he difference between an ordinary annutty and an annulty due is: Multiple Choice an ordinary annuity represents a present value and an annuity due represents a future value. an ordinary annuity represents a future value and an annuity due represents a present value. an ordinary annuity assumes the cash flows occur at the beginning of the period and an annuity due assumes the cash flows occur at the end of the period. an ordinary annuity assumes the cash flows occur at the end of the period and an annuity due assumes the cash flows occur at the beginning of the period.

he difference between an ordinary annutty and an annulty due is: Multiple Choice an ordinary annuity represents a present value and an annuity due represents a future value. an ordinary annuity represents a future value and an annuity due represents a present value. an ordinary annuity assumes the cash flows occur at the beginning of the period and an annuity due assumes the cash flows occur at the end of the period. an ordinary annuity assumes the cash flows occur at the end of the period and an annuity due assumes the cash flows occur at the beginning of the period.

Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:Help

Save &

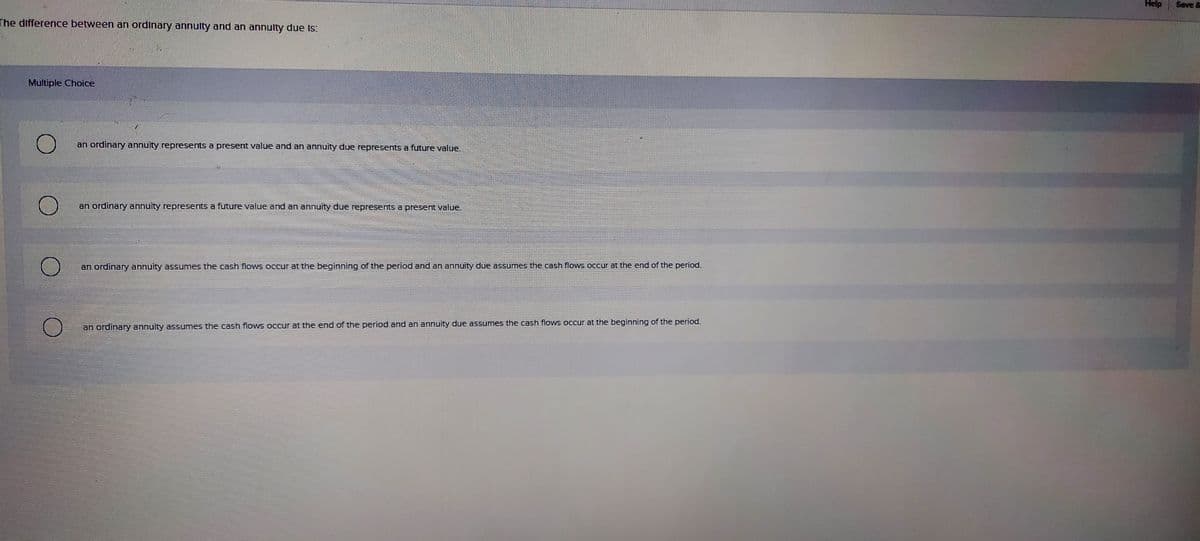

The difference between an ordinary annulty and an annulty due Is:

Multiple Choice

an ordinary annuity represents a present value and an annuity due represents a future value.

an ordinary annuity represents a future value and an annuity due represents a present value.

an ordinary annuity assumes the cash flows occur at the beginning of the period and an annuity due assumes the cash flows occur at the end of the period.

an ordinary annuity assumes the cash flows occur at the end of the period and an annuity due assumes the cash flows occur at the beginning of the period.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning