answer to the nearest cent.

$

-16,365.64

30,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 7 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning