he difference between a Roth IRA and a traditional IRA is that in a Roth IRA taxes are paid on the income that is contrib withdrawals at retirement are tax-free. In a traditional IRA, however, the contributions reduce your taxable income, but th t retirement are taxable. Assume you plan to devote $5,000 to retirement savings in each year. You will retire in 30 yea live for an additional 20 years after retirement. . Assume the before-tax interest rate is 5%. What will be your after-tax 20-year retirement consumption stream if you c a traditional IRA? Assume your tax rate is fixed at 30%. (Round your answers to 2 decimal place.) Answer is complete but not entirely correct. s 20-year consumption stream (assuming monthly payouts) 27,462.69

he difference between a Roth IRA and a traditional IRA is that in a Roth IRA taxes are paid on the income that is contrib withdrawals at retirement are tax-free. In a traditional IRA, however, the contributions reduce your taxable income, but th t retirement are taxable. Assume you plan to devote $5,000 to retirement savings in each year. You will retire in 30 yea live for an additional 20 years after retirement. . Assume the before-tax interest rate is 5%. What will be your after-tax 20-year retirement consumption stream if you c a traditional IRA? Assume your tax rate is fixed at 30%. (Round your answers to 2 decimal place.) Answer is complete but not entirely correct. s 20-year consumption stream (assuming monthly payouts) 27,462.69

Chapter15: Choice Of Business Entity—other Considerations

Section: Chapter Questions

Problem 94TPC

Related questions

Question

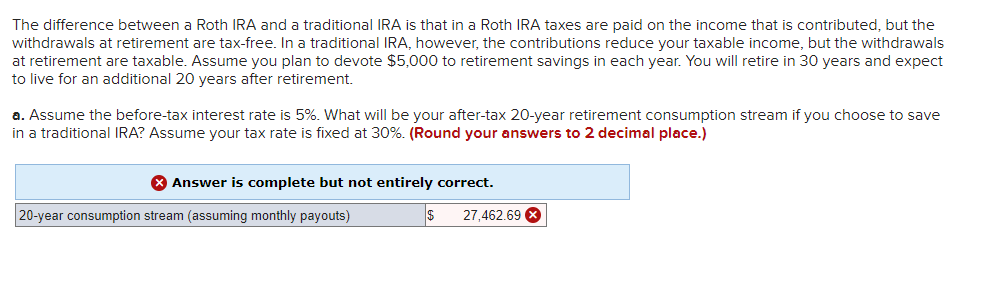

Transcribed Image Text:The difference between a Roth IRA and a traditional IRA is that in a Roth IRA taxes are paid on the income that is contributed, but the

withdrawals at retirement are tax-free. In a traditional IRA, however, the contributions reduce your taxable income, but the withdrawals

at retirement are taxable. Assume you plan to devote $5,000 to retirement savings in each year. You will retire in 30 years and expect

to live for an additional 20 years after retirement.

a. Assume the before-tax interest rate is 5%. What will be your after-tax 20-year retirement consumption stream if you choose to save

in a traditional IRA? Assume your tax rate is fixed at 30%. (Round your answers to 2 decimal place.)

> Answer is complete but not entirely correct.

20-year consumption stream (assuming monthly payouts)

$

27,462.69

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you