he following balances were taken from the books of Aquarius Corpor ordinary Share Capital (10,000 shares issued) = $850,000 ubscribed Ordinary Share Capital (5,000 shares) = $425,000 hare Premium Ordinary = P186,750

he following balances were taken from the books of Aquarius Corpor ordinary Share Capital (10,000 shares issued) = $850,000 ubscribed Ordinary Share Capital (5,000 shares) = $425,000 hare Premium Ordinary = P186,750

Chapter14: Corporation Accounting

Section: Chapter Questions

Problem 8PA: Aggregate Mining Corporation was incorporated five years ago. It is authorized to issue 500,000...

Related questions

Question

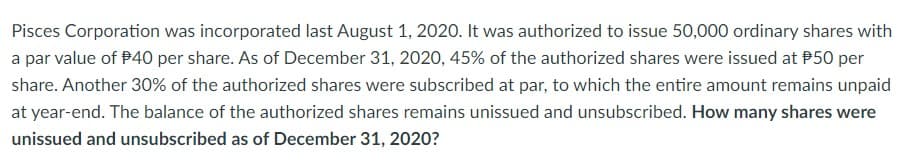

Transcribed Image Text:Pisces Corporation was incorporated last August 1, 2020. It was authorized to issue 50,000 ordinary shares with

a par value of $40 per share. As of December 31, 2020, 45% of the authorized shares were issued at $50 per

share. Another 30% of the authorized shares were subscribed at par, to which the entire amount remains unpaid

at year-end. The balance of the authorized shares remains unissued and unsubscribed. How many shares were

unissued and unsubscribed as of December 31, 2020?

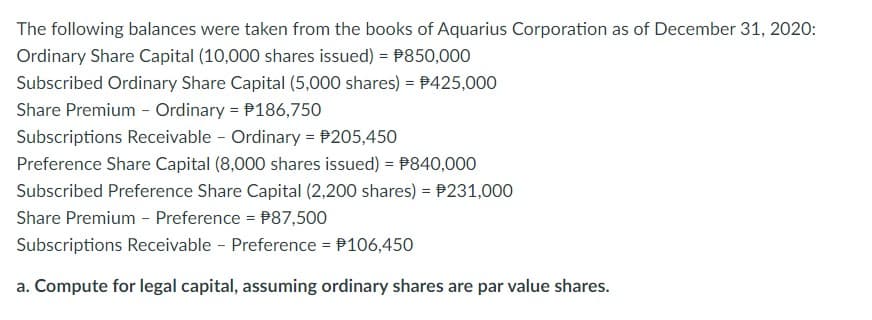

Transcribed Image Text:The following balances were taken from the books of Aquarius Corporation as of December 31, 2020:

Ordinary Share Capital (10,000 shares issued) = $850,000

Subscribed Ordinary Share Capital (5,000 shares) = $425,000

Share Premium - Ordinary = 186,750

Subscriptions Receivable - Ordinary = $205,450

Preference Share Capital (8,000 shares issued) = 840,000

Subscribed Preference Share Capital (2,200 shares) = 231,000

Share Premium - Preference = $87,500

Subscriptions Receivable - Preference = $106,450

a. Compute for legal capital, assuming ordinary shares are par value shares.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning