he following statements is TRUE? emand for a bond declines when it becomes less liquid, decreasing the in elatively more liquid bonds. prporate bond market is the most liquid bond market. ifferences in bond interest rates reflect differences in default risk only.

he following statements is TRUE? emand for a bond declines when it becomes less liquid, decreasing the in elatively more liquid bonds. prporate bond market is the most liquid bond market. ifferences in bond interest rates reflect differences in default risk only.

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter4: Bond Valuation

Section: Chapter Questions

Problem 2Q: Short-term interest rates are more volatile than long-term interest rates, so short-term bond prices...

Related questions

Question

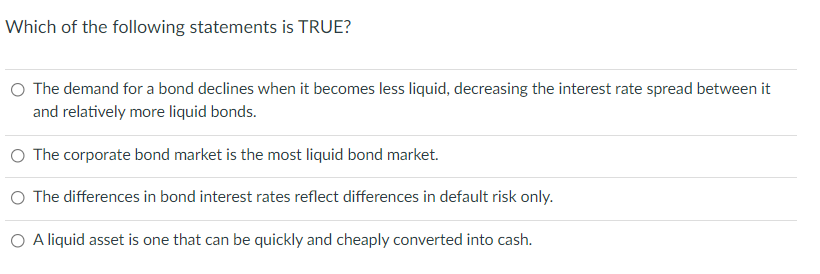

Transcribed Image Text:Which of the following statements is TRUE?

O The demand for a bond declines when it becomes less liquid, decreasing the interest rate spread between it

and relatively more liquid bonds.

O The corporate bond market is the most liquid bond market.

O The differences in bond interest rates reflect differences in default risk only.

O A liquid asset is one that can be quickly and cheaply converted into cash.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT